Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks Attempt to Shrug Off Jobs

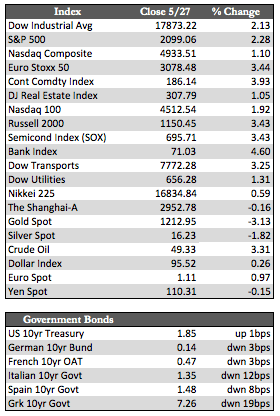

Equity markets worldwide were a touch softer this week. European markets led the way down by a couple of percent, but there was no clear reason why. The market has been rallying since mid-February on the back of both good and bad news, so I suspect we will eventually see downside behavior of the same nature. That said, the market had difficulty gaining any upside momentum this week, even though it had plenty of news it could have spun in its favor. Exhibit A was the long awaited yet surprisingly dismal non-farm payroll report on Friday. It registered the creation of 38,000 jobs in May instead of the 160,000 that were expected. News with shock value like this would normally have produced a rally, but in this case stocks were off sharply. The Dow lost about 140 points in the early going, then made the usual attempt to recoup its losses by the close – but failed. My assessment of this behavior is that stocks have topped out and are now ready to discount certain harsh realities that we all know exist. This is still just a feeling (in line with my biases), so I may be a few months ahead of reality in that assessment.

Away from stocks, Treasuries and German Bunds raced higher, which sent corresponding yields plummeting to near record lows. The metals firmed up against the dollar thanks to the jobs report, with gold up 2.26% to silver’s 0.78%. The miners once again were the relative outperformers in the metals market, finishing the week with a gain of 11.4%.

In the weeks leading up to the Fed policy meeting June 15th, anything could happen in the markets. I don’t think anyone can be completely confident that the Fed won’t raise rates the intended (and non-threatening, I might add) 25 basis points. Aside from the lone US jobs report, we still have quite a few indicators that have been flashing red on a consistent basis since last year in terms of inflation. The latest such was the ISM Prices Paid at 63.5, up from 59.0 in April. I don’t want to make a big deal out of it, but I do believe the Fed should, at the very least, be marginally concerned that inflation has yet to take a nosedive when economic activity does so. That said, I would classify the market action between now and that next policy meeting as “up for grabs” – at least until, as I have said before, second-quarter earnings season gets underway.

Best Regards,

David Burgess

VP Investment Management

MWM LLC