Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

The Race to Debase Spreads

The fallout from the euro’s collapse spread a bit farther this week, prompting central banks to either take action or at least discuss protecting their currencies from becoming too strong. Singapore initiated measures to “manage” its exchange rate lower. Denmark not only lowered rates for the third time (to -0.5), but also stopped selling its own government bonds to deprive investors of krone-denominated investment options. China injected about $9.6 billion through reverse repos to boost its cash markets, while both South Korea and South Africa placed themselves on standby. Russia appeared in the mix with a rate cut (from 17% to 15%), but this may have had more to do with newly applied (Ukraine) sanctions. Add to that list Canada, India, Turkey, Japan, Malaysia, Thailand, and of course the eurozone, all of whose central banks are actively debasing their respective currencies, and you’ve got a fairly substantial currency war in progress.

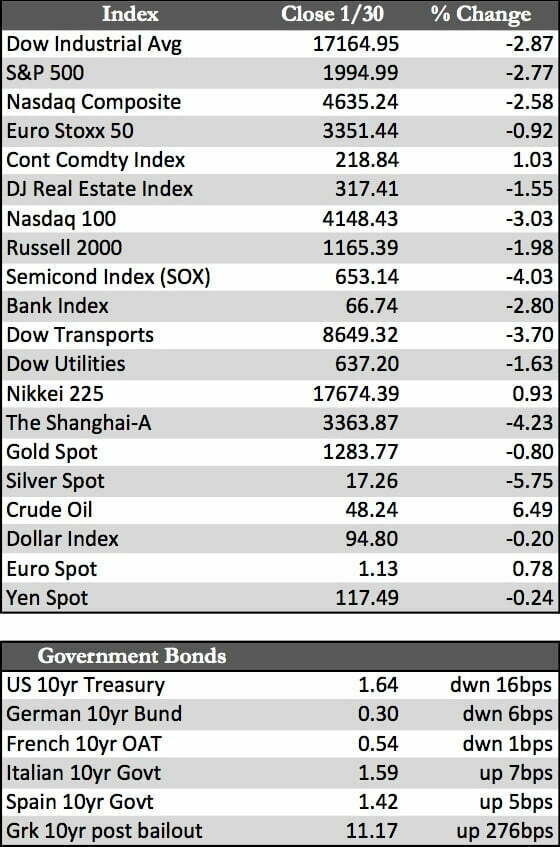

Typically markets would be jumping at the chance to use newfound financing to juice markets higher, but the exact opposite occurred this week. All but the Swiss and German stock indexes saw some pretty heavy selling to finish the week in the red. US indexes were hit the hardest, with the broader equity markets down over 2.0%. Treasuries spiked higher, while both the dollar and the metals saw some volatility but ended the week relatively unchanged. It’s difficult to make sense of such developments at this point; so many things are getting jumbled. But the matter may be simplified by a question: If every central bank is leaning toward selling paper – who’s buying? Perhaps the markets are sensing the uncomfortable answer to this question and responding by moving to areas of safety (i.e., Treasuries and gold). Gold has been outperforming virtually every currency except the US dollar. Even though gold has been firming up nicely in US dollar terms, Treasuries are still the go-to here in the States when the “risk off” trade is in effect.

Typically markets would be jumping at the chance to use newfound financing to juice markets higher, but the exact opposite occurred this week. All but the Swiss and German stock indexes saw some pretty heavy selling to finish the week in the red. US indexes were hit the hardest, with the broader equity markets down over 2.0%. Treasuries spiked higher, while both the dollar and the metals saw some volatility but ended the week relatively unchanged. It’s difficult to make sense of such developments at this point; so many things are getting jumbled. But the matter may be simplified by a question: If every central bank is leaning toward selling paper – who’s buying? Perhaps the markets are sensing the uncomfortable answer to this question and responding by moving to areas of safety (i.e., Treasuries and gold). Gold has been outperforming virtually every currency except the US dollar. Even though gold has been firming up nicely in US dollar terms, Treasuries are still the go-to here in the States when the “risk off” trade is in effect.

At the moment, lower gas prices and lower mortgage rates have temporarily revived US consumer spending and provided the Fed with a quiver of reasons to ignore the weaker-than-expected GDP figures (2.6% vs. 3.0% expected for 4th quarter 2014) and hold off on QE. But on the other hand, the oil industry is in the process of laying a not-so-small financial goose egg fraught with systemic risks. So far, the bear market in energy has wiped away roughly $353.0 billion in equity and $40.0 billion in high-yield energy bonds from investor wealth. Parenthetically, that’s out of an estimated, and still at risk, $1.4 trillion invested in marginal oil projects in the last five years. In any case, there appear to be tradeoffs the Fed will have to consider. Ultimately, stock markets may cast the final vote, as volatility is bound to increase the longer the Fed remains on the sidelines.

Till next week,

David Burgess

VP Investment Management

MWM LLLP