Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

No Patience on Wall Street

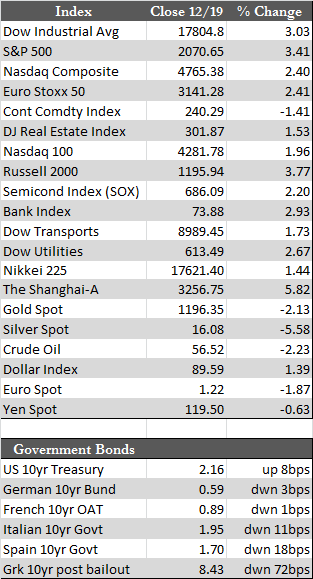

In Wednesday’s FOMC communique, the Fed said that it would be “patient” to raise or normalize its target rate in 2015. Stocks immediately began celebrating that welcome news and spent the remainder of the week in party mode attempting to break previous highs set earlier this month. To put things in perspective, the Dow gained a little over 700 points, or 4.31%, in a space of three days’ time. That’s 458% annualized for anyone willing to do the math, and therefore unlikely to continue at that pace indefinitely. It’s not really clear why rate policy had such an effect on stock prices since a rate hike or a series of them would be devastating to an ultra-leveraged financial system such as ours – and therefore out of the question. But it is what it is. The bullish sentiment spread to overseas stock and bond markets, which included the emerging markets. Treasuries fell while the dollar set a new high, which translated to moderate losses for the metals.

Aiding and abetting the dollar rally were a series of dovish foreign central bank actions that seemed to trump the Fed’s mere change in language. The Swedish central bank stated its intention to take its benchmark interest rate below zero, while the Swiss national bank actually did, to negative 0.25%. Both did so to combat “declining inflation,” which has become the common vernacular for accelerating credit delinquencies. Also, Japan’s re-elected Shinzo Abe is armed with what he believes is a mandate to revive Japan’s economy. He is set to unveil a stimulus package that’s expected to include, among other things, additional money printing as the cure. As for the ECB and its bond-buying program, a consensus between the ECB and German authorities has yet to be reached.

Aiding and abetting the dollar rally were a series of dovish foreign central bank actions that seemed to trump the Fed’s mere change in language. The Swedish central bank stated its intention to take its benchmark interest rate below zero, while the Swiss national bank actually did, to negative 0.25%. Both did so to combat “declining inflation,” which has become the common vernacular for accelerating credit delinquencies. Also, Japan’s re-elected Shinzo Abe is armed with what he believes is a mandate to revive Japan’s economy. He is set to unveil a stimulus package that’s expected to include, among other things, additional money printing as the cure. As for the ECB and its bond-buying program, a consensus between the ECB and German authorities has yet to be reached.

All that is to say I’m not sure the dollar rally this week has any real legs. If the US economy continues to negatively surprise as it has (i.e., December Empire State at -3.58; Philly Fed down 16.6 to 24.2; slipping housing starts, permits and retail profits), then the Fed will be seen as ultimately joining the ranks of other developed-world central bankers in printing or promising to print their way out of a funding crisis. The shale-oil debacle and its pool of bad debts is just one example. For now, it’s a good thing the metals haven’t cascaded to the downside in any given disruption. That bodes well for the eventual turn in the dollar, which for all intents and purposes will be on hold until early next year. In the meantime, it’s likely that gaming stocks, the dollar, and other assets vital to the P&L line is high on Wall Street’s to-do list as we approach year-end.

On a separate note that may be of interest to MWM investors: With the energy sector in decline, MWM hopes to include a few select assets at discounts into portfolios, though the timing of such an investment is still relatively unknown. Prices for oil and gas, though cheaper than they were six months ago, may yet have further to go until a “bottom” or some semblance thereof can be adequately determined. Partial allocations with the intent to “average in” to the sector are a distinct possibility.

Best regards, and Merry Christmas. There will be no weekly recap next week, but comments will resume on January 2nd.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP