Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks Trump Data in FOMC Decision

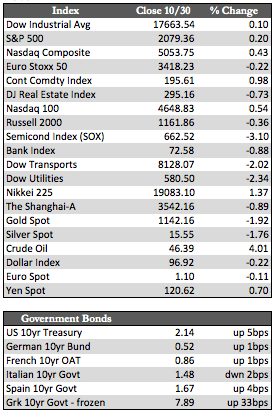

In last week’s recap, we thought it possible that the Fed would skew hawkish now that stocks had rallied to within striking distance of previous highs. Given the tenor of Wednesday’s FOMC statement, that’s precisely what it did. Rates were left unchanged and a statement about global risks to the US economy and markets was removed, while a rate hike for December was put back on the table. Whether or not the Fed is using the market as a barometer for policy isn’t completely knowable, as it’s something they’ll likely never admit, but it seems plausible in this case. Most of the economic data released lately (for September) would logically have elicited a dovish response. In any case, US equities didn’t seem to care. They spiked higher after a brief sell-off, and finished modestly in the black for the week.

If stocks seemed impervious to a change in tone at the Fed, outside assets did not. Treasuries, real estate, the dollar, and commodities all finished lower on the week. If not for the quarter- and year-end mark-up season, I suspect stocks would have performed similarly. In the weeks ahead, we’ll see if stocks can hold onto their upside momentum or if the decline in the overall earnings picture and questionable holiday season prospects will begin to have an impact. I tend to lean towards the latter conclusion, but so far the markets have been able to ignore just about everything, building predominantly on a select few big names – including Priceline, Facebook, Google, Baidu, Amazon, Linked-in, and a few other internet colossi.

If stocks seemed impervious to a change in tone at the Fed, outside assets did not. Treasuries, real estate, the dollar, and commodities all finished lower on the week. If not for the quarter- and year-end mark-up season, I suspect stocks would have performed similarly. In the weeks ahead, we’ll see if stocks can hold onto their upside momentum or if the decline in the overall earnings picture and questionable holiday season prospects will begin to have an impact. I tend to lean towards the latter conclusion, but so far the markets have been able to ignore just about everything, building predominantly on a select few big names – including Priceline, Facebook, Google, Baidu, Amazon, Linked-in, and a few other internet colossi.

There will of course come a time when the metals begin to take their cues from something else than the Fed, which I imagine at some point will be completely discredited for its faulty and destructive polices. That was certainly not the case this week, as the metals retreated on the Fed’s rate outlook – which of course shouldn’t be taken seriously. I still believe the Fed would like to see a more profound correction in stocks before hitting the gas on QE again, for many reasons previously discussed in this recap. In that scenario I think the metals will do quite well as a port in the storm for investors. For now, the metals may be under some minor pressure until stocks or the major indexes become a bit more cautious, as the underperforming broader market continues to suggest.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP