Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Shutdown Can’t Hold a Good Rally Back

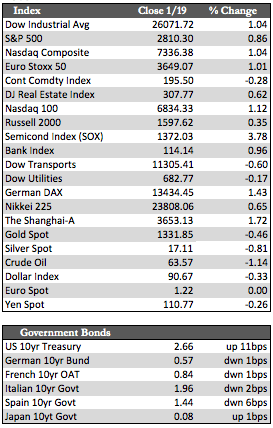

Stocks seemed to ignore what is now being called the “Schumer Shutdown” over budget talks, as such most of the major indices (excluding the Transports) managed a small gain on the week, thanks in part to the usual Friday end-of-day rally.

The short-term Treasury market, now on its fifth year of losses, continued to decline. Its yield trajectory is almost a mirror image of the steep ascent ongoing in stocks (at least since September of last year). I mention this because carry trade dynamics are at work, in which speculators borrow at the short end and invest long (whether in stocks or bonds). It’s a trend worth following because the cost of borrowing is crucial to successful returns. To put the changes in perspective, the two-year Treasury yielded less than 0.25% in 2013; today it sports a yield just north of 2.07%. Last week, we talked about triggers that would put stocks into a tailspin – well, skyrocketing borrowing costs could certainly be one of them.

Away from stocks, Treasury yields (at the long end) crept higher and are now nearing last year’s highs, EGBs and Asian debt were relatively stable. Profit taking defined the oil market this week, as hedge funds stepped in to trim positions on a rally “gone too far.” The dollar also took a little off the top – again. It fell more than a point, to 90.50, which, according to Trump, is a good thing. Though that may be true for the economy and jobs, I remain skeptical as to the benefits a weaker dollar will ultimately have on financial markets. Gold and silver seemed to dance to the tune of the government budget talks rather than the dollar. They ended the week off by about a half a percent – discounting a favorable outcome.

Away from stocks, Treasury yields (at the long end) crept higher and are now nearing last year’s highs, EGBs and Asian debt were relatively stable. Profit taking defined the oil market this week, as hedge funds stepped in to trim positions on a rally “gone too far.” The dollar also took a little off the top – again. It fell more than a point, to 90.50, which, according to Trump, is a good thing. Though that may be true for the economy and jobs, I remain skeptical as to the benefits a weaker dollar will ultimately have on financial markets. Gold and silver seemed to dance to the tune of the government budget talks rather than the dollar. They ended the week off by about a half a percent – discounting a favorable outcome.

As I mentioned last week, shares of JPM have already priced in well over 20 years’ worth of benefit from the tax cut – as have many other blue-chip stocks. Clearly, this rally, whether it continues or not, is not really about Trump or his policies anymore. Instead, it’s about speculation and the momentum behind it. The metals may take a hit if the government can come to terms over the budget, but I wouldn’t expect losses to be deep or long lasting. The metals are really being bought for different reasons – primarily as a hedge against stocks.

Next week, we’ll hear from the ECB and the BOJ on rates, while Trump will be in Davos attending the World Economic Forum. We’ll also get more on earnings, which for the most part have been skewed (positively) by excessive consumer spending related to last years’ storms.

Best Regards,

David Burgess

VP Investment Management

MWM LLC