Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Risk On, Risk Off

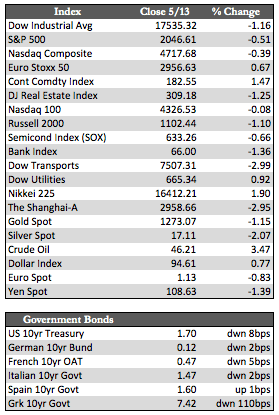

Stocks started the week with a mind to move higher. For a few days they did just that – benefitting from any headline, good or bad. Whether it was the decline in Chinese balance of trade, Germany’s uptick in April factory orders, talk of a third bailout for Greece, the BoE’s rate decision, or Taro Aso’s threat to debase the yen, all roads led to Rome. Stocks seemed to grind and then gap higher in a few instances, with the NASDAQ leading the way thanks to a handful of biotech firms. Even gold was getting hammered as the notion of “risk on” seemed to be taking hold. By Wednesday, however, the bullish tone reversed. The Dow lost over 200 points in short order, for no apparent reason other than some weakness in retail stocks due to market share gains at Amazon. Then Disney registered an earnings miss that night, and Taiwan Semiconductor (the supplier of Apple A10 chips) issued a bleak second-half forecast the next day. Those events better explain the pressure on stocks that held the bulls in check for the week.

All that said, I still believe that stocks don’t really need a reason to initiate a decline. Exhaustion points don’t always give fair warning that the top has been put in. But I find the news from Taiwan Semiconductor interesting, to say the least, since it puts a real crimp in the now pervasively bullish theory that a rebound in the economy is underway. Of course, US retail sales did surprise to the upside (up 1.3%, led by autos and gas), as did consumer sentiment, which jumped from 90 to 95 in April. However, consumer credit (up 11.09% in March) and inflation (as measured by import prices and the PPI) have been rising just as fast, if not faster. So I would take any good news with a grain of salt.

All that said, I still believe that stocks don’t really need a reason to initiate a decline. Exhaustion points don’t always give fair warning that the top has been put in. But I find the news from Taiwan Semiconductor interesting, to say the least, since it puts a real crimp in the now pervasively bullish theory that a rebound in the economy is underway. Of course, US retail sales did surprise to the upside (up 1.3%, led by autos and gas), as did consumer sentiment, which jumped from 90 to 95 in April. However, consumer credit (up 11.09% in March) and inflation (as measured by import prices and the PPI) have been rising just as fast, if not faster. So I would take any good news with a grain of salt.

As for the metals, gold did not break through the 1,300 mark, which was a possibility I pondered last week. Instead, we seemed to go through a small consolidative phase in which gold touched down around 1256 at the low. What was key, I think, is that gold, silver, and the miners shook off those losses to some degree as the week progressed, despite the fact that the dollar spiked higher against both the yen and the euro. Treasuries were also strong for a third consecutive week, which is to say that no matter how many rallies we’ve seen in stocks, there appears to be an undercurrent in the market preparing for tougher times. Like Treasuries (thus far), the metals seem to be thriving on that undercurrent regardless of intermittent dollar strength. In any case, this may mean a breakout above 1,300 for gold has only been delayed. Its price action in the midst of the usual negatives has continued to impress.

Best Regards,

David Burgess

VP Investment Management

MWM LLC