Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

The Air is Getting Thin Up Here (For Stocks) – Something’s Got To Give

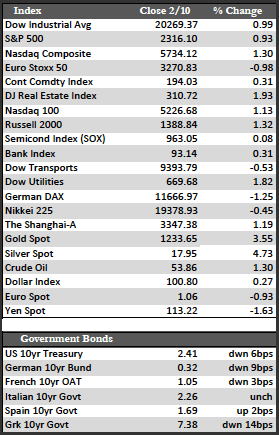

US and overseas stocks enjoyed another bounce, adding a little over a percent on the week as the bulls were fired up once again on the back of another Trump headline. This time the Administration promised to release a “phenomenal” tax plan that will affect both corporations and individuals in the next few weeks. The plan, overseen by ex-Goldman Sachs President Gary Cohn, calls for lowering the corporate tax rate by half to 15% and an across the board (in all brackets) tax-cut and an increase in the standard deduction (to $15,000 in higher brackets) for individuals. I believe they are considering a repeal of the estate tax as well. The details will unfold over time, but the onus is still on House and Senate Republicans. They are still scratching their heads as how to finance the deal (i.e., where to cut government jobs and spending) in light of the current $587 billion annual U.S budget deficit. Keep in mind that that’s our budget deficit in supposedly good times, or near a top in the economic cycle. In any case, investors are perilously content to discount all the positives and push stocks to historic valuations while they completely ignore the negatives.

Away from stocks, Treasuries and higher quality European government bonds (i.e., German Bunds) were marginally higher in search of safety, though that strength faded a bit following Trump’s tax announcement. Crude oil moved sideways as US production increases were seen offsetting recent OPEC cuts. Since October of last year, US oil production has retraced about half its decline, with an increase of about 500,000/bbl. per day. With that, I’m guessing the oil price is going nowhere for a little while longer, and will undoubtedly put pressure on the less profitable players in the industry. As for the dollar, it fared better this week, perhaps due to Trump’s patching up trade relations with Japan, though this did not have a negative impact on the metals. They posted solid gains, with gold up 1.1% to silver’s 2.56%.

Away from stocks, Treasuries and higher quality European government bonds (i.e., German Bunds) were marginally higher in search of safety, though that strength faded a bit following Trump’s tax announcement. Crude oil moved sideways as US production increases were seen offsetting recent OPEC cuts. Since October of last year, US oil production has retraced about half its decline, with an increase of about 500,000/bbl. per day. With that, I’m guessing the oil price is going nowhere for a little while longer, and will undoubtedly put pressure on the less profitable players in the industry. As for the dollar, it fared better this week, perhaps due to Trump’s patching up trade relations with Japan, though this did not have a negative impact on the metals. They posted solid gains, with gold up 1.1% to silver’s 2.56%.

Though stocks seem to be in blow-off mode, the indexes are behaving as if they want to correct. Daily rallies have been characterized by relatively low volume and cautious selling by the close. That is in addition to the bond market weakness (discussed here often) and what I would call a weak earnings season – not on the basis of earnings per share, which has been grossly distorted by leveraged share-buybacks, but on the basis of revenue growth. That metric slowed from this time last year by about 0.50%. Anyway, perhaps now that Trump has dangled the big tax cut in front of traders we will get to see stocks normalize in coming weeks as the emotional hype begins to subside.

Best Regards,

David Burgess

VP Investment Management

MWM LLC