Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

New Highs Met with a Yawn?

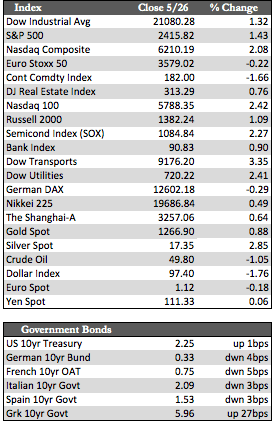

At last week’s recap, the indices seemed poised to break a few records this week. That’s exactly what happened. Both the S&P 500, which broke the significant 2,400 level, and the Nasdaq (powered by chip stocks predominantly) raced to new highs without much hesitation. The same kind of relentless upside action was also evident in both the Dow Industrials and the Dow Transports, as they were up 1.3% and 3.35% respectively for the week. Still, neither managed to break out into record territory. That’s not to say that traders won’t attempt another push at those highs next week. It’s been easy to persuade the FOMO crowd to buy into the rally on a purely technical and performance-chasing basis, even as the foundations for this rally continue to deteriorate at an accelerated pace since the election. All that is simply to say that the rally is getting tired at these record-setting levels. Upside volume and momentum is weak, showing a lack of any real conviction, and the leadership is narrowing fast around a few high-flying FANG-type stocks.

I also find it interesting that the general consensus held that the economic and corporate data released this week suggested that the economy was on “solid footing.” I know that the Fed minutes released on Wednesday conveyed this sentiment (as usual) with its hawkish message. But other than that, I really don’t know where anyone would get that impression. In April, US new home sales fell 11.4%, existing home sales were down 2.3%, durable goods orders were off 0.7%, and the advanced goods trade balance (deficit) widened by $2.5 billion to $67.6 billion. The initial data out for manufacturing and service data for the month of May was, on balance, unchanged – ex the Richmond Fed Manufacturing Index, which collapsed from 20 to 1. On the corporate front, Best Buy reported results for its 2018 fiscal first quarter. Sales at the company have contracted from $49.6 billion per year in 2013 to a bottom-feeding pace of between $39 and $40 billion annually today. A small uptick in sales in this latest quarter (of $0.1 billion) was deemed testament to the US consumer’s prevailing strength.

I also find it interesting that the general consensus held that the economic and corporate data released this week suggested that the economy was on “solid footing.” I know that the Fed minutes released on Wednesday conveyed this sentiment (as usual) with its hawkish message. But other than that, I really don’t know where anyone would get that impression. In April, US new home sales fell 11.4%, existing home sales were down 2.3%, durable goods orders were off 0.7%, and the advanced goods trade balance (deficit) widened by $2.5 billion to $67.6 billion. The initial data out for manufacturing and service data for the month of May was, on balance, unchanged – ex the Richmond Fed Manufacturing Index, which collapsed from 20 to 1. On the corporate front, Best Buy reported results for its 2018 fiscal first quarter. Sales at the company have contracted from $49.6 billion per year in 2013 to a bottom-feeding pace of between $39 and $40 billion annually today. A small uptick in sales in this latest quarter (of $0.1 billion) was deemed testament to the US consumer’s prevailing strength.

Away from stocks, the dollar strengthened marginally, perhaps due to Trump’s somewhat successful visits with leaders in the Middle East or the Manchester terrorist incident. Treasuries along with European government bonds firmed up late in the week as the upside momentum in stocks faded into the close Friday. Oil fell thanks to another disappointing OPEC meeting, where desperately hoped-for cuts in production by US producers were put on indefinite hold. As for the metals, they enjoyed a stealthy week of gains; gold increased 0.88% to silver’s 2.84%. $1,295 represents the most immediate resistance point for gold, but if confidence continues to waiver amid political uncertainty and a slowing economy, I don’t think we’ll see gold held up for too long before heading to $1,350.

Best Regards,

David Burgess

VP Investment Management

MWM LLC