Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Ok, We’ve “Bounced” – Now What?

The December rout in stocks never happened – at least, that’s what it seems everyone would like to believe at this point. Both sentiment and stocks have rebounded from that year-end bludgeoning. The indices have returned to “respectable” levels – and even above higher-range moving averages in a few cases. However, the rally has been choppy at best, with most advances accompanied by a fair amount of selling. The implication is that whatever has driven stocks to this point, whether the trade pact with China, a government shutdown-free wall, a more dovish yet optimistic Fed, and/or earnings that didn’t look so bad thanks to Florence and Michael, traders believe events are temporary at best in terms of their ability to fuel further rises.

With all of these bullish trump cards having already been played, I really don’t know what the bulls are going to do now. Stocks are now in the second most overbought position in history (the last was just before the dot.com crash), yields/term premiums are still restrictive, tax cut benefits have been and are fading, and forward earnings guidance has been negative on average (e.g., Amazon). It will be interesting to see how the bulls handle these dynamics as we head deeper into this year, but it’s my assumption that, given the secular nature of the risks at hand, the focus and action will return to December-like levels sometime soon.

With all of these bullish trump cards having already been played, I really don’t know what the bulls are going to do now. Stocks are now in the second most overbought position in history (the last was just before the dot.com crash), yields/term premiums are still restrictive, tax cut benefits have been and are fading, and forward earnings guidance has been negative on average (e.g., Amazon). It will be interesting to see how the bulls handle these dynamics as we head deeper into this year, but it’s my assumption that, given the secular nature of the risks at hand, the focus and action will return to December-like levels sometime soon.

Turning to the economic data, the releases this week were unfortunately skewed a bit. Thanks to hurricanes Florence and Michael, we received an uptick in New Home Sales for November when we normally see a fairly large decline. With the seasonal adjustment, US New Home Sales spiked by 16.9% to 657,000 from 562,000 in October. Without the adjustment, New Home Sales rose by only 4,000, or 0.7%. January Non-Farm Payrolls showed an increase in jobs created of 304,000, though this might be due to government workers jumping the fence into the private sector during the shutdown. Incidentally, December NFPs were revised down from 312,000 to 222,000 – so the three-month average really didn’t change much. Aside from this, there were a few ISM and purchasing managers indexes – but they were either relatively unchanged or dampened by the midwestern cold snap.

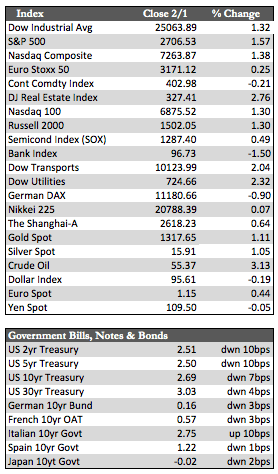

Away from that, our dovish friends at the Fed pushed Treasuries a bit higher, the dollar a bit lower, and the metals nearer to breakout levels as gold added about 1.08% to silver’s 1.15%. Oil gained about 3% as US sanctions were applied to Venezuela. Next week we have the State of the Union address from Donald Trump, a BoE policy decision, US trade data, and a few more earnings reports (i.e. Google).

Best Regards,

David Burgess

VP Investment Management

MWM LLC