Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Post-election: Stocks Crank, Bonds Tank

Preceding and subsequent to the election results Tuesday night, markets experienced some of the most volatile moments I have ever seen in my career. Behind that volatility we had a media in denial that focused on many the wrong things, and an American public, clearly fed up with the past several years of governmental mismanagement (and media obfuscation), casting a vote for something completely different. President Elect Donald Trump, I believe, represents a change for both Republicans and Democrats, and leadership that will bring about greater efficiencies and order in an environment where we have had very little of either to speak of. I have posted an article that appeared on the NPR website outlining Trump’s near-term goals, and I would encourage everyone to read it. He’s aiming at some hard choices, ones that many will disagree with, but I do believe they represent some changes in the direction of what has made America great for all.

That said, I know what many of you who read this are thinking. There are challenges ahead, especially the financial kind, referring to our debts (in excess of $80 trillion) that won’t go away regardless of who holds office. Suffice it to say, whatever consequences our leveraged indulgences force upon us in the near future, I believe there is confidence to be had in a President who at the margin will not bend (as easily) toward more socialism in the process. Those of course are my own personal thoughts – for whatever they are worth.

That said, I know what many of you who read this are thinking. There are challenges ahead, especially the financial kind, referring to our debts (in excess of $80 trillion) that won’t go away regardless of who holds office. Suffice it to say, whatever consequences our leveraged indulgences force upon us in the near future, I believe there is confidence to be had in a President who at the margin will not bend (as easily) toward more socialism in the process. Those of course are my own personal thoughts – for whatever they are worth.

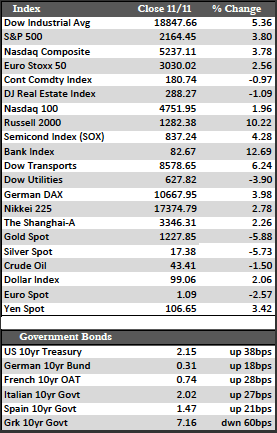

Back to the market action, following the election, stocks rallied, as the Dow added over 800 points to set a new high on the dichotomous premise that Trump would lower taxes while simultaneously increasing fiscal stimulus. Bonds of course did not take to those prospects in the same way stocks did, as Treasuries fell (as did municipals) a dramatic 7 points in just a few days, with the 30-year tacking on about 40 basis points to a yield of 2.94%. Equity and fixed income markets worldwide moved in sympathy with US markets, while the dollar retraced to its interim highs, which lowered demand for the metals. Gold lost 5.88% to silver’s 5.76%. Technically speaking, the metals are in no man’s land at this point, but in my opinion this opens up an opportunity to buy somewhere between now and when the Fed is expected to raise rates Dec 14th.

In the meantime, we will just have to wait for the markets to settle into its new norm. More to the point, I don’t think the rally in stocks can proceed without the cooperation of the bond market – which by the way has been leaking steadily both here and abroad since June of this year (long before Trump’s victory). But as I have said here before, performance gaming may carry the stock market through to year-end, after which we might get some clearer indication of what the markets are truly capable of.

Best Regards,

David Burgess

VP Investment Management

MWM LLC