Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks Grind Higher

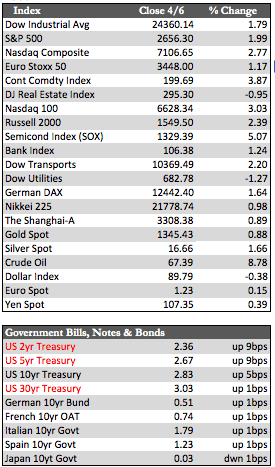

Earlier in the week, Trump’s tight grip on foreign policy had markets second-guessing their bullish resolve. That momentary tension was quickly eased as traders and investors subordinated international trade risks to first-quarter earnings releases. We heard from a handful of the biggest banks, including Wells Fargo, Citigroup, and JP Morgan. They all seemed to do quite well at “beat the number” (with the possible exception of Citigroup on revenues), as gains in equity trading, commercial loans, and net interest income more than offset losses in fixed income. However, to say that they grew in a conservative or healthy sense would be to overstate the case, in my opinion. Their increase in business did not stem from demand deposits, but from massive increases in leverage either by the banks (short term) or their customers (long term). In any case, bank shares were smacked for about a 2.0% loss in trading on Friday, perhaps due to some balance sheet risk, but more likely the negative impact the Fed’s hawkish policy is having on loan growth among consumers (i.e., mortgages). Markets dipped into negative territory in sympathy with the banks at the close Friday, but that action was not enough to erase weekly gains of 1.5% to 3.0%, depending on the index. One suspects that the stock bulls retain hopes for better earnings reports in the weeks to come.

There wasn’t much to speak of on the economic front, though a fairly weak CPI of -0.1% in March (likely perceived as pressure on the Fed to be more dovish) may have helped to inspire the mid-week rally in stocks. Even so, that number didn’t stop the two-year treasury yield from climbing to an interim record of 2.36% – which is proof to me that carry-trade appetites haven’t been sated, even after the Dow’s 8.4% contraction from its high, set in January. Away from all this, oil jumped, the dollar fell, and the metals rose after Trump’s sanctions against Russia and firm reaction to the use of chemical warfare in Syria.

There wasn’t much to speak of on the economic front, though a fairly weak CPI of -0.1% in March (likely perceived as pressure on the Fed to be more dovish) may have helped to inspire the mid-week rally in stocks. Even so, that number didn’t stop the two-year treasury yield from climbing to an interim record of 2.36% – which is proof to me that carry-trade appetites haven’t been sated, even after the Dow’s 8.4% contraction from its high, set in January. Away from all this, oil jumped, the dollar fell, and the metals rose after Trump’s sanctions against Russia and firm reaction to the use of chemical warfare in Syria.

Next week, we’ll get a look at U.S. retail sales, Shinzo Abe’s visit to the White House, the IMF’s annual meeting, and more earnings reports. Whatever the outcome of these events, I suspect that a breakout to the upside may be in the offing now that speculators have pushed markets back to more significant levels. If so, we may see the Dow back over 25,000 before testing its limits and failing again.

Best Regards,

David Burgess

VP Investment Management

MWM LLC