Here’s our weekly recap of the precious metals markets for July 24. As of this recording, here is where precious metals stand:

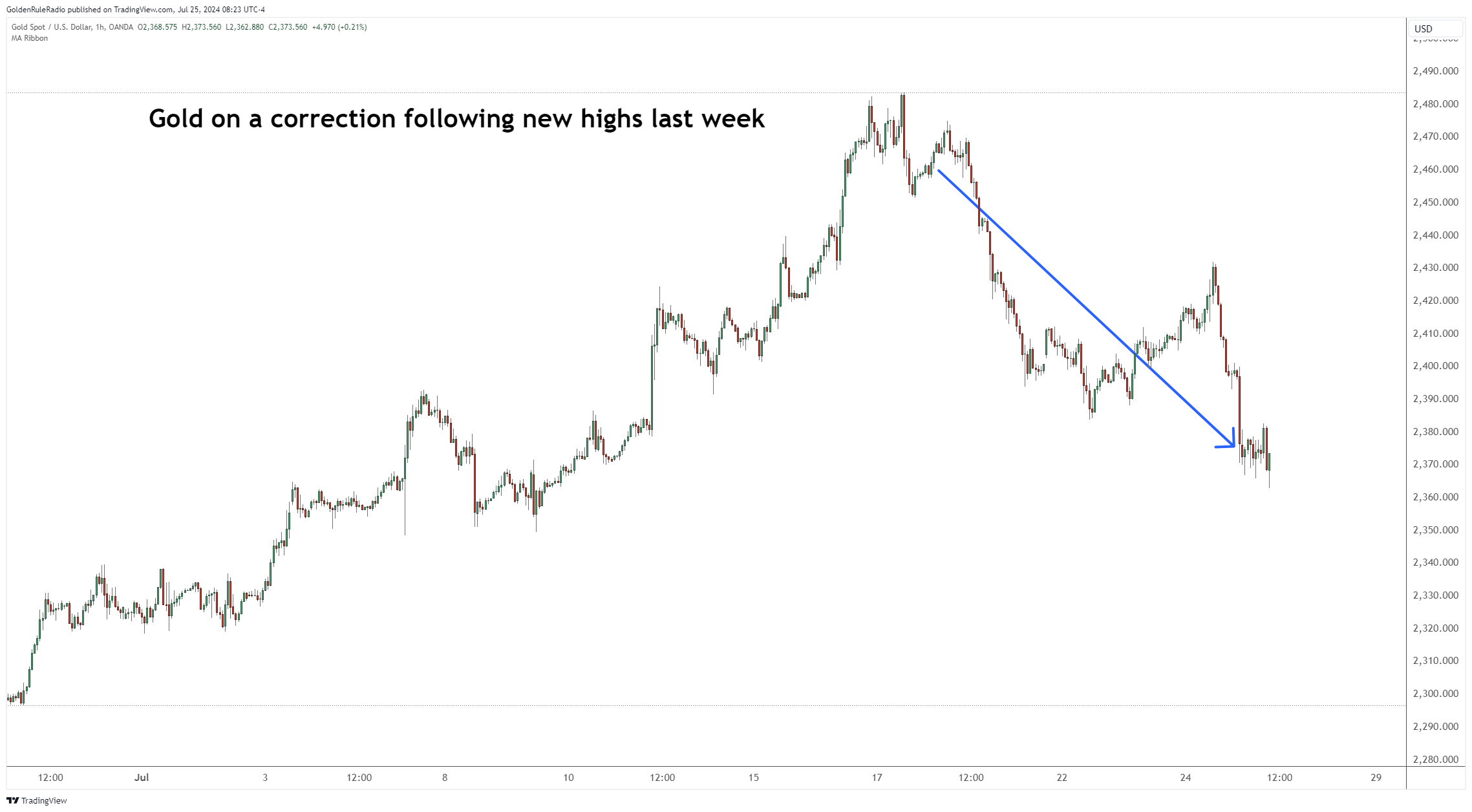

The price of gold is at $2,400 down just over 2% — coming off a high of $2455 from a week ago.

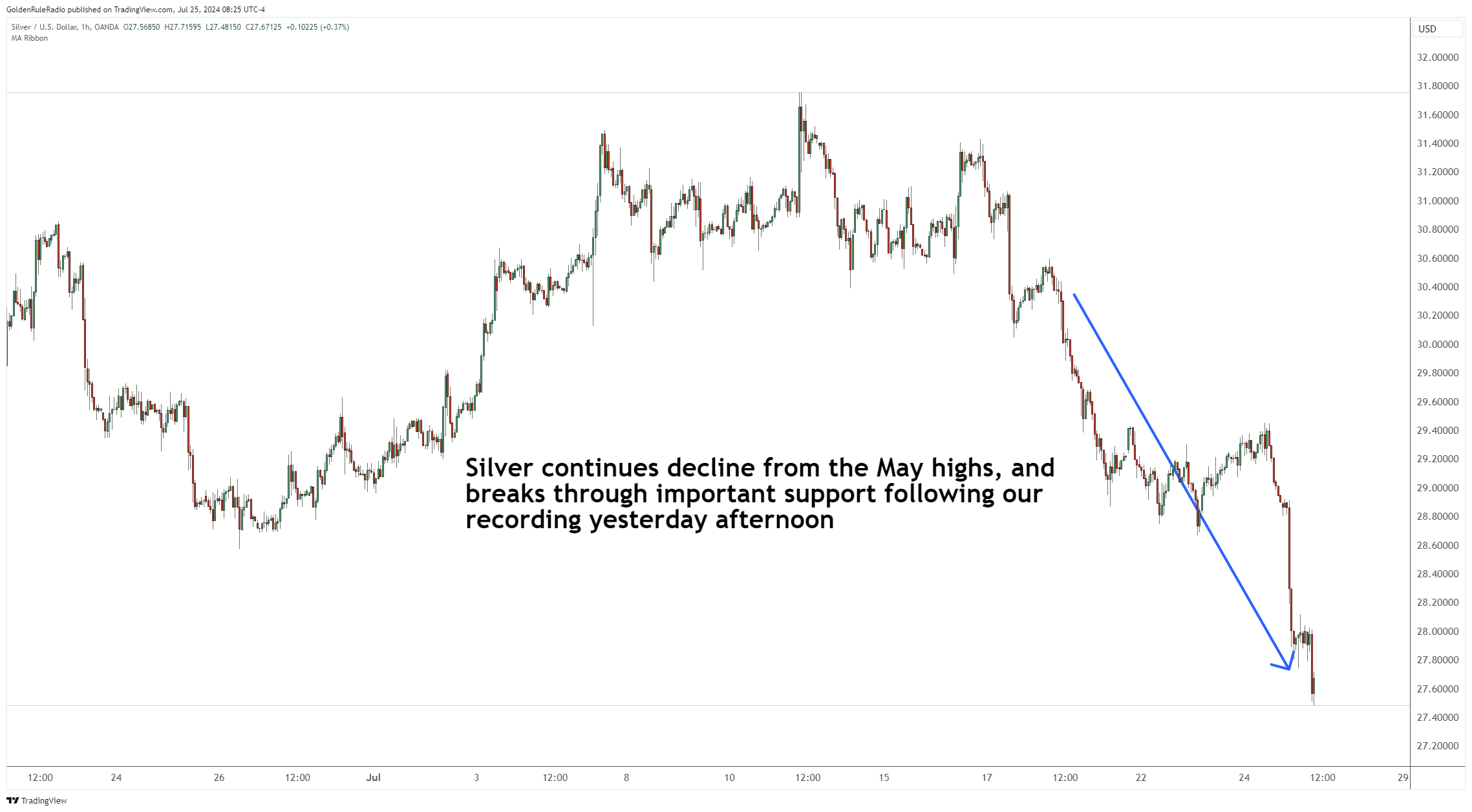

The price of silver is down 4% at $29, declining from $30.21 last week.

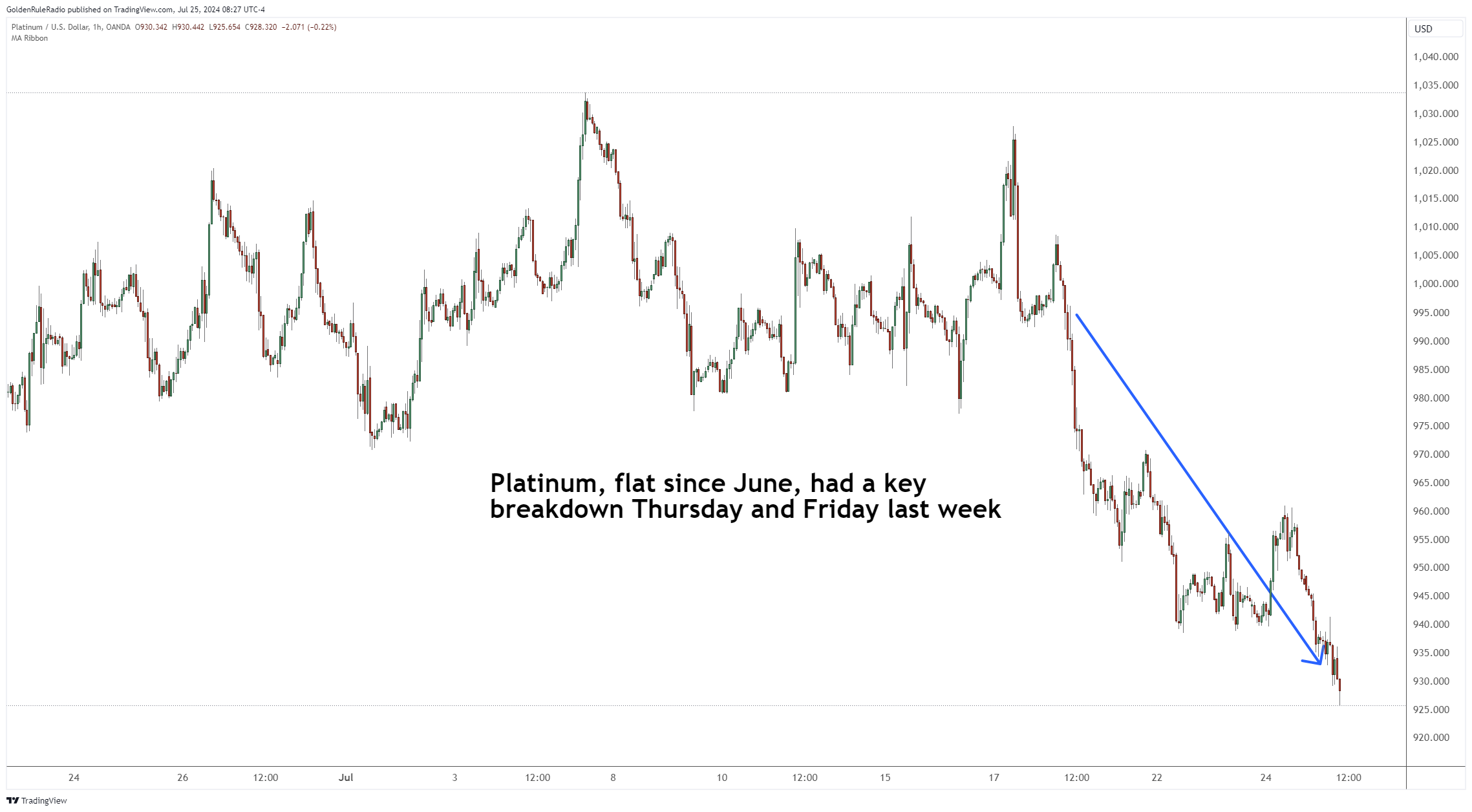

The price of platinum is down to $958, sliding 4% from $966 a week earlier.

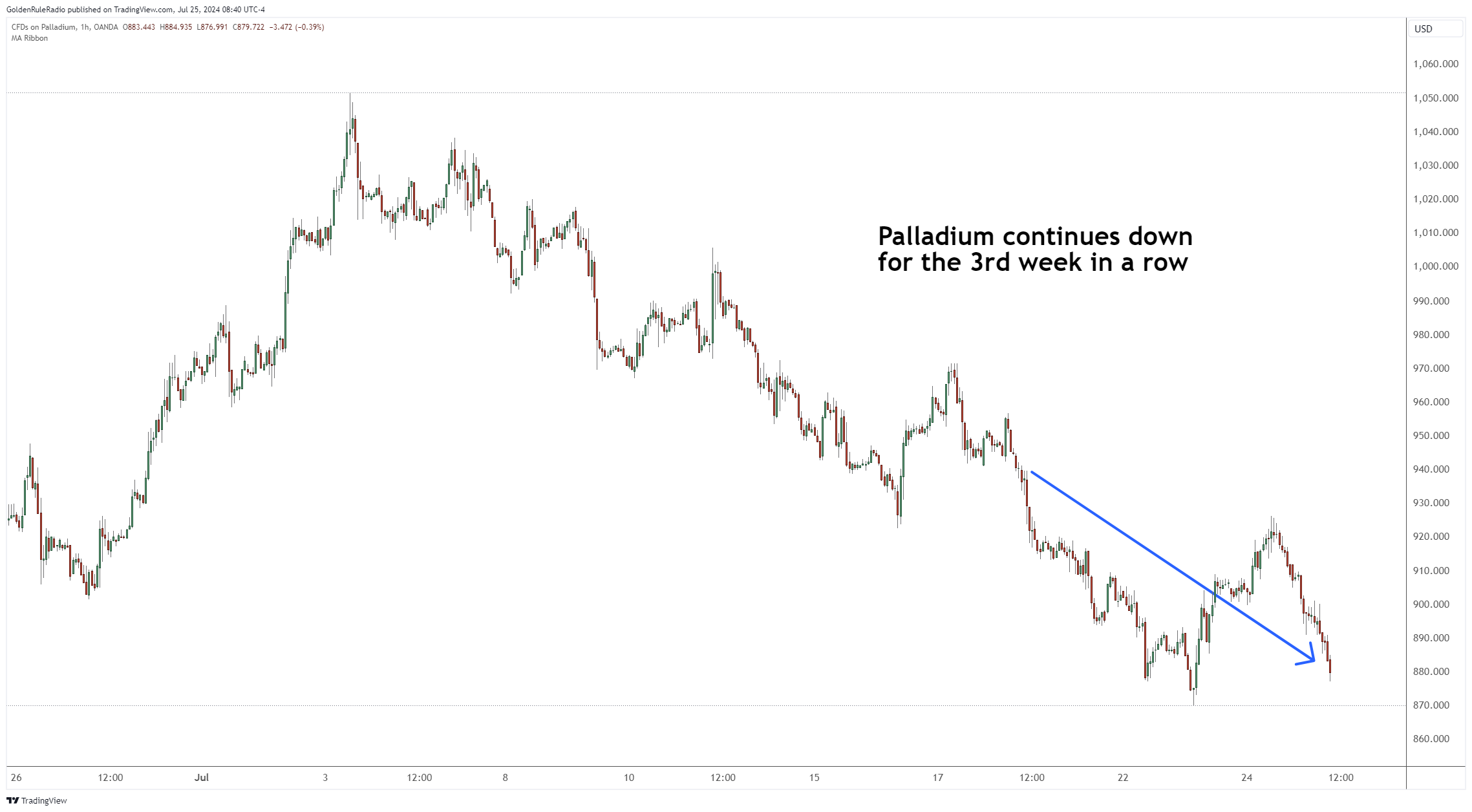

The price of palladium is only down 1% to $949, from $957 a week ago.

Looking at the broader markets, there’s a lot of volatility all around.

As of this recording the NASDAQ lost 722 points; the S&P 500 declined 128 points or 2.33%; the DJIA fell over 500 points; and the Dow Transports lost over 240 points.

US Political Shift

The political uncertainty in the US is partially responsible for driving the volatility in the metals markets.

President Biden withdrew his bid for reelection on July 21, and he endorsed Vice President Kamala Harris as the Democratic presidential candidate. This move comes off an active Republican National Convention last week. Now, we’re certain that there will be a change in the presidency. However, it’s hard to tell what the political landscape will look like by the end of the year.

Gold = Safe Haven Asset

While precious metals prices may be on the move during this election year, it’s prudent to plan ahead and be ready for your next gold buying opportunity. Gold provides a layer of protection and stability to a diversified portfolio, especially important during uncertain times.

A McAlvany precious metals advisor will be happy to discuss your personal situation and advise you on the best time for you to purchase ounces of gold. You can get in touch and schedule a no-obligation consultation with one of our advisors at 800-525-9556. Our office is open Monday through Friday from 8am – 5 pm Mountain Time.