Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Trouble with the Curve, Part Deux

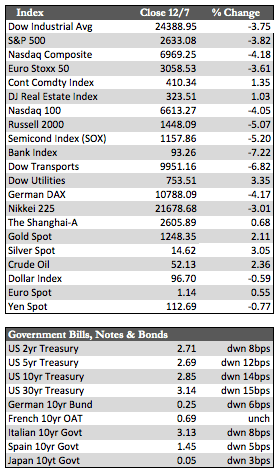

The trade truce between Trump and Xi Jinping was severely jeopardized when Canada arrested Chinese CFO Meng Wanzhou of the Huawei Tech company for allegedly conducting business with the sanctioned country of Iran. Stocks tanked. The major indices fell between 2.9% and 6.0% in fairly volatile trade and amid higher-than-average volume. That said, there were a few rallies during the week, most of which were caused by dovish talk by a few Fed officials. None of the rallies has yet to hold or build any significant upside momentum.

Anything can happen between now and year-end, but my analysis is that while the trade pact (or something else) may serve as a trigger for these downside moves in stocks, it’s really the flattening and/or inverting of the yield curve that’s producing the consistent undertow. Treasury rates have fallen in the last few weeks as Fed talk of lower rates of growth spurred an investor rotation into bonds. Normally, cheaper rates would be viewed as a positive for the economy. However, the unintended consequence here is that long rates have fallen faster than short rates, which has begun a dangerous inversion process along the curve (starting with the 3- and 5-year Treasury yields). I say dangerousbecause in the past this has usually led to either a sharp deleveraging across markets or a recession.

Now I said all that to say this: So far, no matter which direction the Fed has gone on policy – dovish or hawkish – this trouble with rates persists in one shape or form. That fact lends credence to what I’ve said here before – that the Fed isn’t really in control of things anymore. In creating a debt bubble by lowering rates to near zero for too long, it has essentially passed the baton of structural rate determination (i.e., bubble popping) to natural market forces.

Now I said all that to say this: So far, no matter which direction the Fed has gone on policy – dovish or hawkish – this trouble with rates persists in one shape or form. That fact lends credence to what I’ve said here before – that the Fed isn’t really in control of things anymore. In creating a debt bubble by lowering rates to near zero for too long, it has essentially passed the baton of structural rate determination (i.e., bubble popping) to natural market forces.

Anyway, back to the meat and potatoes. There was plenty of economic data to support the notion that the economy is slowing. Durable, factory, and capital goods orders all softened in October. In November, wage growth slowed while the ADP employment change added 179,000 against expectations of 195,000. The NFP added 155,000 versus expectations of 198,000 (250,000 or better signals expansion). Oddly enough, the ISM manufacturing and services polls were a bit firmer in the same month, though the prices paid component in the manufacturing index cratered from 71.6 to 60.7.

Next week, we’ll see PPI, CPI, and import price data along with retail sales results for November. Consumer spending appears to have peaked in October following the California fires and hurricanes Florence/Michael. That in combination with early season discounting leads me to believe that sales will taper off as we head into year-end. The metals perked up on long overdue dollar weakness, with gold adding 1.9% to silver’s 2.8%. Up to this point, the US has looked better economically than other developed nations – which has helped the dollar on a relative basis. However, without Harvey-size storms to cloud real economic activity, this is no longer the case.

Best Regards,

David Burgess

VP Investment Management

MWM LLC