Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stock Bulls Pulling Out All the Stops

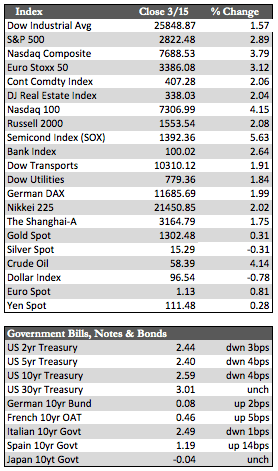

Stocks managed to build some momentum off the rally that began last week. By the close Friday, the tech-heavy NASDAQ had added about 4.0%; the industrials, 1.2%. Accelerated share buybacks, a series of analyst upgrades (mostly tech), triple witching, and the usual optimism over trade with China formed the underpinnings for the advance.

All of this was more than enough to offset continued signs of a less-than-robust US economy. January data has been next to useless, skewed by effects of excessive winter weather. It made some indicators better (e.g., Retail Sales of 0.2%) and some worse (e.g., New Home Sales, -6.7%) than they should have been. But the February data has been more reliable and consistent with the global slowing paradigm – to include last week’s 20,000 non-farm payrolls report and the 117% increase in Challenger job cuts. CPI and PPI inflation stats came in on the lower end of expectations, at 0.2% and 0.1% respectively. Manufacturing did likewise, with industrial production at 0.1% (0.4% expected) and the manufacturing (SIC Industry groups) production at -0.4%.

All of this was more than enough to offset continued signs of a less-than-robust US economy. January data has been next to useless, skewed by effects of excessive winter weather. It made some indicators better (e.g., Retail Sales of 0.2%) and some worse (e.g., New Home Sales, -6.7%) than they should have been. But the February data has been more reliable and consistent with the global slowing paradigm – to include last week’s 20,000 non-farm payrolls report and the 117% increase in Challenger job cuts. CPI and PPI inflation stats came in on the lower end of expectations, at 0.2% and 0.1% respectively. Manufacturing did likewise, with industrial production at 0.1% (0.4% expected) and the manufacturing (SIC Industry groups) production at -0.4%.

Why should this be important to stocks? Because this slowing, per se, is the result of tighter financial conditions caused predominantly by market forces, not Fed and/or other central bank influences. So, it will be interesting to see just how long the rally – or, better said, the charade – in equities can persist.

Away from stocks, the weaker economic data was not ignored. Safe haven fixed income rallied, the dollar fell, and the metals rebounded – with gold closing just above the critical level of $1,300. Oil perked up, as well, perhaps as the US dollar battled with key support levels, but more likely in response to a sharp decline in weekly inventories of crude and gasoline. Next week, Federal Reserve and BoE officials will decide on rates, and we are likely to get slightly more dovish leanings. And of course, we will receive more information on either or both of the two overplayed sagas, Brexit and China/US trade.

Best Regards,

David Burgess

VP Investment Management

MWM LLC