Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Jobs Say, “No QE For You”

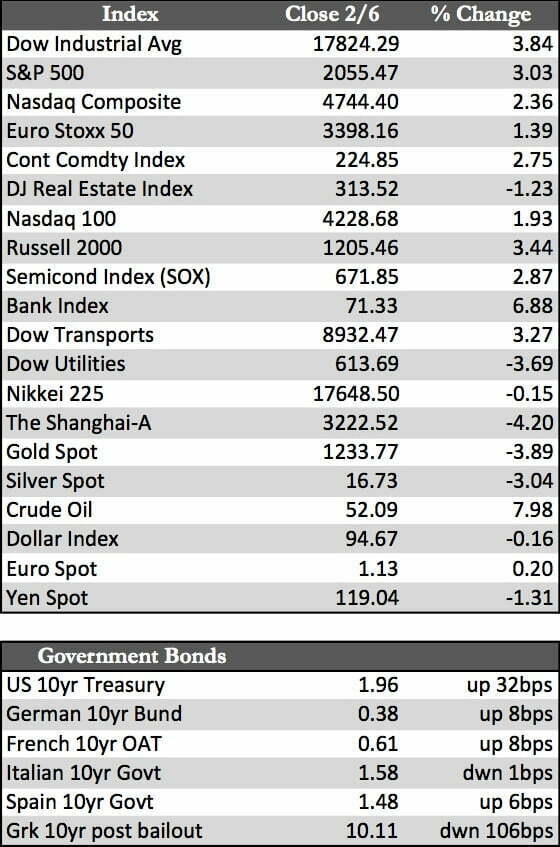

In last week’s recap we mentioned there would be some benefit to consumers from low long-term interest rates and gas prices. According to the latest jobs report, the benefits of which may now be filtering through the economy, 257,000 non-farm jobs were created in January (222,000 were expected). By the looks of it, many of the new jobs were full-time, in contrast to the part-time jobs that have predominated over the past few years. To ice the cake, the December jobs figure was revised higher by 77,000 to 329,000. To the casual observer these numbers may not mean very much. However, if the economy is producing 250,000 or more jobs on a consistent basis, it would suggest that an expansion is at hand. That’s exactly how the news headlines presented the situation, which sent stocks higher and bonds lower in the early going on Friday. However, good news is usually bad news for ultra-levered markets because it implies that Fed tightening may lie ahead.

As if to affirm that supposition, equities gave up their early gains on Friday to end the day on a somber note. Speculators’ ardor was cooled by the specter of less Fed patience and a corresponding hike in the target-rate by June. Even though stocks rebounded nicely during the week (on supposed Greek debt resolutions and short squeezes), Friday’s reaction to the jobs data may reveal the underlying tone in trade that will prevail until another event or data point trumps the recent jobs data. Said a different way, stocks may be held in check until “bad news” resurfaces, and there’s no telling exactly when that might be. But make no mistake: Any good news in the pipeline is directly related to the ability of interested parties to “lever-up.”

As if to affirm that supposition, equities gave up their early gains on Friday to end the day on a somber note. Speculators’ ardor was cooled by the specter of less Fed patience and a corresponding hike in the target-rate by June. Even though stocks rebounded nicely during the week (on supposed Greek debt resolutions and short squeezes), Friday’s reaction to the jobs data may reveal the underlying tone in trade that will prevail until another event or data point trumps the recent jobs data. Said a different way, stocks may be held in check until “bad news” resurfaces, and there’s no telling exactly when that might be. But make no mistake: Any good news in the pipeline is directly related to the ability of interested parties to “lever-up.”

On Thursday, both Bloomberg and the Financial Times ran articles summarizing world debt levels. At last read, debt markets reached nearly $200.0 trillion in market cap. Excluding “shadow banking” activities, that’s up $57.0 trillion since the crisis of ’08. In any case, if the underperformance of high-yield debt markets serves as any indication of a future break in credit channels, a surprise inflection point may be approaching. Keep in mind that a QE-dormant Fed adds to this risk exponentially.

Treasuries bounced a bit as stocks lost momentum in midday Friday trade, but remained rather subdued, as they were all week, against the tide of stronger equities. Gold was clubbed, but remained firmly above support at $1228.13 (the 50-day moving average), while the dollar rallied to challenge its peak resistance level of 95.52. Gold and dollar movements appear to be consolidative in nature at present, so downside risk for gold and upside potential for the dollar may be limited from here. Instead, look for gold to build a base around the $1215.00 level if the bottom hasn’t already been established. Implicit within that analysis is the belief that the Fed (along with other central banks) is thoroughly behind the curve in containing the outsized and metals-friendly credit risks (energy sector debt of $1.0 trillion is no exception) associated with the aforementioned debt levels.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP