Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

U.S. Stocks Take a Bow

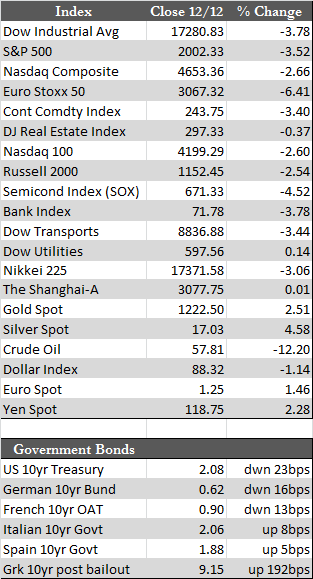

News of a 0.7% hike in U.S. Retail Sales was not enough to keep markets buoyed for the week. The headline figure may not have been the whole story this time around, as many of the products flying off of the shelves of companies such as Walmart and Amazon were sold as early as October and at heavily discounted prices. That, in addition to some fairly poor Chinese production numbers, kept stocks under pressure all the way into the close Friday. At that time, the major stock indexes were seen making a beeline for their respective 50-day moving averages. The declining oil price may have contributed, as many keep saying, but that’s a theory about which I am doubtful. Declining gas prices usually stimulate the economy. Instead, it may simply be that the markets (debt markets in particular) are finding it difficult to speculate away critical events, as they have in the past, in the absence of QE from the Fed.

In other but not quite unrelated news, Greece called a snap election. The ASE index fell nearly 13.0% on Tuesday and 20.18% for the week due to fear that radical socialists in the Syriza party could gain in power. Since the crisis of 2011-12, Greece has had to maintain some semblance of a balanced budget in order to qualify for EU bailouts backed by Germany. It’s a guess on my part, but the socialist policy may oppose these financial arrangements that have thus far kept Greece on life support, and thereby jeopardize the Greek recovery – so called. The BoE decided to hold off on QE for a while, even as Britain’s CPI declined again in the face of slower growth; Japan’s GDP declined for a second time (officially a recession) to 1.9%; and, as mentioned before, China’s production fell yet again – even though its stock markets (Shanghai indexes) have soared nearly 40% this year. The takeaway from all of this is that nothing has been “contained,” and, judging by the desperate actions of the central bankers in question, massive amounts of QE may have actually made matters much worse than anyone has been told.

In other but not quite unrelated news, Greece called a snap election. The ASE index fell nearly 13.0% on Tuesday and 20.18% for the week due to fear that radical socialists in the Syriza party could gain in power. Since the crisis of 2011-12, Greece has had to maintain some semblance of a balanced budget in order to qualify for EU bailouts backed by Germany. It’s a guess on my part, but the socialist policy may oppose these financial arrangements that have thus far kept Greece on life support, and thereby jeopardize the Greek recovery – so called. The BoE decided to hold off on QE for a while, even as Britain’s CPI declined again in the face of slower growth; Japan’s GDP declined for a second time (officially a recession) to 1.9%; and, as mentioned before, China’s production fell yet again – even though its stock markets (Shanghai indexes) have soared nearly 40% this year. The takeaway from all of this is that nothing has been “contained,” and, judging by the desperate actions of the central bankers in question, massive amounts of QE may have actually made matters much worse than anyone has been told.

The fact that each dip in the metals seen in the last few weeks has been treated as a buying opportunity may again be an early indication that speculators are catching on to these central bank failures and/or simply responding to the weakness in U.S. stocks. Gold and silver posted a second consecutive week of gains, up 2.51% and 4.57%, respectively. Signs of “low-inflation,” as shown in this week’s U.S. PPI figures, may hold price momentum in the metals down, but once it’s clear that low inflation translates into credit risk (i.e., in the shale oil industry), gold’s use as a currency hedge/safe haven should begin to accelerate.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP