Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stock Rally Stalls Ahead of the Fed

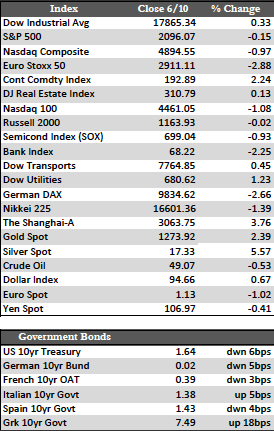

Earlier this week, the market was all ears for what Yellen had to say about the rather large drop in jobs announced last Friday. Though her remarks were rather balanced on the subject, bulls tuned out everything but the dovish part and goosed stocks higher all the way to the close on Wednesday. At that time, as has been the case during several trading sessions lately, stocks here in the US had trouble maintaining upside momentum. I could see no US-specific reason for the stall, but there was an undertow in equity markets that emanated from Europe. Lower corporate profit forecasts, Mario Draghi’s less-than-upbeat speech on the eurozone, and of course the upcoming Brexit vote sent indices lower there by about 2.5% for the week.

As I said last week, US stocks have had very little reason to sustain the rally that started back in February of this year. That fact makes me think that stocks might also decline without much warning or reason. I can’t say with certainty whether this week marked a top for stocks or not, but the market action has at least begun to suggest that stocks have exhausted themselves in this latest move and are ready to head lower – regardless of anything the Fed says or does in next Wednesday’s FOMC meeting.

As I said last week, US stocks have had very little reason to sustain the rally that started back in February of this year. That fact makes me think that stocks might also decline without much warning or reason. I can’t say with certainty whether this week marked a top for stocks or not, but the market action has at least begun to suggest that stocks have exhausted themselves in this latest move and are ready to head lower – regardless of anything the Fed says or does in next Wednesday’s FOMC meeting.

Away from stocks, the tailwind provided by the jobs report/Fed response sent US Treasury rates near all-time lows and the metals back with striking distance of interim highs. Gold chalked up a gain of 2.53% to silver’s 5.52%, with an average 2.5% return for the miners. That move was in the face of the fact that the dollar ended the week with a slight gain, apparently on the back of a few traders who expect the Fed to follow through on a rate hike next week. Again, I don’t think a hike of 25 basis points to 0.75% would do any real damage, though it might help the Fed regain some badly needed credibility. But, given the current state of economic affairs, it’s likely that a rate hike (if one occurs) will be the last until the Fed is perhaps forced to raise rates after a post-crisis rescue attempt.

Best Regards,

David Burgess

VP Investment Management

MWM LLC