Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Yellen: A Word to the Wise

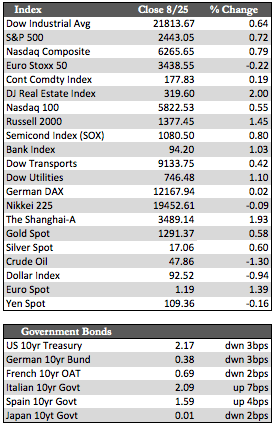

In terms of the market action for this week, it was a wash. Stocks really didn’t build discernable momentum in any particular direction. Stocks rallied hard Tuesday on the back of a perceived relaxation of US political tensions, but when stocks failed to capitalize on that move, they just meandered for the duration of the week, at length giving back a small portion of their gains predominantly in reaction to this year’s orations at the Jackson hole symposium. At the time of this writing, Mario Draghi had yet to speak, but Yellen had made her remarks. From what I could gather from them, she was not only dovish in regards to monetary policy, but was also critical of Congressional attempts to ease post-crisis regulations that in her opinion have made the financial system “safer” without unduly hurting the economy. With that I would wholeheartedly agree. I keep hearing that regulations have held us back when in the past two decades we’ve had two bubbles and are now near the apex of a third. Those distortions mean that the laws we have are either completely impractical or have yet to be enforced. I personally believe the latter is the case. Yellen’s term ends in February next year, and it’s fairly clear she intends to walk at that time since her remarks stand in opposition to her would-be employer’s (DJT) current agenda.

Away from stocks, high-quality defensive assets staged another steady advance. Rounding out that list would be US Treasuries, German Bunds, French OATs, JGBs, and, of course, the metals. Gold finished the week on a high note thanks to Yellen’s speech, and now looks ready to break through and above the 1,300 level – which is where it was pre-election. Apparently, more than two million ounces traded hands 20 minutes before Yellen spoke. Oil gained a little, and gasoline prices spiked in the wake of hurricane Harvey. The dollar continued to slide, induced by Trump Administration setbacks and the dovish Fed chatter. If the dollar breaks below the 92.16 level, it’s very possible we could see a “stagflation” scenario start to take shape.

Away from stocks, high-quality defensive assets staged another steady advance. Rounding out that list would be US Treasuries, German Bunds, French OATs, JGBs, and, of course, the metals. Gold finished the week on a high note thanks to Yellen’s speech, and now looks ready to break through and above the 1,300 level – which is where it was pre-election. Apparently, more than two million ounces traded hands 20 minutes before Yellen spoke. Oil gained a little, and gasoline prices spiked in the wake of hurricane Harvey. The dollar continued to slide, induced by Trump Administration setbacks and the dovish Fed chatter. If the dollar breaks below the 92.16 level, it’s very possible we could see a “stagflation” scenario start to take shape.

As usual, the talking heads from Capitol Hill and Jackson Hole took precedence over the economic data, which was not so stellar – again. PMI data was mixed, new and existing home sales declined 9.4% and 1.3%, respectively, while durable goods orders fell 6.8% – all from June to July. Ex transportation and aircraft, durable goods orders looked a little better at 0.5%. Next week, we’ll get a look at US jobs, as well as some key inflation data. As for the markets, I am still looking to see whether the correction in stocks has legs or not. The S&P 500 actually finished the week below its 50-day moving average. I really don’t know if that means much in front of the typical Monday morning rally, but given the setbacks in Washington (and with the debt ceiling issue just around the corner), the market still has every reason at this point to give up a considerable portion of its post-election gains.

Best Regards,

David Burgess

VP Investment Management

MWM LLC