Here’s the news of the week — and how we see it here at McAlvany Wealth Management:

NFPs = Another Rate Hike?

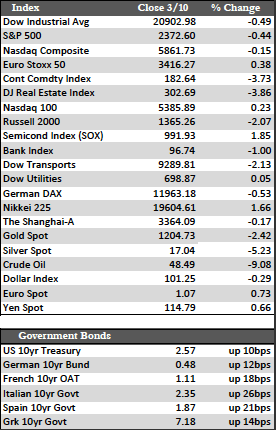

Trade action this week was uneventful, even as lawmakers released a healthcare plan intended to phase out Obamacare over the next three years titled the “American Health Care Act.” Most markets here (ex the dollar) seemed apprehensive ahead of the FOMC meeting next Wednesday where the Fed is expected to raise rates by at least a quarter of a point. The action is fairly certain following the fairly “good” non-farm payroll (NFP) report that showed 235,000 jobs were created in the month of January. In any case, stocks enjoyed a small rally into the close on Friday, as the jobs number wasn’t good enough to scare everybody, but the rally wasn’t enough to erase losses that amounted to about a half a percent. Both Treasuries and metals were also a bit weaker in reaction to rate expectations, as the 10-year yield finished the week near an interim high of 2.57% and gold consolidated just above $1,200. Oil was lower on the back of more chronically bloated inventories, and the dollar, though stronger early in the week, gave up all its gains and ended relatively unchanged following the NFP report.

Overseas markets behaved in similar fashion, as there was a bit of trimming in both stocks and bonds. European government bonds were especially affected, as several 10-year yields were seen approaching or breaking out above their highs for the year. Spain was seen leading in that charge, as were others in the PIIGS group. To my surprise, though, German, French, Austrian, Swedish, Norwegian, and Dutch debt (the higher quality/conservative group) was also found testing and breaking beyond its former highs as well (in terms of yield). Draghi’s lack of commitment to more stimulus at a time when Europe is struggling economically (factory orders in Germany [-7.4%] and France [-1.0] fell in January) certainly did not help the situation.

Overseas markets behaved in similar fashion, as there was a bit of trimming in both stocks and bonds. European government bonds were especially affected, as several 10-year yields were seen approaching or breaking out above their highs for the year. Spain was seen leading in that charge, as were others in the PIIGS group. To my surprise, though, German, French, Austrian, Swedish, Norwegian, and Dutch debt (the higher quality/conservative group) was also found testing and breaking beyond its former highs as well (in terms of yield). Draghi’s lack of commitment to more stimulus at a time when Europe is struggling economically (factory orders in Germany [-7.4%] and France [-1.0] fell in January) certainly did not help the situation.

It seems we are in limbo at the moment without a near-term catalyst to drive the markets one way or the other. The bigger picture continues to look grim in that the ECB prints over 70 billion euros a month to buy bonds, yet rates there continue to climb and economies continue to founder. It’s a story that I believe has already had an impact here in the US, though too subtly to be seen or felt through the media driven hype. Given all that, markets might meander (including gold) ahead of the Fed’s decision next Wednesday, after which we might see trading activity return to normal. Gold in particular may do well beyond Yellen’s remarks, as most investors know full well there is a limit to raising rates in this environment.

Best Regards,

David Burgess

VP Investment Management

MWM LLC