Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks Bounce, Obstacles Remain

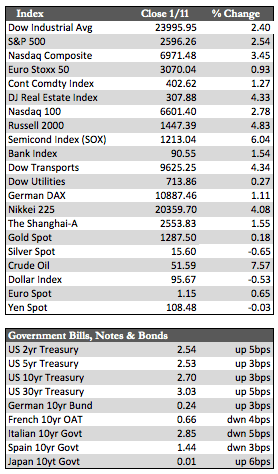

Jerome Powell’s bullish remarks about the US economy combined with optimism over trade with China trumped risks of a prolonged government shutdown and some downbeat FOMC minutes on Wednesday. As a result, stocks gained about 2.0% on the week, led by gains in the consumer discretionary, industrial, and real estate (REITS) sectors. Shares of banks and other financial institutions were the laggards for the week, and stood virtually unchanged. On balance, it was a week where the “risk on” paradigm took effect – fueled by hopes that the selling spree we witnessed in December has run its course. I remain doubtful about that. We have yet to see the bond market rally (in tandem with stocks) to produce the lower cost of debt needed to feed consistently higher stock prices. It’s a problem I believe Wall Street has become fully aware of, and as such we’re likely to see more selling into the rallies (sparked by a trade deal etc.) as traders get ahead of what are likely to be eventual deleveraging risks.

Along those lines, it was interesting to see that bid-to-cover ratios within recent Treasury auctions have been on the decline. This means demand isn’t what it used to be, or supplies have expanded beyond a saturation point – or both. In any case, it was a topic of discussion today on Bloomberg TV that the bid-to-cover ratio on 3-year Treasury notes had dropped to a fresh 10-year low of 2.44 during auctions January 8th. 10-year auctions are said to be suffering the same fate, and it’s something that’s likely to worsen as our deficit has exploded (to more than $850 billion) over the last year. Needless to say, Treasury rates rose this week. Still, they showed no signs of severe instability – yet.

Along those lines, it was interesting to see that bid-to-cover ratios within recent Treasury auctions have been on the decline. This means demand isn’t what it used to be, or supplies have expanded beyond a saturation point – or both. In any case, it was a topic of discussion today on Bloomberg TV that the bid-to-cover ratio on 3-year Treasury notes had dropped to a fresh 10-year low of 2.44 during auctions January 8th. 10-year auctions are said to be suffering the same fate, and it’s something that’s likely to worsen as our deficit has exploded (to more than $850 billion) over the last year. Needless to say, Treasury rates rose this week. Still, they showed no signs of severe instability – yet.

Aside from this, the dollar was fractionally lower and failed to rebound above its 100-day moving average of 96.0. This helped the metals maintain composure in an otherwise bearish context amid a decline in December’s CPI of 0.1%. Crude oil rallied in excess of 7.0% in reaction to the risk-on mentality and OPEC production cuts.

Next week, we’ll get a look at 4thquarter earnings beginning with the banks (Citigroup). Bank earnings have been adjusted lower by an average of 8.1% since last quarter, and we’ll see if they’ve set themselves up to beat those lowered estimates, and if the markets choose to bid the shares up in response or not. Whatever the outcome, it may set the tone for the entire earnings season. Brexit, China/Mexico trade, Japan inflation, and the government shutdown will no doubt be topics du jour as well.

Best Regards,

David Burgess

VP Investment Management

MWM LLC