Podcast: Play in new window

Precious metals show no signs of stopping this week as gold climbs nearly 12% and silver shoots up a staggering 25%. Platinum and palladium both see around 10% increases, with platinum nearing the $3,000 mark. Over in equities we saw the S&P approaching its previous highs. The U.S. dollar weakens even further and drives more capital into the metals markets.

Let’s take a look at where precious metals prices stand as of Wednesday, January 28:

The price of gold is up 11.75% at $5,390 as of recording.

The price of silver is up 25%, sitting at $116.20 in the last week, which is crazy to me.

Platinum is up 10.5%, sitting at $2,666 as of recording. However, platinum was up 20% at one point this week, almost breaking that $3,000 mark. It wasn’t too long ago that platinum was $900 per ounce.

Palladium up about 11%, currently sitting at $2,075.

Looking over at the paper markets…

The S&P 500 is up 1.5% to 6,980. It did break through 7,000 to a new all-time high intraweek.

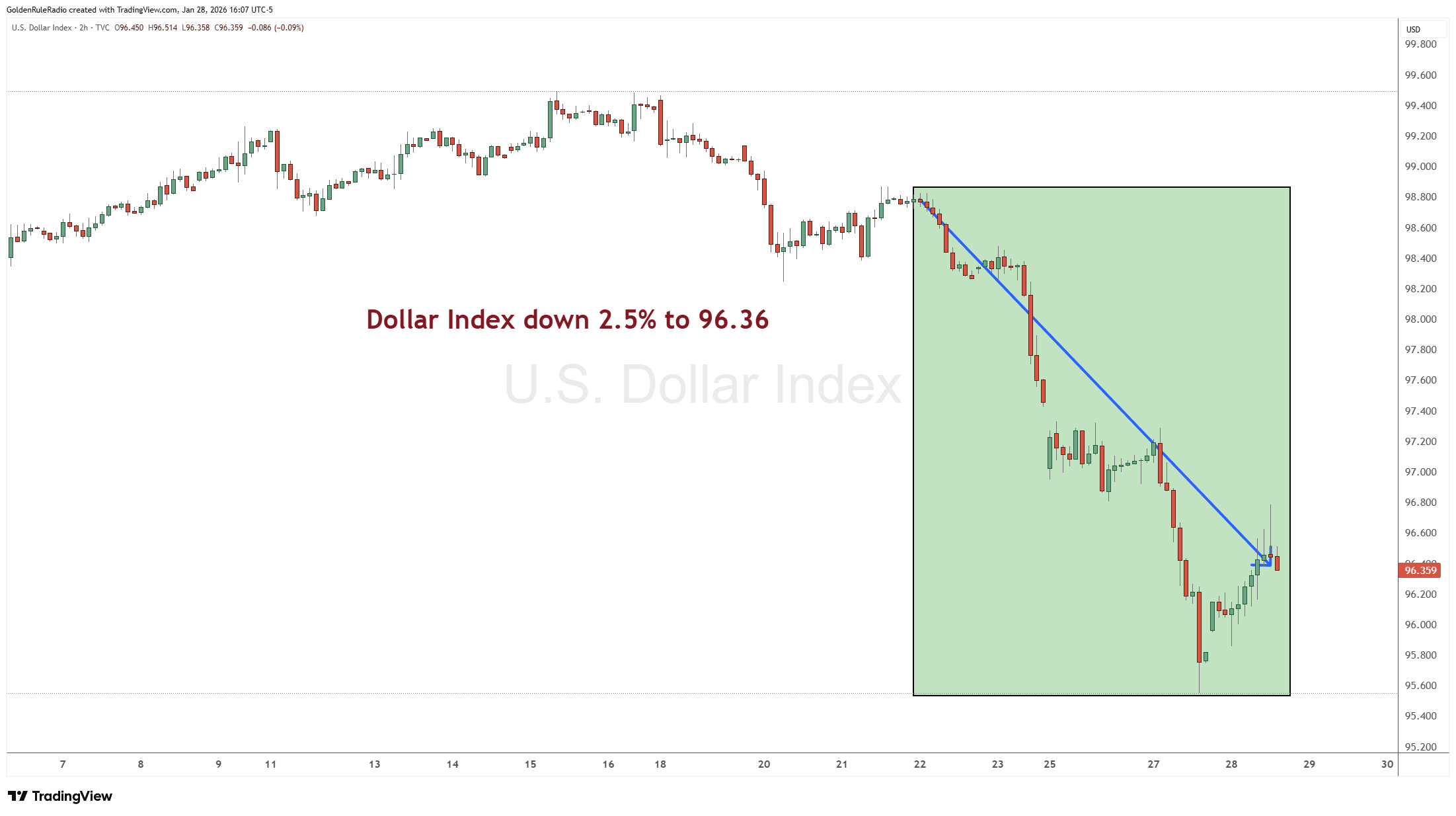

And the US dollar index is down 2.5%, currently sitting at 96.36.

Japan’s financial stress lit the fuse

The U.S. quietly intervened in the foreign exchange market to bail out Japan — injecting dollars to prevent Tokyo from dumping Treasurys. That support propped up Japan but weakened the U.S. dollar, and when the dollar drops, gold and silver pop. This event wasn’t just a currency story; it was a signal to global investors that sovereign stress is spreading. It was a bailout — and the world noticed.

In effect, Washington chose to bail out a key ally rather than let the market force a painful liquidation of U.S. debt.

For consumers, the cost shows up as a weaker dollar and higher prices for anything real — especially gold. The dollar index dropped roughly 2.5%—3% on the week. Gold responded with one of its largest single‑day and single‑month dollar gains on record, up more than $200 in a day and over $1,000 on the month.

The “weaker dollar playbook” is back

President Trump openly supports a softer U.S. dollar — calling it “great” because it encourages exports, boosts GDP growth, inflates asset values, and increases tax revenue. It also makes it easier to service an enormous and growing debt load — especially with roughly a quarter of U.S. debt rolling over this year.

But there’s no free lunch. The same process that makes the government’s problems “easier” makes your cost of living structurally higher.

The Fed, for its part, just paused on rate cuts — a 10‑to‑2 vote to hold, the first time since late 2025 that they’ve resisted easing. They’re talking about getting inflation back to 2%, but the money supply (M2) is still growing around 4.6% annually. In other words, policy is now openly biased toward a currency that buys you less over time, and the metals are simply repricing that reality.

Western investors are finally buying

For years, you’ve heard about central banks, Asian buyers, and sovereigns quietly accumulating gold while the Western retail investor mostly stayed on the sidelines. That’s changing — fast. One of the clearest signs is the massive spike in trading volume in silver ETFs. SLV, the largest silver‑backed ETF, just saw about $40 billion in turnover in a single day, roughly triple its previous record from 2011. That is not “tourist” money; that’s a wall of capital rediscovering silver.

Silver has moved from roughly $30 an ounce a little over a year ago to challenging the $120 level in this latest surge. A four‑fold move in that time frame is what late‑cycle adoption looks like as mainstream investors finally react to damage that has already been done to the currency.

Once the crowd engages, volatility goes up while good entry points become harder to come by. If you’re trying to build or rebalance a core physical position, you’re better served acting while you still have some pricing and product availability rather than waiting for the next panic headline.

The dollar’s decline is policy, not accident

Roughly a quarter of U.S. debt is rolling over this year, which means massive refinancing ahead — and likely more Fed balance sheet expansion. M2 money supply in the U.S. exploded from about $15 trillion to over $21 trillion during the COVID era, then flattened out and now sits near $22.4 trillion — not the same runaway growth, but still pushing higher.

More important is that the velocity of money (how often a dollar circulates) has climbed from near 1.1 up to about 1.4. That increase in velocity is part of why you’re seeing equity markets hitting new highs and metals sprinting; more of the existing money stock is actually moving through the system.

The Fed has been shrinking its balance sheet for several years, but that trend has already started to tilt back upward as it deals with refinancing needs and market stress.

In practice, that means more support for financial assets and a steady bleed on savers who sit in cash.

Geopolitics and energy could amplify the trend

Beyond currencies and rates, geopolitical risk keeps gold’s bid alive. Tensions with Iran are escalating again, with U.S. rhetoric around armadas, nuclear sites, and “time running out” back in the headlines. At the same time, you’ve got ongoing instability in places like Venezuela and a still‑fragile situation in Eastern Europe and Asia.

Interestingly, energy prices have eased, which does help you at the pump and in the grocery store — at least temporarily. But lower energy doesn’t fix the core problem of an over‑leveraged financial system and a currency being managed for political goals rather than long‑term stability.

Historically, periods when governments lean on the currency and bond markets to manage unserviceable debt loads end up being very friendly to gold owners and very punishing to anyone who assumes “normal” will return in time.

Use a Precious Metals IRA for tax‑efficient ounces

If a meaningful part of your net worth is in retirement accounts, you can hold physical gold, silver, platinum, and palladium inside an IRA structure (Traditional, Roth, SEP, SIMPLE, and even 401(k) rollovers). This lets you shelter gains from current taxation while building a pool of hard assets you can draw on later to offset rising living costs.

McAlvany has been doing metals IRAs since the option became available in the 1980s, and we pair that with ratio‑trading strategies inside the account to compound ounces over time.

If you’re ready to open a precious metals IRA, the team at McAlvany can help. Call us at for a free, no obligation consultation at 800-525-9556.