Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

No End to Tax Bill Rally?

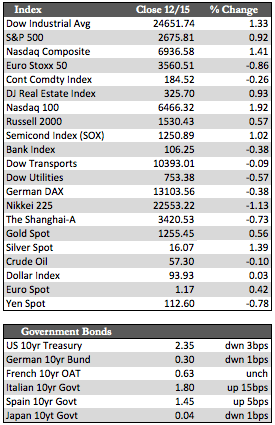

This week saw another ramp job that pushed the major U.S. averages into record territory. The impetus behind what I would call the “melt-up” was, for the most part, a dual hope: first, that the Fed would lean dovish in Wednesday’s FOMC meeting, and second, that the tax bill would be locked down as the last of the GOP holdouts caved in and voted “yes” (i.e., Corker, Rubio). As expected, the Fed raised the target rate by 0.25% to 1.50% and flagged next year for three more hikes. They also raised their GDP growth forecast to 2.5% from 2.0%, but maintained their outlook for inflation. As for the tax code, Rubio was granted his request for child deductions while the AMT tax for corporations was removed – the latter of which revived speculative interest in technology stocks. In any case, I have said this before, that with the Dow up nearly 37.0% since the election, stocks have discounted virtually to perfection all we can expect from Trump’s policies, which leaves very little room for imagination heading into next year. For now, the bulls have the advantage of hype, low volume, and momentum on their side, so we really can’t expect things to calm down until after year-end.

Aside from this, U.S. retail sales posted a 0.8% gain in November – twice the norm, which might reflect confidence in the tax bill, stock market, or residual storm related sales. For the same month, U.S. PPI and CPI indexes rose 0.4% on the back of higher energy/oil prices. This was also evident in the U.S. import price index, which added 0.7% overall, but, excluding energy prices, rose only a modest 0.1%. Finally, U.S. industrial production rose a meager 0.2% compared to 1.2% in October, which implies that a “post-storm” downshift in economic activity is still in progress.

Aside from this, U.S. retail sales posted a 0.8% gain in November – twice the norm, which might reflect confidence in the tax bill, stock market, or residual storm related sales. For the same month, U.S. PPI and CPI indexes rose 0.4% on the back of higher energy/oil prices. This was also evident in the U.S. import price index, which added 0.7% overall, but, excluding energy prices, rose only a modest 0.1%. Finally, U.S. industrial production rose a meager 0.2% compared to 1.2% in October, which implies that a “post-storm” downshift in economic activity is still in progress.

In other markets, Treasuries and the like overseas experienced a small bounce after Yellen declared no change to the Fed’s inflation expectations, but the bounce didn’t hold as fixed income finished nearly unchanged for the week. On the same words from Yellen, the dollar fell and the metals rose – gold added nearly 15 points to 1,255. However, those gains reversed to some degree later in the week as focus shifted to the tax bill. Oil traded sideways, again, as did other commodities. Stocks overseas continued to “leak,” perhaps due to a surprise tightening by the PBoC or because the rest of the world has lost interest in propagating the Trump trade. Next week, hopefully, we’ll get some real clarity on the tax bill and a more reasonable glance at how stocks want to behave in the aftermath.

Best Regards,

David Burgess

VP Investment Management

MWM LLC