Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Waiting on Washington

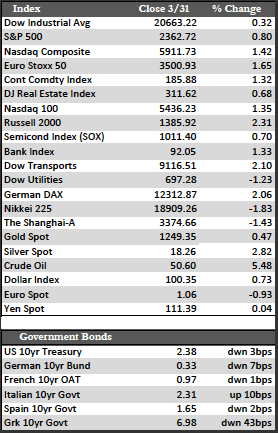

Last week, I thought it possible that stocks would enjoy some sort of a “bounce,” and for all intents and purposes that’s exactly what happened this week. The Dow and S&P added just shy of a percent off their respective 50-day moving averages, and the tech-heavy Nasdaq pushed on to a new high. I believe this action was fueled by a short squeeze precipitated by more merger speculation, the most recent of which was a buyout of Exar by MaxLinear for about $472 million. The size of the deal wasn’t all that impressive, but the 22.4% premium MaxLinear paid was – which, I believe, is why we are getting a melt-up effect on valuations across the industry. In any case, after the technical bounce that took place on Monday, the majority of stocks failed to gain any real traction to the upside. They were perhaps stifled by a crosscurrent of events, to include the hashing and rehashing of Obamacare reform, possible OPEC production cuts, Fed policy, and of course month-end performance gaming – none of which really had a lasting impact on the tape in the end.

Away from stocks, Treasuries were flat, oil fought its way back above the lowest of moving averages, and the dollar rallied as Fed speakers clung to the status quo for rate hikes this year. Remarkably, this didn’t stop the metals from tacking on some modest gains by the end of the week. The gold $1,265 level still seems to be where traders have formed the “line in the sand” in the options market. I suppose if we can breakout above that level, we could see some significant upside. If we don’t, the metals may be in for some rough sledding over the near term. I have a tendency to lean towards the former, though it may be a bit of a grind before that breakout occurs. What we’re really looking for, in my opinion, is a paradigm shift in the Trump trade, which may have already transpired with what looks to be a soft repeal/replacement of Obamacare.

Away from stocks, Treasuries were flat, oil fought its way back above the lowest of moving averages, and the dollar rallied as Fed speakers clung to the status quo for rate hikes this year. Remarkably, this didn’t stop the metals from tacking on some modest gains by the end of the week. The gold $1,265 level still seems to be where traders have formed the “line in the sand” in the options market. I suppose if we can breakout above that level, we could see some significant upside. If we don’t, the metals may be in for some rough sledding over the near term. I have a tendency to lean towards the former, though it may be a bit of a grind before that breakout occurs. What we’re really looking for, in my opinion, is a paradigm shift in the Trump trade, which may have already transpired with what looks to be a soft repeal/replacement of Obamacare.

On the economic front, personal consumption expenditures in the fourth quarter rose 3.5%, though this was offset by a downbeat number for personal spending in the month of February of 0.1% (1.2% annualized). Inflation as measured by the Personal Consumption Expenditure Deflator Index rose a modest 0.1% in February, but was above the Fed’s target (2.0%) on a year-over-year basis at 2.1%. For the same month, pending home sales rose 5.5%, yet were down 2.4% year over year. Next week, the market will start to eye first quarter corporate earnings results. Expectations for companies within the S&P 500 have already been ratcheted down by 2.5% year-to-date.

Best Regards,

David Burgess

VP Investment Management

MWM LLC