Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Nearer a Break-out

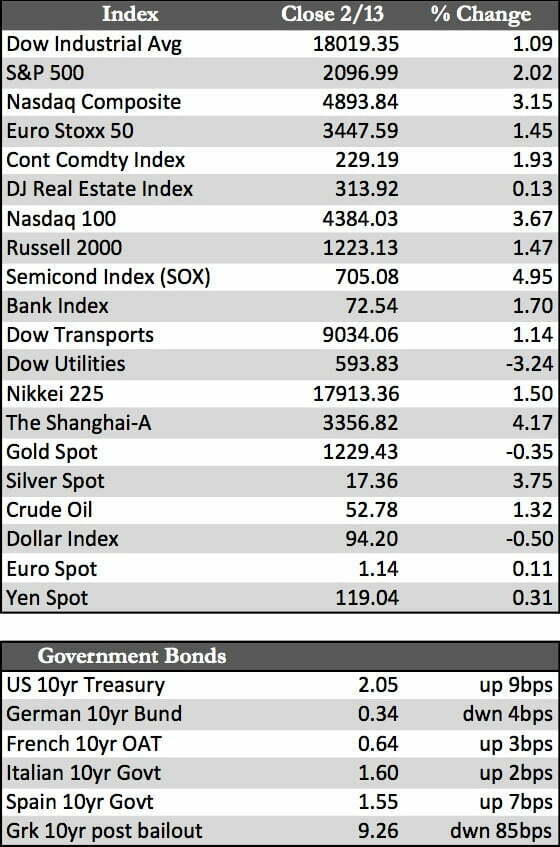

Early in the week stocks were higher worldwide as it appeared that both Ukrainian and Grecian issues would be put to rest. Though neither the Russians nor the Germans offered many concessions to resolve their respective crises, all was deemed progress. That gave speculators the green light to run the board on stocks, though neither dominant party really has a solution in place for the deeper structural issues in its region – economically/fiscally speaking. Later in the week, fuel was added to the proverbial flame when Sweden went negative on its key rate (to -0.1%). The BoE announced it would expand its bond buying program (if “inflation” remained low), and China’s lending growth revived in January. Parenthetically, and for what it’s worth, developed nations are now monetizing more than 100% of global debt issuance. Consider also that the U.S. is not printing (officially) at the moment, but its debt issuance is included in the totals. In any case, the concurrence of apparent structural reforms in Eastern Europe and newfound sources of QE from the ECB caused German and U.S. stocks (NASDAQ and the S&P) to post new highs, though both the Dow and the broader indexes failed to confirm.

U.S. retail sales fell in January, led by gas stations (-9.3%). U.S. jobless claims rose above 300,000 again to 304,000, and Michigan Sentiment indicators fell to 93.6 from 98.1. Remember, the retail figures measure dollars spent, not gallons consumed, so as oil prices fall there are fewer dollars being spent per gallon. Oil and gas consumption is currently at all-time highs in gallon terms. Incidentally, supply is still outpacing demand, despite the oil rig shutdowns. Pricing pressure on oil therefore looks as if it’s here to stay for a while. In any case, the headline news here in the States, not being so rosy, may have helped send stocks higher. A direct correlation was hard to establish, though, as most stateside events were overshadowed by the events unfolding in Europe.

U.S. retail sales fell in January, led by gas stations (-9.3%). U.S. jobless claims rose above 300,000 again to 304,000, and Michigan Sentiment indicators fell to 93.6 from 98.1. Remember, the retail figures measure dollars spent, not gallons consumed, so as oil prices fall there are fewer dollars being spent per gallon. Oil and gas consumption is currently at all-time highs in gallon terms. Incidentally, supply is still outpacing demand, despite the oil rig shutdowns. Pricing pressure on oil therefore looks as if it’s here to stay for a while. In any case, the headline news here in the States, not being so rosy, may have helped send stocks higher. A direct correlation was hard to establish, though, as most stateside events were overshadowed by the events unfolding in Europe.

As the euro rose in response to political/fiscal “fixes” across Europe, the dollar fell from its lofty perch. That arrested the recent consolidative move in gold above support at $1,215, and may mark the beginning of a dollar/gold inflection point – but that may still be too early to determine. What we do know is that gold is, as I write, outperforming most currencies worldwide due the continuing dependency on, yet growing inefficiency of, stimulus by a host of central banks that we’ve made mention of in this forum before. That said, global demand for gold is on the rise as we head further into 2015. The only element missing from a breakout in the gold price is the Fed, which has yet to concede the seriousness of several looming issues (debt, default, etc.) here at home. In the meantime, I suspect gold can now start building from its current levels, albeit quietly, up to the time when those issues come home to roost.

Best regards,

David Burgess

VP Investment Management

MWM LLLP