Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Tax Bill Fever – Breaks to 101 from 105

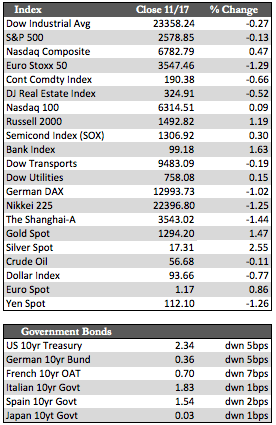

Notwithstanding Thursday’s 187-point Dow rally driven by more “historic” tax bill legislation passed by the House, stock performance for the week was rather subdued. That analysis doesn’t include the NASDAQ, which found some legs (+0.61%) thanks to a long-awaited revival in earnings at CISCO. The Dow, the Dow Transports and the S&P were all marginally weaker. It’s probably not worth talking about the details in the tax bill since a consensus has yet to be reached. Suffice it to say that the latest House version comes with very few changes from the first, with perhaps one outstanding exception – that the tax changes be made permanent. That, in addition to the fact that the bill will add an estimated $1.4 trillion to the budget deficit (which violates Senate rules) over the next decade, has some believing the tax bill will be dead on arrival in the Senate. We’ll just have to wait and see, but what it all means for stocks at this point is cause for argument. I believe stocks have discounted a perfect outcome in Washington, and, unfortunately, such an outcome is absolutely required by a financial sector that has radically over-leveraged itself in expectation of the prospect.

Away from the tax hype, the post-storm economic uptick we encountered (mostly in autos) has begun to cool. Inflation data was rather benign as the CPI and Import Price Index came in at 0.1% and 0.2% respectively in October compared to a much more robust 0.5% and 0.8% in September. US retail sales also took a dive from 1.9% growth in September to 0.2% in October, while preliminary manufacturing surveys (Empire State, Philadelphia Fed, and Kansas City Fed) for November shed anywhere between 18% and 30% from the previous month. The one bright spot occurred in housing – though I suspect traders believe the data is unsustainable beyond the impact of the storms. Housing starts popped 13.7% and permits 5.9% in October. In any case, I do believe that data played a crucial role (along with the tax debate) in the stall in stocks, weakness in the dollar, trending rally in Treasuries, and revival in the precious metals.

Away from the tax hype, the post-storm economic uptick we encountered (mostly in autos) has begun to cool. Inflation data was rather benign as the CPI and Import Price Index came in at 0.1% and 0.2% respectively in October compared to a much more robust 0.5% and 0.8% in September. US retail sales also took a dive from 1.9% growth in September to 0.2% in October, while preliminary manufacturing surveys (Empire State, Philadelphia Fed, and Kansas City Fed) for November shed anywhere between 18% and 30% from the previous month. The one bright spot occurred in housing – though I suspect traders believe the data is unsustainable beyond the impact of the storms. Housing starts popped 13.7% and permits 5.9% in October. In any case, I do believe that data played a crucial role (along with the tax debate) in the stall in stocks, weakness in the dollar, trending rally in Treasuries, and revival in the precious metals.

Gold rallied and held above its highest moving average of $1,288 (suggesting a breakout). Silver attempted to do likewise, but fell back and finished slightly below its 200-day moving average of $17.34. Gold gained 1.14% to Silver’s 1.54% for the week. From here, I imagine the metals will advance on the basis of a weakening economy/stock market/dollar, and not a more dovish Fed. The Fed may still want to prevent the proliferation of more leveraged speculation (if that’s even possible). Even with the Fed playing moderator, I still believe gold near $1,350 can be achieved before year-end. Next week, Yellen will speak, FOMC minutes will be released, and we’ll get a look at Black Friday results.

There will be no recap next Friday in observance of the holiday. We here at McAlvany Wealth Management would like to wish you a very happy Thanksgiving!

Best Regards,

David Burgess

VP Investment Management

MWM LLC