Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Market Action Mixed after Fed Rate Hike

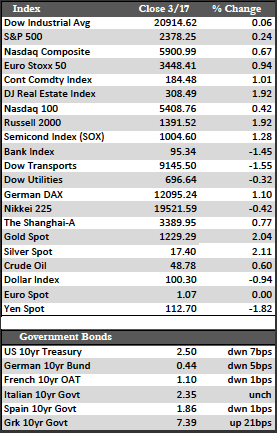

Despite a more dovish than expected Fed, stocks gave back a portion of their pre-FOMC meeting gains to finish essentially flat for the week. Tech was stronger, which may not be saying much, while banks, utilities, and healthcare-related issues led to the downside. The Fed action, in my opinion, was a non-event, since they did exactly what they were expected to do (raise rates 0.25%, with two more increases scheduled this year and three more in 2018). As I said last week, it’s what investors expect the Fed to do in the future that counts, and I don’t believe anyone expects the Fed to tighten until it hurts the financial system. Said a different way, easy money and easy borrowing are holding our economy together (for the moment), and I don’t think the Fed will do anything deliberate to undermine that situation. This is why I believe every rate hike is treated as if it’s the last. Gold and silver rallied a few percent each, and the dollar fell from interim highs. As stocks fell, money moved into bonds by the end of the week, but I can’t say for sure if this was a rotation to safety or just a “rebalancing” of expectations post-Fed.

That said, however, the economic data released this week may have spooked stock traders just a bit. In February, housing starts rose 3.0%, permits fell 6.2%, industrial production was flat at 0.0%, and both the PPI and the CPI retreated from their January pace of 0.6% to only 0.3% and 0.1%, respectively. In March, the Empire Manufacturing Index fell from 18.7 to 16.4, and the Philadelphia Fed Business Outlook fell from 43.3 to 32.8. Confidence surveys and the Leading Index (of economic indicators) were relatively unchanged from previous levels. However, I would expect confidence to shift as it becomes increasingly clear that Trump’s plans are running headlong into more budgetary constraints and Congressional dissent than previously expected – even though Trump has repeatedly warned of an inherited “mess.”

That said, however, the economic data released this week may have spooked stock traders just a bit. In February, housing starts rose 3.0%, permits fell 6.2%, industrial production was flat at 0.0%, and both the PPI and the CPI retreated from their January pace of 0.6% to only 0.3% and 0.1%, respectively. In March, the Empire Manufacturing Index fell from 18.7 to 16.4, and the Philadelphia Fed Business Outlook fell from 43.3 to 32.8. Confidence surveys and the Leading Index (of economic indicators) were relatively unchanged from previous levels. However, I would expect confidence to shift as it becomes increasingly clear that Trump’s plans are running headlong into more budgetary constraints and Congressional dissent than previously expected – even though Trump has repeatedly warned of an inherited “mess.”

Overseas, European stocks rallied on more EU-friendly election prospects, while bond markets there continued to appear weak, especially in Portugal, where banking sector issues have begun to resurface. Portugal’s 10-year jumped nearly 25 basis points to 4.257% as a state-owned bank (Caixa Geral de Depósitos SA) issued €500 million worth of the riskiest debt (first to default in case of a crisis) the nation has ever seen, in a test of investor appetites. The bank will also try to cut costs to qualify for a €2.5 billion “stabilizing” injection. In short, Europe is not exactly the image of health, even as the ECB considers both hiking rates and retreating from QE.

Next week, we’ll see just how much more there is to the US stock market rally. It continues to show signs of moderating, despite the usual Trump headlines, and we’ll also see if the metals markets can build some momentum from here – as I believe they can. The next test for gold will show up somewhere around the $1,265 level.

Best Regards,

David Burgess

VP Investment Management

MWM LLC