Podcast: Play in new window

Precious metals prices declined over the last week after a lot of movement in recent weeks. Let’s look at where precious metals stand as of October 9, 2024.

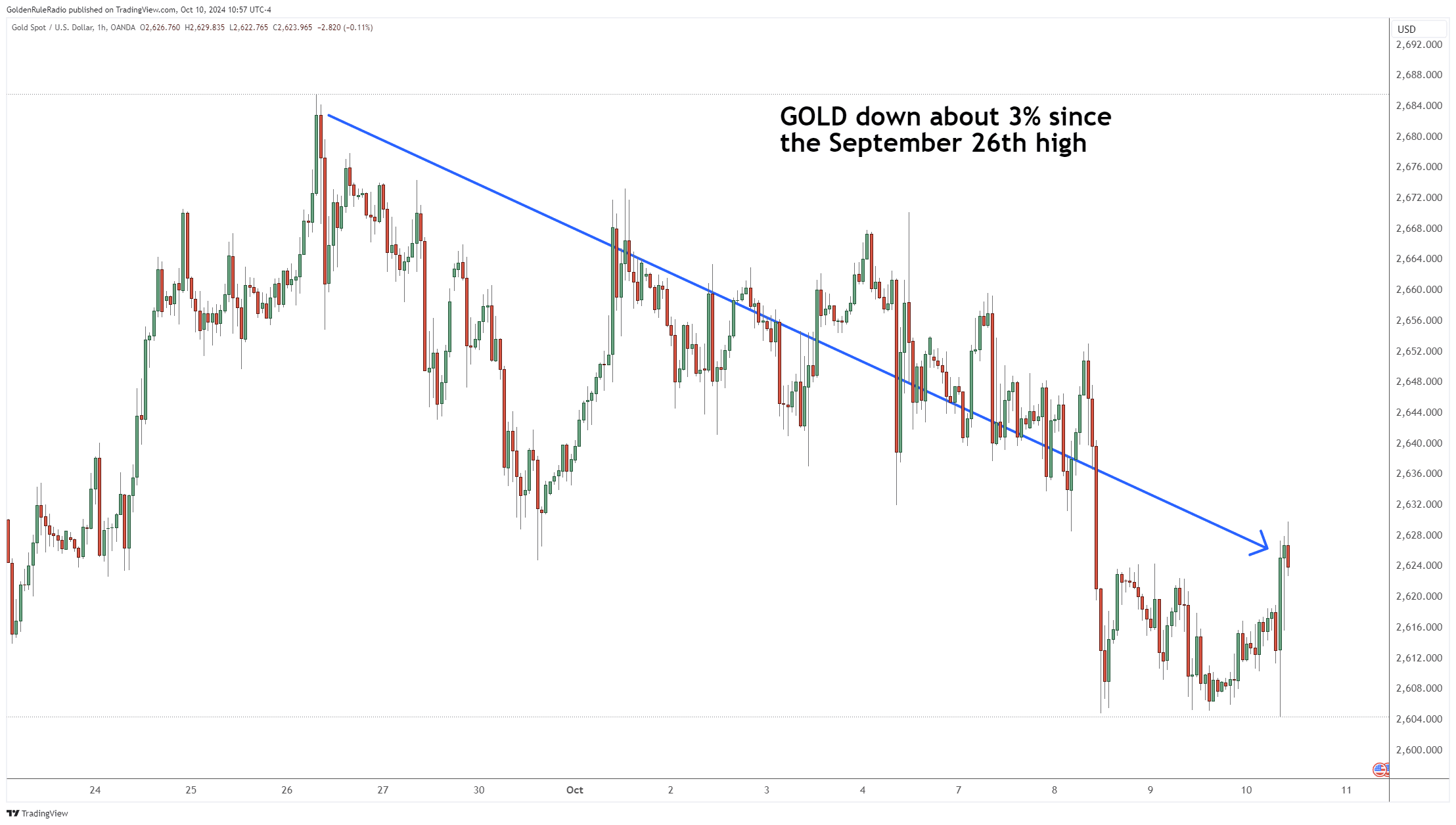

The price of gold is down about 3% from the $2,685 top it reached.

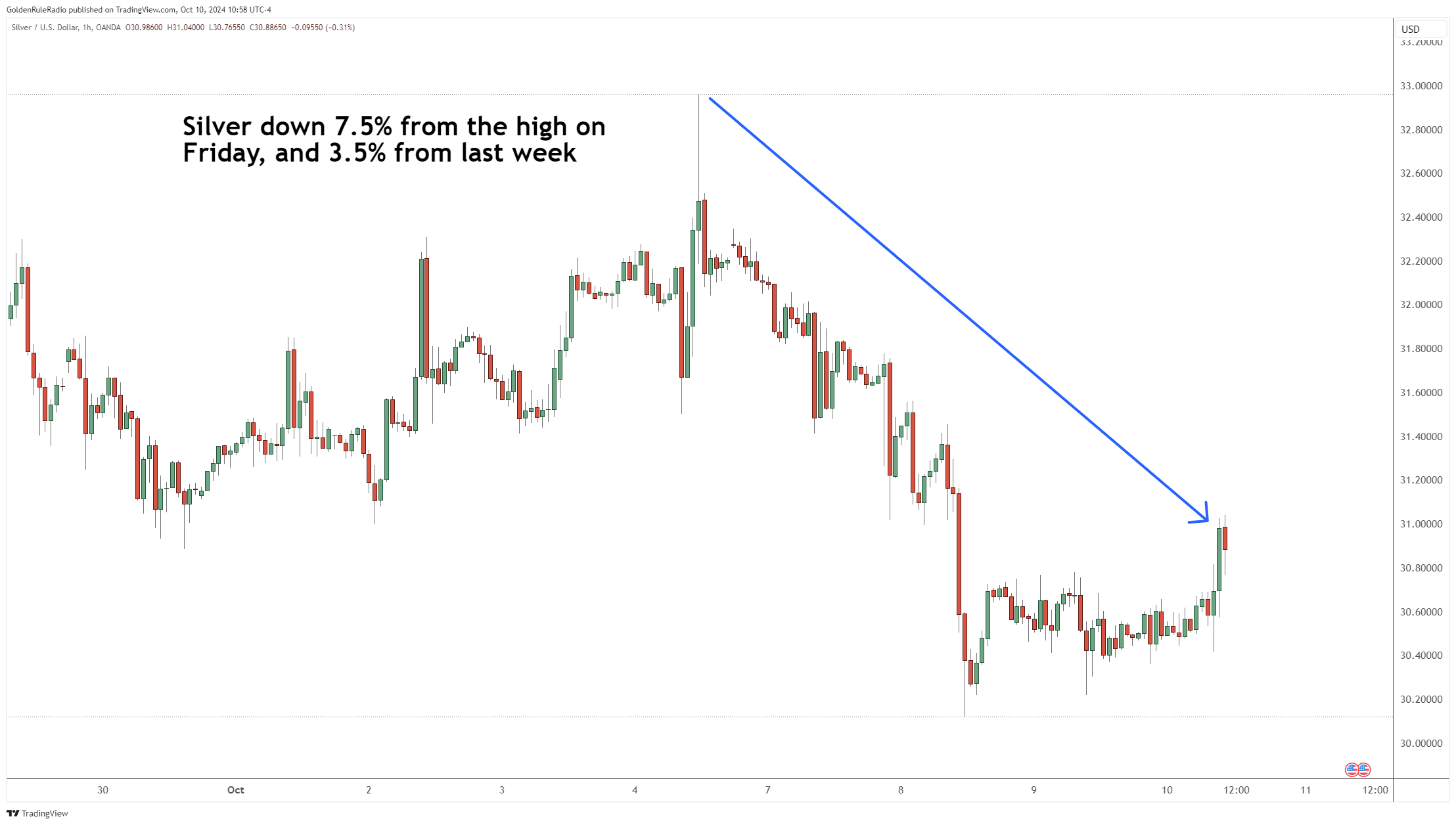

The price of silver is down about 7.5% from the $32.95 top that it reached. However, it is still holding above $30.

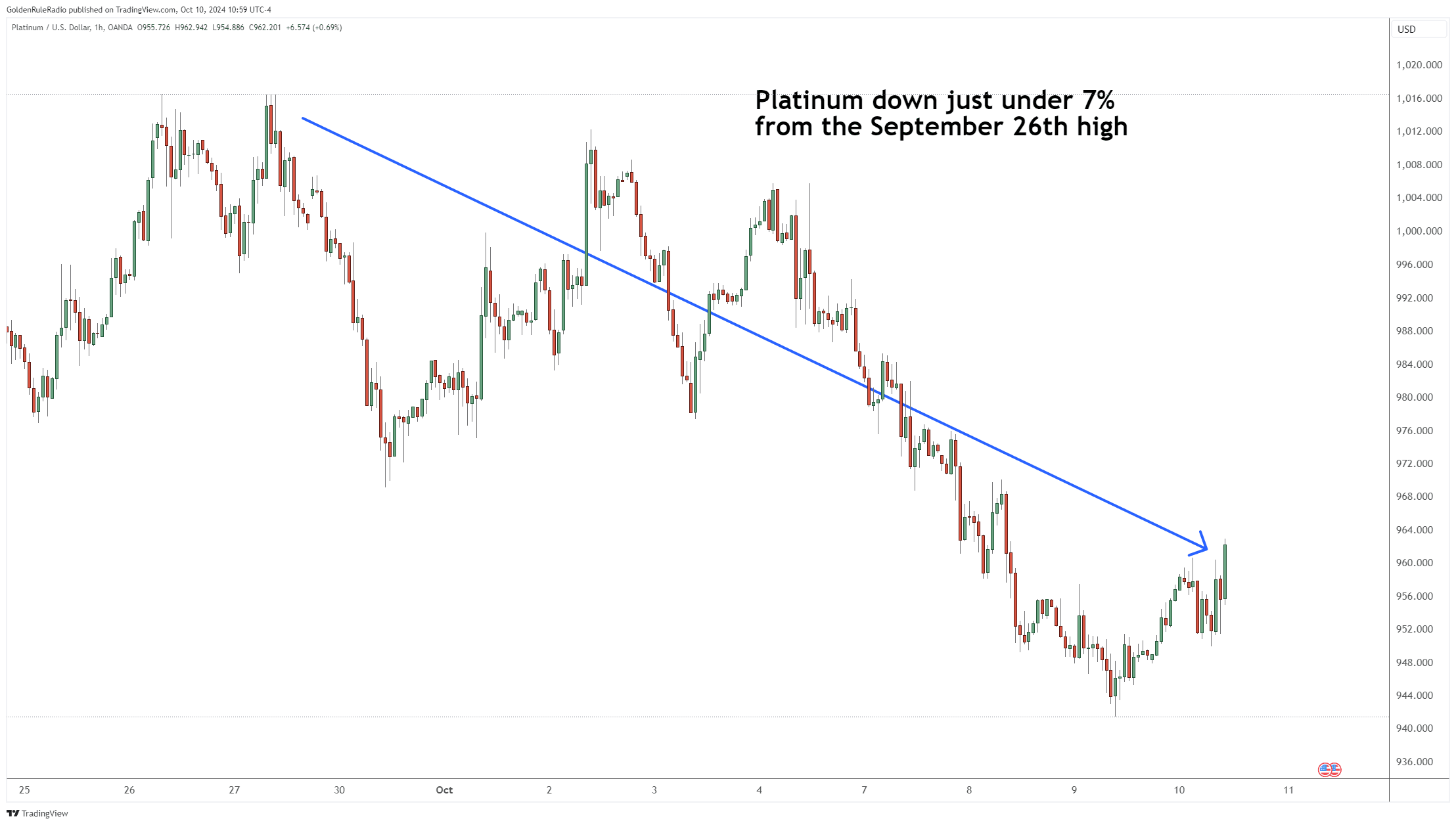

Platinum is down about 6.7% from its high at $1,016.

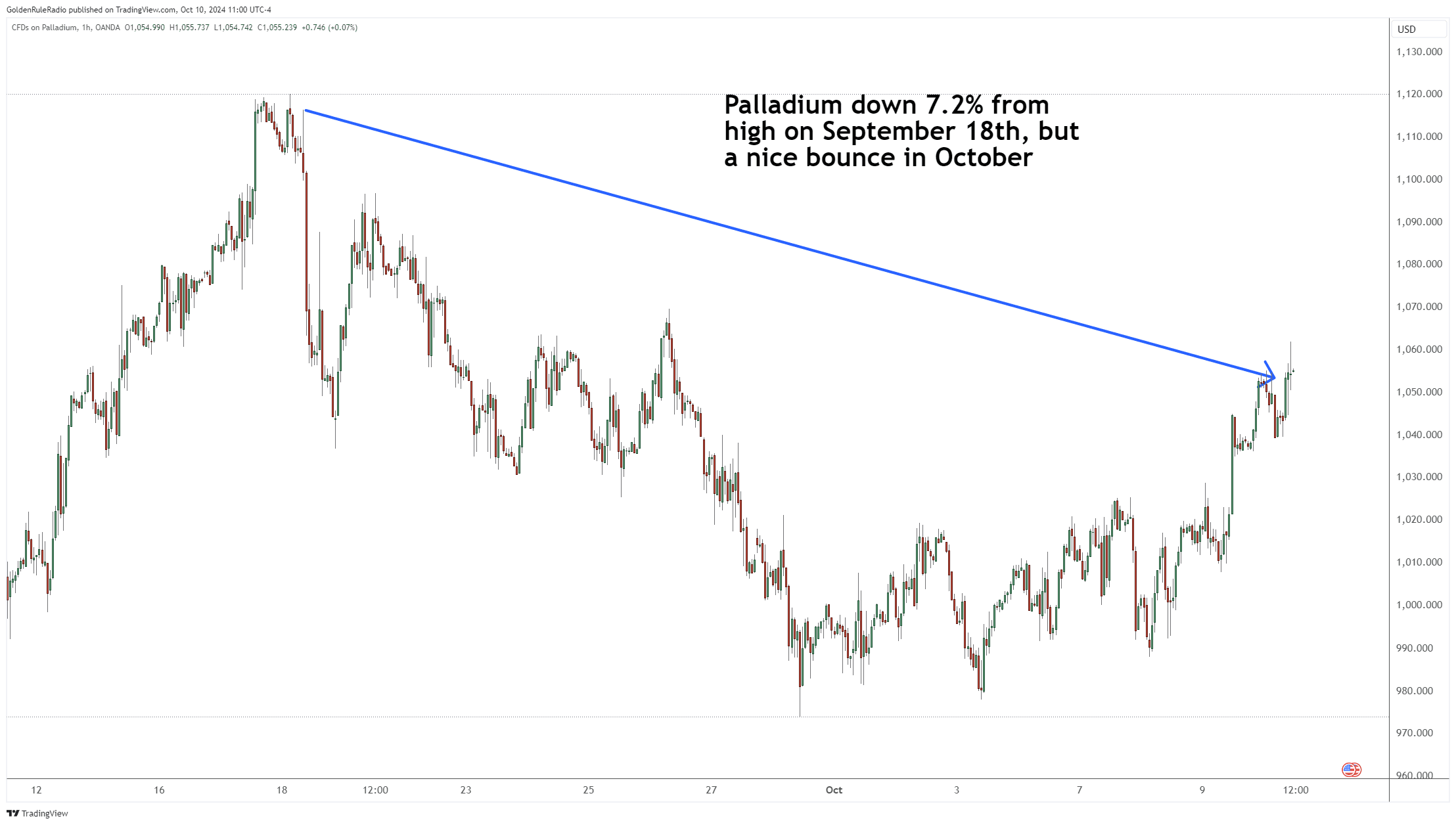

Palladium is down around 7.2% from its top of $1,120.

Gold has been the most steady of all the precious metals on the heels of a significant move up. In comparison, silver has been a bit more volatile. Platinum and palladium have been holding steady side-by-side.

Price of Gold and Elections

We looked at the last 13 elections — back from 1972 to now. In reviewing the data, we looked at the initial response post-election as well as the next year’s charts to see how the price of gold would move.

We discovered that when a Democrat wins, the price of gold tends to rise about 0.5% from the Wednesday right after the election through the end of the week. This spike is then followed by an initial decline by about 1.1% for the following two to eight weeks post election.

We see the opposite when looking at the other party. If a Republican wins, the price of gold will drop about 0.5% for that same initial period. And that initial drop will reverse and increase by about 1.1% over the next short-term period.

Demand for Gold and Elections

The focus is often on the price of gold and precious metals. But what gets more interesting is looking at the demand for gold. In the first year and then the subsequent year after that, the physical demand after a Democratic presidency win is twice as high as it is after a Republican presidency win.

Gold Predicts Election Winner?

In the six months leading up to an election that a Republican ultimately won, the gold price had a very strong six months. In the six months prior to a Democratic win, the price of gold was down to flat. So is gold currently predicting a Republican win? Only time will tell.

US Debt Monster Looms

No matter who sits in the White House in January, there will still be a $36 trillion debt with interest on the debt now eclipsing military spending. By the end of the year, the debt payments will likely be eclipsing social security spending. That is the unmovable object facing either administration. It will only continue to get worse. There will be a continued erosion of trust from the American people — no matter who wins.

Protect Your Wealth With Gold

Gold is a powerful safe haven and insurance policy against economic and political uncertainty.

Now is the time to reach out to a trusted McAlvany advisor for precious metals investing advice. They are happy to speak with you about your investment goals and strategy for investing in gold and other precious metals. Reach us at 800-525-9556