Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Rally Aside – It’s Still Dicey

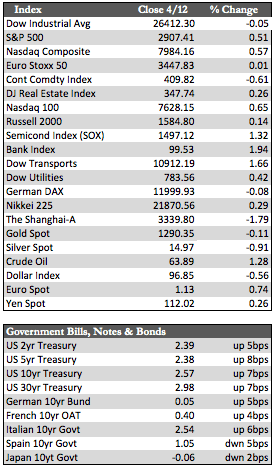

The major stock indices finished the week in mixed fashion, trading within range of last week’s interim highs – ex the transportation index, which “broke out” after Delta’s results showed the impact of 737 MAX plane issues to be negligible upon earnings. US/China trade developments (regarding enforcement) and bank earnings kept the broader market out of what would otherwise have been the loss column. JP Morgan and Wells Fargo both reported better than expected earnings Friday morning, and delivered decent growth across the majority of segments. Shares of both banks rose sharply that same morning. By day’s end, however, only shares of JPM finished with a gain (of 4.6%), as Wells Fargo (-2.62%) warned that its interest income could decline in subsequent quarters, perhaps owing to yield curve issues.

The strong rotation that occurred from stocks into bonds during the first part of this year was bound to have a positive impact on interest rate-sensitive sectors (homes, autos, bank loans, refi, etc.). Therefore earnings “beats” should be more or less expected, and perhaps deemed unsustainable since the “growth” is of non-organic origins. Recent performance in bank shares reflects this little-known truth. The KBW Bank index is still off 14% from the highs set in early 2018, and remains in technical decline. Keep in mind that banks usually lead or follow the broader market. The fact that they aren’t should be a warning sign to stock bulls.

The strong rotation that occurred from stocks into bonds during the first part of this year was bound to have a positive impact on interest rate-sensitive sectors (homes, autos, bank loans, refi, etc.). Therefore earnings “beats” should be more or less expected, and perhaps deemed unsustainable since the “growth” is of non-organic origins. Recent performance in bank shares reflects this little-known truth. The KBW Bank index is still off 14% from the highs set in early 2018, and remains in technical decline. Keep in mind that banks usually lead or follow the broader market. The fact that they aren’t should be a warning sign to stock bulls.

Away from stocks, Treasury yields rose across the curve, though the spread between the 2- and 10-year remained flat around 16bps. The dollar lost some ground, and might be topping out – this, despite ECB dovishness and another Brexit delay (to Oct 31st). Gold investors insisted on dumping the metal back below the $1,300 mark on what should have been an expected 0.6% rise in PPI inflation for the month of March. Oil held steady around $64/bbl on an offset between a rise in US inventories and a reduction in Saudi output. Relevant US economic data (anything beyond March) was sparse. There was a fairly substantial 5.6% decline in mortgage applications for the week ending April 5th, implying that any economic momentum stemming from the recent decline in rates will be short-lived.

Bank and other deep cyclical earnings aside, S&P 500 Q1 earnings are expected to decline for the first time in three years, led by energy, tech, and materials. Further, companies have borrowed large sums (51% more than last year’s first quarter) to buy back their shares at an accelerated pace for the sole purpose of concealing earnings (per share) shortfalls. All of this leads me to believe that the underlying economic weakness is greater than anyone cares to admit, which in turn makes one wonder what corporate America or the financial sector will do for an encore.

Best Regards,

David Burgess

VP Investment Management

MWM LLC