Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stock Momentum Takes Pause After Fed Meeting

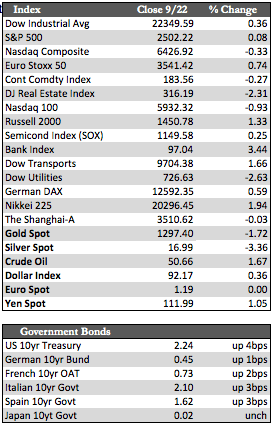

Stocks rallied ahead of the FOMC policy meeting on Wednesday, in hopes that the Fed would be more dovish in the aftermath of the storms. Yellen and kept rates unchanged and announced plans to normalize the Fed’s balance sheet by as much as $5.0 billion, and raise rates one more time this year. She also described the recent slowdown in the inflation data as a “mystery,” but dispelled concerns by saying that the economy was strong enough to handle more rate hikes. In any case, the markets behaved in mixed fashion for the remainder of the week, as the indices shed some of their earlier gains – ex the Dow Transport index, which jumped after Fed-Ex posted some better-than-expected earnings (which were no better than last year’s). All in all, defensive stocks/names outperformed their growth-oriented counterparts through to the close on Friday. NASDAQ leaked a bit from Tuesday due to some momentum loss within the FANGs, Apple and its suppliers.

Away from stocks, the dollar managed a small gain and the Treasury curve flattened following Yellen’s remarks. The latter was achieved by some selling at the short end and buying at the long end of the curve. The 5-year Treasury added about 6 bps to 1.86 while the 30-year shed 1bp to 2.78.

Away from stocks, the dollar managed a small gain and the Treasury curve flattened following Yellen’s remarks. The latter was achieved by some selling at the short end and buying at the long end of the curve. The 5-year Treasury added about 6 bps to 1.86 while the 30-year shed 1bp to 2.78.

An inverted yield curve, if you’re new to the term, is where short rates exceed the long. It almost always precedes and indicates a recession. Obviously, we are still some distance away from that situation, but it’s interesting to see traders take the Fed’s comments somewhat seriously, which has not been the case for some time. For the most part, overseas markets moved in sympathy with those in the US, though this Sunday’s German election may be having a more positive impact on stocks in Europe. The prospect of maintaining the status quo seems to be having a calming effect on volatility. By that I mean, that Merkel is favored to win a fourth term over the nearest competitor that trails by 15 percentage points in the polls.

Where we go from here is still a matter of debate. If we don’t see a correction in stocks begin to take shape in the oftentimes-volatile month of October, it’s likely that stocks will weather the low-volume holiday trade and finish well for the year. If we do get a correction, I suspect it will be bought (for window-dressing purposes) and we’ll finish the year fairly close to where we are now. Regardless, demand for the metals may not change very much in either circumstance, since they have been bought consistently as protection against an overdue pullback in stocks. Technically, gold held for a few days at the $1,310 level up until the FOMC meeting, at which time gold experienced some selling pressure to find support at $1,295, per renewed threats out of North Korea.

Best Regards,

David Burgess

VP Investment Management

MWM LLC