Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

More Nothingness from Central Bankers

Whatever bullish attitude investors had at the outset of this week quickly reversed on Friday with the words of Boston Fed-head Eric Rosengren. He said that there was a “reasonable case” for a rate increase given the growing risk of the economy overheating. Of course, Rosengren wasn’t the only central bank official talking tough. In a policy meeting Thursday, Mario Draghi said that there was no need to increase QE at this time because current QE was in fact working. Contradictory remarks were made by another Fed official, Dan Tarullo, who said he would need more evidence that inflation was above the 2% target before rushing into a rate hike. However, I believe the one-two punch offered up by Rosengren and Draghi was enough to send stocks (and other markets) into a tailspin. The Dow lost nearly 400 points by the close of trade on Friday.

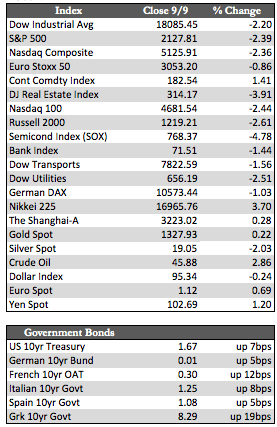

For the week, crude oil performed better than the broader market – due to the hurricanes. As the Dow and S&P fell by a little over 2.0%, 30-year Treasury yields rose by 12 basis points and gold gained 0.22% while silver lost 1.9%. Overseas markets behaved no differently, with the exception perhaps of stocks in Hong Kong that have benefitted nicely from recent capital shifts emanating from Shanghai. Apparently Hong Kong offers higher- or more reliable-yielding assets, as well as more relaxed regulation, than Shanghai. Authorities in the latter have been cracking down on the speculative/leveraged community (and rightly so).

For the week, crude oil performed better than the broader market – due to the hurricanes. As the Dow and S&P fell by a little over 2.0%, 30-year Treasury yields rose by 12 basis points and gold gained 0.22% while silver lost 1.9%. Overseas markets behaved no differently, with the exception perhaps of stocks in Hong Kong that have benefitted nicely from recent capital shifts emanating from Shanghai. Apparently Hong Kong offers higher- or more reliable-yielding assets, as well as more relaxed regulation, than Shanghai. Authorities in the latter have been cracking down on the speculative/leveraged community (and rightly so).

As for my own opinions regarding the events of this week, I have many, perhaps too many to share within this abbreviated write-up. But I will say that it’s fairly obvious, at least for those paying attention, that the arguments presented by these central bankers hold absolutely no water whatsoever. As I discussed last week, the US economy is nowhere near “overheating.” As for inflation, the Fed benchmark PCE index was up 3.21% in 2015 and 2.61% so far in 2016. The last time I checked, those are rates that well exceed the Fed’s 2.0% inflation target. So much for Rosengren and Tarullo. As for Draghi, I find it rather duplicitous that he can simultaneously lower his GDP growth and raise his inflation forecasts when he and others around him define both growth and inflation as the exact same thing.

In any case, it doesn’t really matter at this point what they say or do. As I have said many times here before, and again last week, stimulus has begun to lose its effectiveness on growth altogether. When the metals begin to realize this and not flinch at every mention of a meaningless rate hike, they will likely breakout to the upside. But for now, the action in the metals is what it is, as they say. On the plus side, the metals have held to a much better technical (still bullish) position than stocks, and I would interpret this as a favorable undertone for the metals in coming weeks. As to whether that interpretation will be borne out by events – we will just have to wait and see what the future brings.

Best Regards,

David Burgess

VP Investment Management

MWM LLC