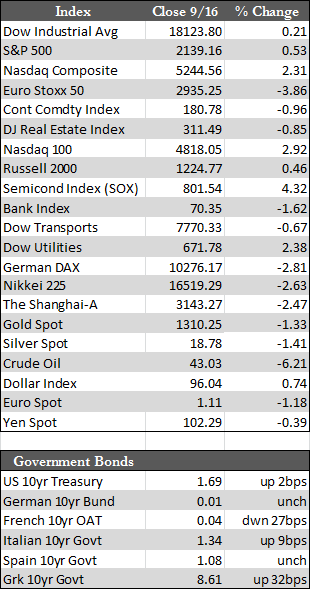

After last Friday’s drubbing, US stocks managed a small gain this week, mostly thanks to some dovish remarks made by Fed head Lael Brainard and the upcoming FOMC (typically easy) policy meeting next Wednesday. Apple also helped propel stocks higher as pre-orders for the new iPhone 7 were supposedly better than expected and as Samsung recalled somewhere near a million phones due to incendiary issues with its lithium ion batteries. Apple shares added nearly 11.0% and led gains in the Nasdaq of over 2.0% and the SOX (Philadelphia Semi Index) of over 4.0%. But the real development, as of late has been in fixed income, where despite all the QE worldwide and the dovish expectations here at home, bonds have continued to slip, as the 30yr Treasury has tacked on about 36 basis points to 2.45% over the last few weeks.

This, in my opinion is why stocks have been finding it difficult to erase recent losses and breakout to the upside. As I have noted here before, if central banks cannot “manipulate” rates (or markets in general) to the downside AND foster growth at the same time (a.k.a. liquidity trap) then leveraged operators may begin to throw in the towel and trigger the long awaited correction in stocks (and bonds). But since psychology still hasn’t changed quite yet, and by that I mean the attitude towards the Fed and its assumed abilities to cure all ills, I may be getting ahead of myself in that belief as 36 basis point move in Treasuries or a 20 basis point move in German Bunds really doesn’t amount to all that much. It’s the mere fact that these rates are rising again, while the powers that be are printing in an effort to affect rates in the opposite direction that matters. So this will be something to pay close attention to  in the weeks to come.

in the weeks to come.

Away from US stocks and bonds, European stocks were clubbed for about 2.0 to 3.0% depending, largely due to (as noted above) to this worldwide yet subtle backup in fixed income, while the US Dollar strengthened and crude oil retraced back into the low 40s. Aside from this, both US industrial production (-0.4%) and Retail Sales (-0.3%) fell in August, as a sign the economy is still not gaining significant traction, but again, I don’t know that this mattered to the “bad news is good news” stock bulls if the efficacy of QE is being held in question. As for the metals, they still seem to be operating under the “Fed might be hawkish” fantasy, as gold reverted, yet reluctantly, to its 100day moving average of around $1,304 – where it found some support.

Best Regards,

David Burgess

VP Investment Management

MWM LLC