Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Questionable Earnings Not Yet a Concern,

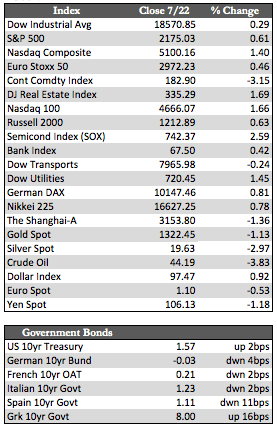

After setting a new record in the Dow, S&P, and NASDAQ earlier in the week, stock prices faded a bit into the close on Friday. The cause was presumably this week’s ECB policy meeting, where Draghi gave speculators no hope for further QE, now or in the future. He did, however, discuss rather vaguely the idea of bailing out Italian banks (when the time comes) with “public” funds. What he meant by this was unclear, but it kept European bank shares from extending declines now over a year old. That said, it’s also not clear whether Draghi’s failure to print will keep US stocks from ascending to even greater heights in the days to come. Stock bulls are content (so far) with US second quarter earnings – so much so that dreams of an even better second half have begun to fill their heads.

Such dreams thrive on fiction more than fact, as Wall Street continues to promote the idea that beating estimates is good – even though actual results, on average, are still lower than they were a year ago (despite the ultra-low borrowing rates we’ve seen of late). I obviously can’t comment on all the companies that reported this week, but there were some mixed standouts. Netflix missed rather substantially, seeing its shares take a 14% nosedive. Intel beat its number, but still couldn’t convince investors that things would improve; its shares lost a few percentage points. Microsoft and IBM were both rewarded with share price gains on a “beat” in both cases. Microsoft benefits came from forcing its new operating system upon its users (which I am sure spurred software upgrades) and a lower tax bracket. IBM hasn’t seen real revenue and/or profit growth, even factoring in acquisitions, in over 17 quarters. But if I were to sum up those developments with a few other observations at GE and Honeywell, for instance, I would say that many attempts have been made to win investors over this quarter. Most results still have major problems, including inventory builds that will be difficult to unload in time to match the lofty expectations set for third quarter.

Such dreams thrive on fiction more than fact, as Wall Street continues to promote the idea that beating estimates is good – even though actual results, on average, are still lower than they were a year ago (despite the ultra-low borrowing rates we’ve seen of late). I obviously can’t comment on all the companies that reported this week, but there were some mixed standouts. Netflix missed rather substantially, seeing its shares take a 14% nosedive. Intel beat its number, but still couldn’t convince investors that things would improve; its shares lost a few percentage points. Microsoft and IBM were both rewarded with share price gains on a “beat” in both cases. Microsoft benefits came from forcing its new operating system upon its users (which I am sure spurred software upgrades) and a lower tax bracket. IBM hasn’t seen real revenue and/or profit growth, even factoring in acquisitions, in over 17 quarters. But if I were to sum up those developments with a few other observations at GE and Honeywell, for instance, I would say that many attempts have been made to win investors over this quarter. Most results still have major problems, including inventory builds that will be difficult to unload in time to match the lofty expectations set for third quarter.

Away from stocks, fixed income stabilized from its recent profit-taking selloff. The dollar gained, building on the expectation of further Fed rate hikes (if you can believe it). The metals consolidated for a second week in a row, with gold now set to repair to its 50-day moving average of 1,288 unless bullish attitudes in the stock market reverse before then. I think that’s possible, as I believe much of the stock price momentum we have seen in our major indexes (and not the broader market) has been based on very temporary streams of flight capital from overseas (think Brexit).

Best Regards,

David Burgess

VP Investment Management

MWM LLC