Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Priced to Perfection Ahead of Earnings

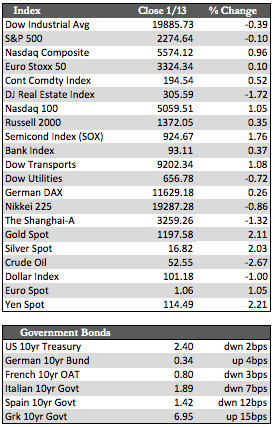

For a few weeks now, the stock market has been having trouble building on the post-election tailwind. This week was no different, even as the NASDAQ touched on a new high – the Dow and the S&P 500 finished the week with small losses. I don’t know if that means stocks have exhausted themselves and are ready to head lower – as I believe they should – but an undertow might be developing given the latest economic and earnings data released this week. That data suggests that credit and leverage are behind the recent uptick in inflation expectations.

U.S. Consumer credit grew at 7.9% (or $24.5 billion) for the year ending in December, which helped produce 4.4% growth in total retail sales over the same period. Bank results out this morning (which I found to be underwhelming, given the hype) confirmed the growth in credit. At JPMorgan, for instance, credit card and commercial loan growth accelerated (quarter to quarter) 6.0% and 5.0% respectively. This lending frenzy is high risk, non-organic, and predominantly a panic reaction to the rise in rates that we’ve had. Accordingly, it’s not a trend that promises any real longevity – which suggests why the momentum in stocks may be fading.

U.S. Consumer credit grew at 7.9% (or $24.5 billion) for the year ending in December, which helped produce 4.4% growth in total retail sales over the same period. Bank results out this morning (which I found to be underwhelming, given the hype) confirmed the growth in credit. At JPMorgan, for instance, credit card and commercial loan growth accelerated (quarter to quarter) 6.0% and 5.0% respectively. This lending frenzy is high risk, non-organic, and predominantly a panic reaction to the rise in rates that we’ve had. Accordingly, it’s not a trend that promises any real longevity – which suggests why the momentum in stocks may be fading.

Away from stocks, Treasuries and EGBs essentially moved sideways, undecided as to the size and scope of future Fed hikes in the wake of conflicting economic data. This included a lower-than-Fed-target increase of 1.6% in the PPI (target is 2%), peak levels in Consumer Confidence, and a 0.6% increase in US Advanced Retail Sales for December (though it was 0.0% ex autos and gas). The US dollar fell below its 50-day moving average of 101.4 in response to concern that Trump’s proposed resurrection of Smoot Hawley style tariffs will morph into trade wars. This may have also helped the metals extend a two-week rally, while crude prices tapered off of interim highs as US drilling growth was seen offsetting any benefit in recent OPEC supply cuts.

Next week we’ll hear more from corporate America by way of earnings. I would expect that the majority of good news has already been factored into stock prices, though the FANGS and the undying quest for 20,000 on the Dow may once again be the exceptions to that rule. As for the metals, gold broke above its 50-day moving average as surmised in last week’s comments, and may now be looking at $1,240 or $1,270 before the next consolidative wave.

Best Regards,

David Burgess

VP Investment Management

MWM LLC