Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Talk of “QE” – Once Again – Kind of Fizzled

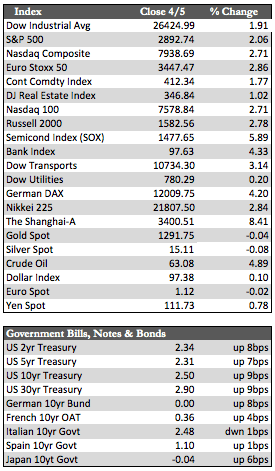

Beyond the first-of-the-month reinvestment rally, where the Dow advanced over 450 points, stocks had to grind their way to their new and celebrated interim highs. China trade, Brexit, and an expected uptick in some of the US economic data all played a role in what turned out to be about a 2% to 3% gain for the major indices.

As I’ve said before, many of these bullish arguments have been discounted several times over. If and when rallies occur, they’re met with a considerable amount of intra-day selling. Even Trump’s extremely dovish suggestions about the Fed Friday had trouble lifting stocks to greater heights. For these reasons and others I’ve mentioned, I believe stocks are going through a massive topping out process. Hedge funds apparently feel the same way, since the ratio of bullish to bearish bets has remained close to its nadir for more than a year.

Trump very plainly told the Fed that it should cut interest rates, stop shrinking its balance sheet, and reinstate QE via its bond-buying program. As mentioned, his pronouncement had very little impact on the markets, either because he’s cried wolf on this topic before or possibly because the prospect of further QE has raised concerns that the yield curve will flatten or invert further – which would dampen financial profits and subsequently the willingness/ability to lend. I give greater credence to the latter based on belief that the Fed is trapped, unable to stimulate, owing principally to our unfunded and ever-increasing deficit(s).

Trump very plainly told the Fed that it should cut interest rates, stop shrinking its balance sheet, and reinstate QE via its bond-buying program. As mentioned, his pronouncement had very little impact on the markets, either because he’s cried wolf on this topic before or possibly because the prospect of further QE has raised concerns that the yield curve will flatten or invert further – which would dampen financial profits and subsequently the willingness/ability to lend. I give greater credence to the latter based on belief that the Fed is trapped, unable to stimulate, owing principally to our unfunded and ever-increasing deficit(s).

Away from stocks, Treasuries fell, but clung to bullish territory on the charts – a bearish indicator for stocks. Failed attempts to pass a Brexit deal kept the pound weak and the dollar strong, which of course pressured the metals. I suspect that global growth issues helped the PMs maintain some technical integrity, as they finished the week relatively unchanged. Oil rose about 4.6% on a sharp decrease in output from one of Saudi Aramco’s largest oil fields – ignoring the surprise surge in US inventories.

Next week, the FOMC minutes may be the only relevant piece of information we get because both the Brexit and the US/China trade deals have been delayed by several weeks. I’m eager to see how the metals will behave given that stocks and the dollar appear to have started another topping out process. Obviously, the price where I thought gold would be headed this week was not correct (i.e., $1,250). Still, given where I believe we are with QE and the longer-term economic outlook, I’m going to stand firm in that prognosis.

Best Regards,

David Burgess

VP Investment Management

MWM LLC