Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Preying on Every Word

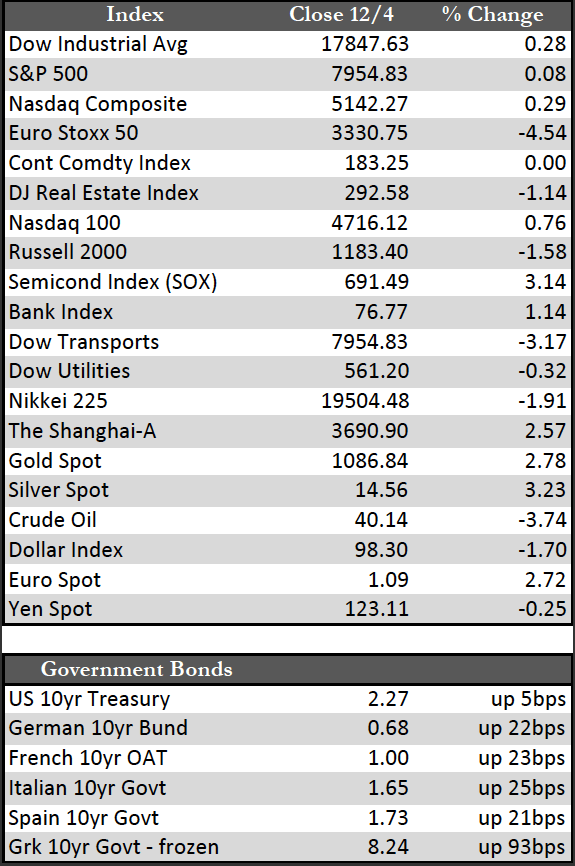

Before trade on Friday, equity markets seemed to be getting the message that central banks are really not inclined to print more money in the near term. Fed chair Janet Yellen said many things this week, but maintained the Fed’s optimism regarding the economy and the intention to raise rates a quarter point by the FOMC’s next meeting on Dec 16th. The ECB decided not to increase QE immediately. These two events sent stocks and bonds into a tailspin worldwide as the news “disappointed” speculators.

All that changed Friday morning when stock operators (or the media) decided that Fed rate hikes would be “gradual,” and Mario Draghi began backpedaling on the ECB policy decision in New York. Draghi said that there can’t be a “limit” to ECB action within its inflation mandates – which effectively translates to: There will be no limit to how much the ECB will print to combat deflation. That, I believe, caused a ramp-up in US stocks that by midday had erased most of the week’s losses. However, as they say, talk is cheap. As I have said in this forum many times, I do not believe central banks can very readily print at a time when QE is having very little positive effect on long-term interest rates. That is a view now shared by a few dissenting members of the ECB board, including Bundesbank President Jens Weidman, who has said very plainly that Draghi’s bond buying program isn’t working.

All that changed Friday morning when stock operators (or the media) decided that Fed rate hikes would be “gradual,” and Mario Draghi began backpedaling on the ECB policy decision in New York. Draghi said that there can’t be a “limit” to ECB action within its inflation mandates – which effectively translates to: There will be no limit to how much the ECB will print to combat deflation. That, I believe, caused a ramp-up in US stocks that by midday had erased most of the week’s losses. However, as they say, talk is cheap. As I have said in this forum many times, I do not believe central banks can very readily print at a time when QE is having very little positive effect on long-term interest rates. That is a view now shared by a few dissenting members of the ECB board, including Bundesbank President Jens Weidman, who has said very plainly that Draghi’s bond buying program isn’t working.

When stock operators finally understand this, there will be profound implications for stocks, bonds, the dollar, and gold. For now, however, confidence in central banks remains intact – albeit tentative. Until the great epiphany, I expect high market volatility, with perhaps a downward bias based on probable issues, beginning with but not limited to U.S. fourth quarter earnings.

Since the last FOMC meeting, when the Fed unexpectedly stuck to its plan for an interest rate hike later this month, gold has been jettisoned by hedge funds that until then had been steadily acquiring the metal (at up to a 17-month high rate). As they dumped, I believe that some short sellers were happy to aggravate the move by piling on.

In the last few days, all that seems to be changing. As to the many reasons why, I suppose you can take your pick. But gold is in an extremely oversold state – of truly historic proportions – and on that basis it really doesn’t need a reason to move higher. Nonetheless, a couple of facts serve as solid indications that a bottom has been put in for the asset class: The miners have been reluctant to set lower lows – even as gold has done so – and the pressure on central banks to “print” continues to build (no matter how ineffective printing will likely prove to be).

Best Regards,

David Burgess

VP Investment Management

MWM LLLP