Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Rally in Stocks Still Has Much to Prove

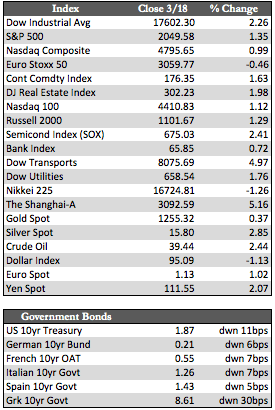

Acting in response to Janet Yellen’s dovish FOMC remarks on Wednesday and an effort to relax lending standards in China overnight Thursday, global stock markets “melted up” this week. US indices led the way higher (except NASDAQ). The strength in stocks surprised me a bit since the Fed didn’t provide speculators with much in terms of substance. Reductions in rate hikes, GDP, and inflation forecasts certainly revealed the Fed’s awareness of global economic risks, but being aware is quite different from printing money. QE would, I believe, carry stocks higher from here, if only for a short time. In any case, stocks enjoyed some more upside. The only thing worth mentioning about it is that the more conservative names in the Dow and the S&P 500 received the lion’s share of the buying pressure – not (in general) the FANGs (Facebook, Amazon, Netflix, and Google). This could mean that the rally still lacks conviction or it could be just noise. Next week’s trading action will tell us more one way or the other, but without a pressing need for the Fed to print now that stocks are higher, I expect a correction of some magnitude (including oil).

Lending weight to that expectation has been a series of less than stellar corporate preannouncements. Caterpillar lowered its guidance for the remainder of this year, which I find odd given that prices for iron ore and non-ferrous metals have risen substantially since the beginning of this year. Also Jabil Circuit, whose largest customer is Apple, reduced its sales forecast by roughly 11.5% for its third quarter. Shares of Jabil declined 11.1% from the announcement Thursday, but more important is what the shortfall will mean for Apple’s numbers for the rest of the year. On the flipside, FedEx raised estimates on the lower end of its earnings forecast by $0.30 to $10.70 per share, and saw its shares soar by more than 12% this week. I don’t doubt the numbers at FedEx, as internet shopping is on the upswing, but internet shopping alone doesn’t give a full representation of the overall economy.

Lending weight to that expectation has been a series of less than stellar corporate preannouncements. Caterpillar lowered its guidance for the remainder of this year, which I find odd given that prices for iron ore and non-ferrous metals have risen substantially since the beginning of this year. Also Jabil Circuit, whose largest customer is Apple, reduced its sales forecast by roughly 11.5% for its third quarter. Shares of Jabil declined 11.1% from the announcement Thursday, but more important is what the shortfall will mean for Apple’s numbers for the rest of the year. On the flipside, FedEx raised estimates on the lower end of its earnings forecast by $0.30 to $10.70 per share, and saw its shares soar by more than 12% this week. I don’t doubt the numbers at FedEx, as internet shopping is on the upswing, but internet shopping alone doesn’t give a full representation of the overall economy.

Away from stocks, fixed income was modestly higher (globally) on the back of the Fed’s dovish talk, while the US dollar trended substantially lower. The metals gained, with silver leading the way higher by 2.85% to gold’s 0.37%. I don’t have a roadmap as to where the metals go from here in the short run, as the rally in stocks could get even crazier than anyone expects. However, when stocks do begin to fade, I expect the metals to pick up speed to the upside since they have had ample time to consolidate gains at current levels.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP