Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks High on QE – Real or Implied

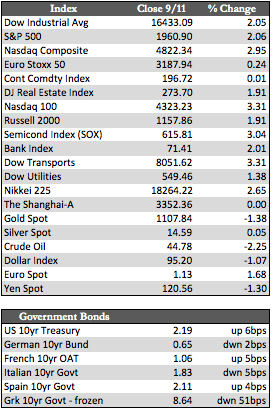

World stock markets were stronger this week, up over 1.5% on average, on promises or talk of QE from Central Banks in China, Japan, and Europe. Though China is the only country thus far to have injected additional funds (of approximately $280 billion), markets have begun to behave as if QE checks have already been written. In that light, I don’t think traders are taking next week’s FOMC meeting and the prospects of a rate hike very seriously, nor are they taking the failures of QE very seriously. China’s efforts haven’t stopped its stocks from rolling over 38.3% any more than the ECB’s €60 billion per month contribution has prevented the German DAX from shedding 18.3% from its highs. Still, US investors may choose to stay ignorant (at least through Wednesday) of the Fed’s limitations when it comes to averting a full scale deleveraging in US equities – which for all intents and purposes may already be underway.

It may also be worth noting that the ECB just beefed up its staff of bank regulators by 25%, or 200+ people, with the intent to monitor its banks more closely. From the information provided it’s not clear why the increase was needed, but it occurs at a time when QE isn’t necessarily getting the job done. ECB suspicions that banks aren’t utilizing QE as prescribed reminds us of when the Fed at Bernanke’s direction in 2013 and ’14 ran stress tests on banks thought to be delinquent (because rates were rising) in purchasing appropriate amounts of Treasuries. In any case, where there’s smoke there’s usually fire, and it’s worth paying attention to this development as we go forward.

It may also be worth noting that the ECB just beefed up its staff of bank regulators by 25%, or 200+ people, with the intent to monitor its banks more closely. From the information provided it’s not clear why the increase was needed, but it occurs at a time when QE isn’t necessarily getting the job done. ECB suspicions that banks aren’t utilizing QE as prescribed reminds us of when the Fed at Bernanke’s direction in 2013 and ’14 ran stress tests on banks thought to be delinquent (because rates were rising) in purchasing appropriate amounts of Treasuries. In any case, where there’s smoke there’s usually fire, and it’s worth paying attention to this development as we go forward.

Beyond the Fed meeting next week, traders should be back to focusing on earnings as the motivator of stock prices. Preannouncements have been mixed so far. If any pattern can be ascertained from the list, retailers (except Walmart) have generally raised their guidance while manufacturers have lowered theirs. Toss that mix in with an expected 16.75% increase in earnings from Q2 to Q3, and you still have a recipe for lower stock prices. If and when that plays out, it should bode well for the metals because we won’t be as able to use China or some other entity as a scapegoat for our own financial troubles.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP