Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks Weaker Before “Brexit,” Earnings Pre-Announcements

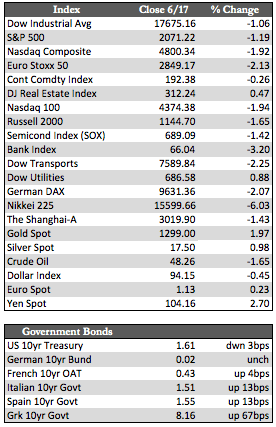

After a brief Monday-morning rally inspired by Microsoft’s $26 billion acquisition of social media firm LinkedIn, stocks both here and abroad began to leak. They racked up losses of between 1% and 2.5% by midweek, presumably on the back of valid concern that the U.K. will be leaving the European Union after a vote scheduled for June 23rd. The “yeas” have the “nays” by a margin of as much as 20% according to polls. Stocks also didn’t care much for the lack of “dovish” talk or action in policy meetings by the Fed, Bank of Japan, and Bank of England – all of which remained unchanged in policy and, as usual, cautiously optimistic. But, even with these and other incidences (such as Orlando) taken into consideration, stocks were, in my opinion, ready to decline after having rallied non-stop since February in the absence of bullish fundamentals.

Always looking for an opportunity to rally, no matter how horrific, stocks shook off some of their losses later in the week following the wrongful death of a British MP and Brexit opponent, Jo Cox. Away from that scene, Treasury rates were caught in rapid decent – in search of zero, I suppose. Oil fell a good 2.6%, while the metals mustered a retest of this year’s interim highs and the dollar remained flat. Gold gained over 1.5% to silver’s 0.60%. The miners were mixed, with a loss in the majors of 1.25% and a gain in the juniors of 1.13%. I can’t see a good reason why the miners under-performed gold other than the fact that they have a tendency to track the broader market from time to time.

Always looking for an opportunity to rally, no matter how horrific, stocks shook off some of their losses later in the week following the wrongful death of a British MP and Brexit opponent, Jo Cox. Away from that scene, Treasury rates were caught in rapid decent – in search of zero, I suppose. Oil fell a good 2.6%, while the metals mustered a retest of this year’s interim highs and the dollar remained flat. Gold gained over 1.5% to silver’s 0.60%. The miners were mixed, with a loss in the majors of 1.25% and a gain in the juniors of 1.13%. I can’t see a good reason why the miners under-performed gold other than the fact that they have a tendency to track the broader market from time to time.

In the next handful of weeks we’ll start to hear from various US firms about earnings for the second quarter. I would not be surprised to see out-performance in interest rate-sensitive areas, such as autos and housing, given the current ultra-low lending rates that the rally in Treasuries has made possible. But the broader groups, in my opinion, will struggle. Unfavorable seasonal comparisons, a relatively strong dollar, and no QE from the Fed (for the moment) should still weigh on results. Along those lines, we heard from Linear Tech today, which said that bookings would be lower than previously estimated. Its shares were off at up to more than 6% today, and managed to drag down the rest of the chip sector with it. That leads me to think the market is not entirely prepared for what will likely be negative surprises.

Best Regards,

David Burgess

VP Investment Management

MWM LLC