Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks Test the Moving Averages

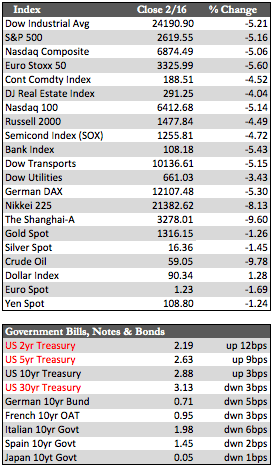

The action in stocks was fairly volatile again this week. This time it was an upside ride as the major indices enjoyed a nice bounce off their respective 100-day moving averages and held their momentum to breach their 50-day moving averages. There was no shortage of cheerleaders along the way. Among them: Trump, with his $1.7 trillion budget talks; Fed chair Powell, who scoffed at the surprise 0.5% increase in January’s CPI; Berkshire Hathaway, with its purchase of additional Apple shares; and of course a gaggle of technicians and media reps all calling a bottom in stocks after the recent turmoil. I could go on, but, suffice it to say that I don’t think I’ve seen this kind of attitude toward stocks since the bubble in year 2000. At that time, the first hit to stocks (in the NASDAQ) was widely viewed as no more than an anomalous buying opportunity. The NASDAQ fell 35% from March to mid-April before staging any kind of rally. The biggest of its rallies was a little over 40% from the interim lows set in May, but fell still fell short of the peak by 13.9%. Then it cratered about 77% over the next few years.

Back then, folks considered a bear market to be anything that fell more than 23%. Today, the threshold for pain seems to have decreased substantially. The NASDAQ’s rally this week was triggered after a rather small but violent 12.12% decline (based on intra-day levels). With that said, it’s anyone’s guess where things will go in the short-run. I think gains will be harder to achieve now that we’ve entered “no man’s land” above the 50-day moving average for most of the major indices (excluding the transports). I say this because inflation seems to be developing a life of its own lately (the CPI has increased 0.5%). Again, this could be a function of storm-related demand, or, more ominously, it could be the result of rising rates – as we’ve mentioned here many times before. Keep in mind that we had better periods of “growth,” per se, from 1987 to the mid-2000s in terms of GDP. However, unlike today, rates back then trended lower. This leads me to believe that the bond “bubble” may be in the initial stages of impairment – where rates move higher on the basis of credit stress rather than growth-related demand for money.

Back then, folks considered a bear market to be anything that fell more than 23%. Today, the threshold for pain seems to have decreased substantially. The NASDAQ’s rally this week was triggered after a rather small but violent 12.12% decline (based on intra-day levels). With that said, it’s anyone’s guess where things will go in the short-run. I think gains will be harder to achieve now that we’ve entered “no man’s land” above the 50-day moving average for most of the major indices (excluding the transports). I say this because inflation seems to be developing a life of its own lately (the CPI has increased 0.5%). Again, this could be a function of storm-related demand, or, more ominously, it could be the result of rising rates – as we’ve mentioned here many times before. Keep in mind that we had better periods of “growth,” per se, from 1987 to the mid-2000s in terms of GDP. However, unlike today, rates back then trended lower. This leads me to believe that the bond “bubble” may be in the initial stages of impairment – where rates move higher on the basis of credit stress rather than growth-related demand for money.

Aside from all this, oil rose in sympathy with stocks as the dollar fell on same. The dollar actually fell to a new intraday low today of 88.25. It closed far above that level, at 89.07, which made for a wild day for the metals. For the week, the metals responded to dollar weakness. Gold added 2.35% to silver’s 1.77% and platinum’s 4.09%. Treasuries trended lower, in step with the dollar, this time across nearly the entire curve (excepting only the 30-year). The 2-year now yields 2.19%, the 5-year 2.63%, the 10-year 2.88%, and the 30-year 3.13%. I have added these to the box scores for your reference. Next week, we’ll get a look at the most recent FOMC minutes and Warren Buffet’s annual letter to shareholders.

Best Regards,

David Burgess

VP Investment Management

MWM LLC