Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks Climb, Yet Bonds Tumble

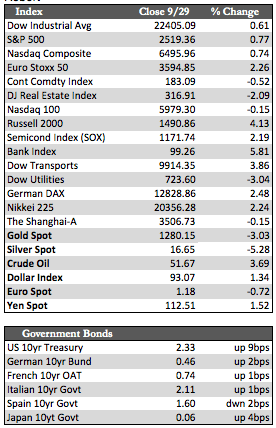

With a little help from Trump’s proposed tax plan, a few optimistic central bankers, and Merkel’s reelection, stocks maintained their composure for the week. European stocks tacked on a fourth straight week of gains off of their pre-election lows, while US stocks added about a percent, ex the Dow, which remained unchanged. Growth stocks and companies that stand to benefit from Trump’s proposal to reduce the corporate tax rate from 35% to 20% took center stage. This of course includes shares of the FANGs and other large-cap tech companies that may repatriate large stockpiles of overseas cash (e.g., AAPL, MSFT, GOOGL, CSCO, ORCL) under the plan. In any case, I really don’t give the bill a high chance of success given the current gridlock in Washington. Even if passed, the bill will do very little about our burgeoning budget deficit (according to the CBO), which at current pace will necessitate an expansion in US debt of $10 trillion (to nearly $30 trillion) over the next decade.

This may in part be why the Treasury market behaved so poorly this week as the rate on the 10-year benchmark rose by about 8 bps to yield 2.34%. I say “in part” because there are other factors that may be weighing on bonds. These include but are not limited to lackluster note auctions in 5-year paper, widening corporate credit spreads, rising delinquencies in subprime, and Yellen’s commitment to hiking rates “gradually” despite what the inflation data may be telling us at present. The 10-year rate is now 31 bps higher than where it was in early September – all other Treasury paper is up about 20 bps (including the 30-year). To sum this up, I believe the markets are trying to say that there is no free lunch anymore when it comes to attempts at stimulating the economy.

This may in part be why the Treasury market behaved so poorly this week as the rate on the 10-year benchmark rose by about 8 bps to yield 2.34%. I say “in part” because there are other factors that may be weighing on bonds. These include but are not limited to lackluster note auctions in 5-year paper, widening corporate credit spreads, rising delinquencies in subprime, and Yellen’s commitment to hiking rates “gradually” despite what the inflation data may be telling us at present. The 10-year rate is now 31 bps higher than where it was in early September – all other Treasury paper is up about 20 bps (including the 30-year). To sum this up, I believe the markets are trying to say that there is no free lunch anymore when it comes to attempts at stimulating the economy.

As for the economic data, much of it was again dismissed as Hurricane related. We are still receiving the “downtick” part of the data – with new and pending homes sales off 3.5 and 2.6%, respectively, in August. We will have to wait and see how the markets react once we get the “uptick” side of the equation, which will reflect the rebuild. Markets, I believe, have already discounted much of the supposed benefit to earnings, but we are heading into year-end where game playing on a theme is common.

The same could be said of gold at the moment. It has done well this year, and that means fund companies may opt to show it on the books at year-end. But competing with that notion is the recent Yellen-induced rally in the dollar, which could extend from today’s 93.005 to north of 96.0 on the charts. Given the fact that the Fed is really trapped in its monetary policy (Yellen admitted as much on Tuesday), I think this latter scenario is a bit far-fetched and should allow gold and the other metals to finish well into the green for the year. $1,271 and $1,250 will be key levels to watch as the year unfolds.

Best Regards,

David Burgess

VP Investment Management

MWM LLC