Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Lots of Movement, Little Progress

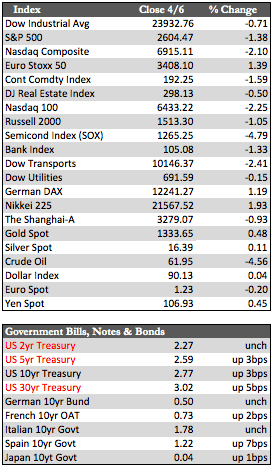

At the start of this week, traders tried to put their “worst is behind us” face on and push stocks higher, as indices added about 2% by midday Thursday. Several merger announcements, a few bottom callers from the Street, and the belief that Trump would surely back down from a full-trade confrontation with China served as fodder for the advance. By weeks’ end, however, that market momentum was disrupted as Trump amplified the trade war against China and newly appointed Fed Chair Jerome Powell presented a case for higher interest rates. By the close on Friday, the indices had lost between 1% and 3%, depending on the index. Powell drew upon the supposed strength in labor and the “economic expansion” as justification for the rate increases. I suspect that reasoning could be a threat to his long-term credibility because the economy has yet to show any real signs of expanding (beyond the effect of the storms last year). That means he’ll ultimately need to find and address the real reason interest rates have been slowly inching up across the curve since mid-2013.

Away from stocks, Treasuries were fractionally weaker across the curve, even as stocks fell into the red. The dollar’s attempt at an advance was once again held in check by Trump’s $100 billion in proposed tariffs on Chinese trade. But that weakness helped gold maintain some technical integrity, even as most commodities (including the other metals) were sold, overridden by political/trade concerns. On the economic front, jobs numbers were mixed again in March, with the ADP at 241,000 and the US NFP at 103,000. Auto sales experienced a small uptick of 3.7% to 13.42 million (annualized) in March. 14.33 million was the storm-related peak reached last September. Next week, we’ll get a glimpse of first quarter earnings, starting with the banks. I suspect there will be some marginal improvement, at least on a year-over-year basis, but the combination of higher rates and deteriorating storm-related activity is likely to put a strain on near-term results and forward guidance.

Away from stocks, Treasuries were fractionally weaker across the curve, even as stocks fell into the red. The dollar’s attempt at an advance was once again held in check by Trump’s $100 billion in proposed tariffs on Chinese trade. But that weakness helped gold maintain some technical integrity, even as most commodities (including the other metals) were sold, overridden by political/trade concerns. On the economic front, jobs numbers were mixed again in March, with the ADP at 241,000 and the US NFP at 103,000. Auto sales experienced a small uptick of 3.7% to 13.42 million (annualized) in March. 14.33 million was the storm-related peak reached last September. Next week, we’ll get a glimpse of first quarter earnings, starting with the banks. I suspect there will be some marginal improvement, at least on a year-over-year basis, but the combination of higher rates and deteriorating storm-related activity is likely to put a strain on near-term results and forward guidance.

Best Regards,

David Burgess

VP Investment Management

MWM LLC