Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Nothing to See Here; Move Along

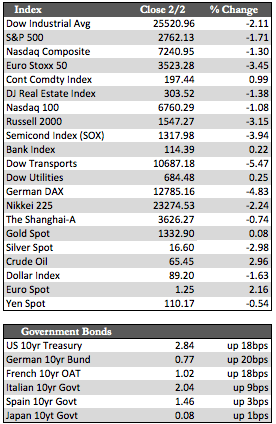

US stocks and their overseas counterparts took it on the chin this week. The Dow and the other major indices shed anywhere between 2.5% and 3.2%. The consensus view holds that the decline occurred for the same reason as the over 30 percent rise since the election – growth. By that, the sages of the stock market mean that rates are rising because we’re growing too fast. Of course, the Fed will be more inclined to contain that growth by raising the benchmark interest rate, which in turn is bad for stocks. The flaw in that line of reasoning is the “growth” element of the argument. If you take out the storm factor, corporate profits have not risen meaningfully above 2014 levels, while interest rates have risen exponentially. The latter are up over 500% at the short end (1- to 5-year Treasuries) and 30% or more from the lows at the long end – with no end to the trend in sight (yet). The question for the bulls, then, is this: If the change in rates implies growth, where are the presumably out-sized profits that should accompany it?

Disappointing results from Amazon, Google, and Apple may have served as the trigger for this week’s decline. As usual, there was nothing wrong with their headline numbers – though Amazon and Google fell short of some fairly lofty expectations. The underlying quality of those numbers was rather poor, as was the forward guidance. Apple not only sold half as many iPhones as it expected this quarter, but it seems to have sold many of them, along with other products, on layaway. Apart from stocks, Treasuries were extraordinarily weak at the long end of the curve, while fractionally stronger at the short-end. Oil tracked stocks lower, while the dollar flat-lined for most of the week, then gained some upside momentum as stocks accelerated to the downside. This put some short term pressure on the metals, causing gold to lose 1.2% and silver 4.63%.

Disappointing results from Amazon, Google, and Apple may have served as the trigger for this week’s decline. As usual, there was nothing wrong with their headline numbers – though Amazon and Google fell short of some fairly lofty expectations. The underlying quality of those numbers was rather poor, as was the forward guidance. Apple not only sold half as many iPhones as it expected this quarter, but it seems to have sold many of them, along with other products, on layaway. Apart from stocks, Treasuries were extraordinarily weak at the long end of the curve, while fractionally stronger at the short-end. Oil tracked stocks lower, while the dollar flat-lined for most of the week, then gained some upside momentum as stocks accelerated to the downside. This put some short term pressure on the metals, causing gold to lose 1.2% and silver 4.63%.

My answer to the question I posed above is that rates are probably not rising because of growth or demand-pull inflation per se. They may be rising due to accelerated credit risk, because that’s the end result of increased borrowing without the proper support (i.e., greater profits). It may take a few more months for that reality to sink into the bullish mindset, but once it does, I don’t think the metals will suffer the kind of knee-jerk reactions we witnessed today.

Best Regards,

David Burgess

VP Investment Management

MWM LLC