Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Still Bouncing

Overseas stocks were mostly weaker as Brexit continued to shake things up across Europe and Asia. Stocks here at home managed to tread water until the jobs report was released on Friday. Then US indices bolted higher on the news of a 287,000 non-farm jobs number for the month of June. It’s hard to interpret the market’s reaction to the jobs number; quite a bit of volatility has been baked into that cake over the last few months thanks to the strike at Verizon and the creation of temporary summer jobs. However, if we average the last six months of non-farm payrolls, we come up with 171,500. That’s still far short of the 250,000 per month needed to indicate an expanding economy, but what the number really means to stock bulls is no rate hikes. In fact, when combined with the overseas issues, the situation is beginning to favor rate cuts rather than hikes, as is the case at present with the Bank of England.

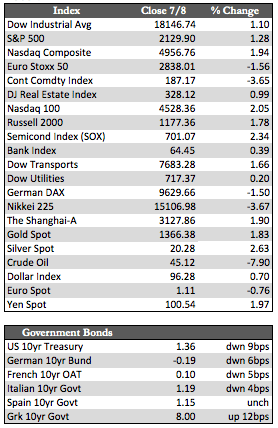

Away from stocks, Treasuries, German Bunds, and Japanese Government Bonds remained quite strong, with yields at record lows. Treasuries in particular held their gains through Friday, despite the rally in stocks (see the box scores for rates). This could also be said of the metals for the week, as they finished strong. Gold gained 1.57% to silver’s 2.16% by the close on Friday. The dollar was mixed, gaining against the euro, pound, and yuan while weakening once more against the yen – a trend now 21 weeks old.

Away from stocks, Treasuries, German Bunds, and Japanese Government Bonds remained quite strong, with yields at record lows. Treasuries in particular held their gains through Friday, despite the rally in stocks (see the box scores for rates). This could also be said of the metals for the week, as they finished strong. Gold gained 1.57% to silver’s 2.16% by the close on Friday. The dollar was mixed, gaining against the euro, pound, and yuan while weakening once more against the yen – a trend now 21 weeks old.

What happens from here is anyone’s guess without additional information. So far, Brexit and the corresponding overreactions (easy talk) by central bankers have clouded the real issues, such as earnings, and subsequently spurred more speculation in stocks. Yet with US markets as heated as they are, stock bulls will be faced with the conundrum of weaker earnings and a Fed that probably won’t cut rates or crank up the presses now that stocks appear to be back to normal and bonds are far better off than they deserve to be. We’ll have more to go on when Alcoa kicks off the Q2 earnings season here in the US on July 11th.

Best Regards,

David Burgess

VP Investment Management

MWM LLC