Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks Losing Momentum?

Stocks in overseas and US markets were all higher this week over renewed expectation of more quantitative easing. Recently reelected liberal party leaders in Japan moved closer to what is being referred to as “cold fusion” monetary tactics. For those unfamiliar with the term, it describes when (theoretically) QE will bypass bank channels to distribute money directly to the masses. Japan isn’t quite there yet, but the bullish crowd can’t help believing it will happen soon.

In any case, US stocks led to the upside, with both the Dow and the S&P breaking out to new highs. Much will be written about this move higher for the US indices, but for all intents and purposes the breakout should be described (yet again, for about the fourth time since last May) as a false top. Trade volumes have been consistently below average, while the Dow Transports and the broader market have yet to confirm the new highs. But that’s not to say this rally can’t continue a while longer. With record-low discount rates in the bond market and a steady stream of flight capital from overseas, the rally could continue through third quarter of this year – unless Q2 earnings put a halt to the momentum.

In that regard, earnings results and the ensuing market action have so far been mixed. At the start of the week, Alcoa won at the game of beat the number. It was rewarded with a 7.7% gain in its shares, even as its revenues and earnings were actually lower year-on-year. The market’s response to JPM’s and Citigroup’s results was similar. Those shares finished 3.8% and 5.6% higher, respectively, on better-than-expected results – though JPM was the only one of the two that managed some revenue growth year-over-year. Beneath the surface, JPM compensated for large declines (up to 37% in some cases) in their investment banking divisions (including M&A,) with a massive increase in loans (commercial and retail) of $106 billion for the quarter. That’s equal to about 40% of JPM’s overall market cap. This expanse in lending at JPM is in contrast to other banks and/or investment houses around the world, including those here in the US (namely Goldman Sachs) that have been tightening their belts. Wells Fargo also beat the number and actually had revenue growth, with earnings a tad below those of last year, only to see its shares decline fractionally on the week. All of which is to say that the market has yet to decide if it wants to discount what appears to be a lackluster start to earnings season – again.

In that regard, earnings results and the ensuing market action have so far been mixed. At the start of the week, Alcoa won at the game of beat the number. It was rewarded with a 7.7% gain in its shares, even as its revenues and earnings were actually lower year-on-year. The market’s response to JPM’s and Citigroup’s results was similar. Those shares finished 3.8% and 5.6% higher, respectively, on better-than-expected results – though JPM was the only one of the two that managed some revenue growth year-over-year. Beneath the surface, JPM compensated for large declines (up to 37% in some cases) in their investment banking divisions (including M&A,) with a massive increase in loans (commercial and retail) of $106 billion for the quarter. That’s equal to about 40% of JPM’s overall market cap. This expanse in lending at JPM is in contrast to other banks and/or investment houses around the world, including those here in the US (namely Goldman Sachs) that have been tightening their belts. Wells Fargo also beat the number and actually had revenue growth, with earnings a tad below those of last year, only to see its shares decline fractionally on the week. All of which is to say that the market has yet to decide if it wants to discount what appears to be a lackluster start to earnings season – again.

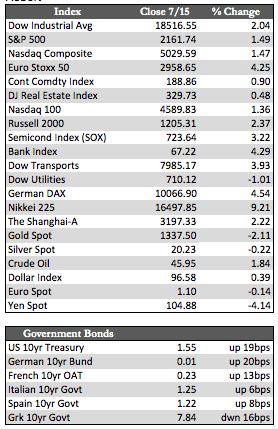

Away from stocks, Treasuries and sovereign debt overseas took a hiatus from their frenzied rally pace, with the price on the US 10-year rising, giving up about a month’s worth of gains. The dollar closed at its highest level in weeks, driven primarily by weakness in the yen. The precious metals consolidated recent gains, with gold retracing to 1,337 and silver to 20.23 per ounce (see the box scores), as defensive assets took a backseat to the rally in stocks. That said, it was interesting to see the Bank of England decide not to lower rates and/or add to its QE program in its most recent policy meeting. There was also an increase in the chances of a Fed rate hike by the end of this year, from 35% to 44%. This recalls a question I have asked in earlier recaps: if markets have already factored in more QE across the board, does that exempt central banks from having to deliver actual QE? So far, the answer is yes. Next week, there will be more on earnings reports as the season gets into full swing.

Best Regards,

David Burgess

VP Investment Management

MWM LLC