Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Not Quite the Same Inflation as the Last 20 + Years

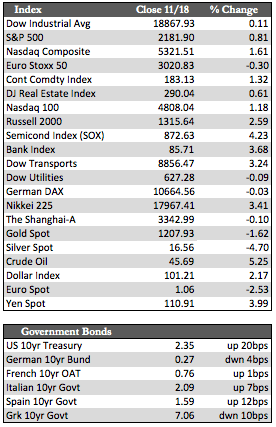

The post-election Trump rally in stocks extended itself into this week, though the gains slowed as overall trade volumes dropped back to below-average levels. Still, the slowing momentum didn’t faze stock bulls very much. They seemed determined to remain in stocks by simply rotating into sectors perceived to be relatively undervalued, especially tech stocks. This held the Dow to meager gains in comparison to the tech-heavy NASDAQ composite, while Treasuries and other fixed income continued to struggle as the 30-year Treasury yield rose to an interim high of 3.03% (that’s an astounding 43 basis points higher than pre-election levels). Still, economic data and Fed officials speaking this week acted as a nice tailwind for stocks. Of note were fairly decent retail sales (+0.8%), wage growth (+3.9%), and industrial production (+0.2%) numbers for the month of October, along with the age-old reiteration by Janet Yellen that rate hikes in the future would be “gradual.”

As far as the economic data is concerned, I think it’s important to distinguish between pre- and post-election activity. The former benefitted from last minute double-digit lending by the banks, while the latter will undoubtedly be subdued by the spike in long-term interest rates. Proof came in the form of a substantial drop in mortgage (-9.2%) and refinance (-11.0%) applications in the week ending November 11th, a decline in the Philly Fed Business Outlook from 9.7 to 7.6, and a slowdown in the index of leading economic indicators from 0.2% to 0.1% – all for the month of November. In any case, as I said last week, I don’t expect the stock market to enjoy uninterrupted prosperity as rates rise, as this will no doubt have a negative effect on spending at all levels, whether consumer, corporate or government. I say despite what might very well be constructive and cost-effective governmental restructuring under the Trump administration.

As far as the economic data is concerned, I think it’s important to distinguish between pre- and post-election activity. The former benefitted from last minute double-digit lending by the banks, while the latter will undoubtedly be subdued by the spike in long-term interest rates. Proof came in the form of a substantial drop in mortgage (-9.2%) and refinance (-11.0%) applications in the week ending November 11th, a decline in the Philly Fed Business Outlook from 9.7 to 7.6, and a slowdown in the index of leading economic indicators from 0.2% to 0.1% – all for the month of November. In any case, as I said last week, I don’t expect the stock market to enjoy uninterrupted prosperity as rates rise, as this will no doubt have a negative effect on spending at all levels, whether consumer, corporate or government. I say despite what might very well be constructive and cost-effective governmental restructuring under the Trump administration.

None of that seems to matter much to stock bulls at the moment, who insist on seeing the hefty rise in rates as a precursor to economic growth. Instead, the move may reveal a heightened sensitivity in response to our nation’s credit profile – ignited by the prospect of lower taxes applied in tandem with higher spending initiatives. As I have said before, these perceptions, however flawed, may persist until early next year when we will have more data to work with. The same is true with the prevailing attitude toward the metals. In the meantime, I am still inclined to treat any weakness in the more defensive areas of the market as potential buying opportunities.

Best Regards,

David Burgess

VP Investment Management

MWM LLC