Podcast: Play in new window

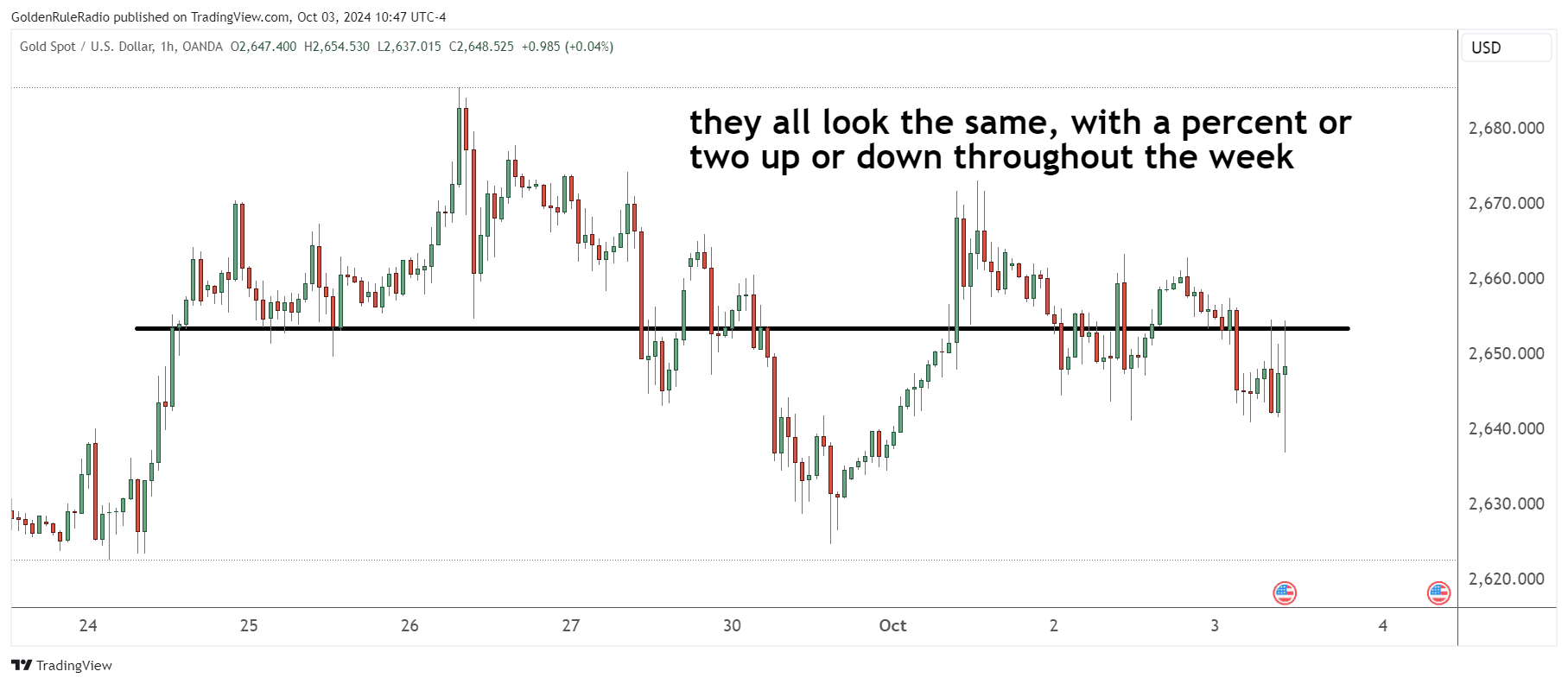

Precious metals had a lot of movement on the heels of the Federal Reserve last week, but things have kind of calmed down gold, silver, and platinum. Let’s look at where precious metals stand as of October 2, 2024

Gold, silver and platinum were flat week over week.

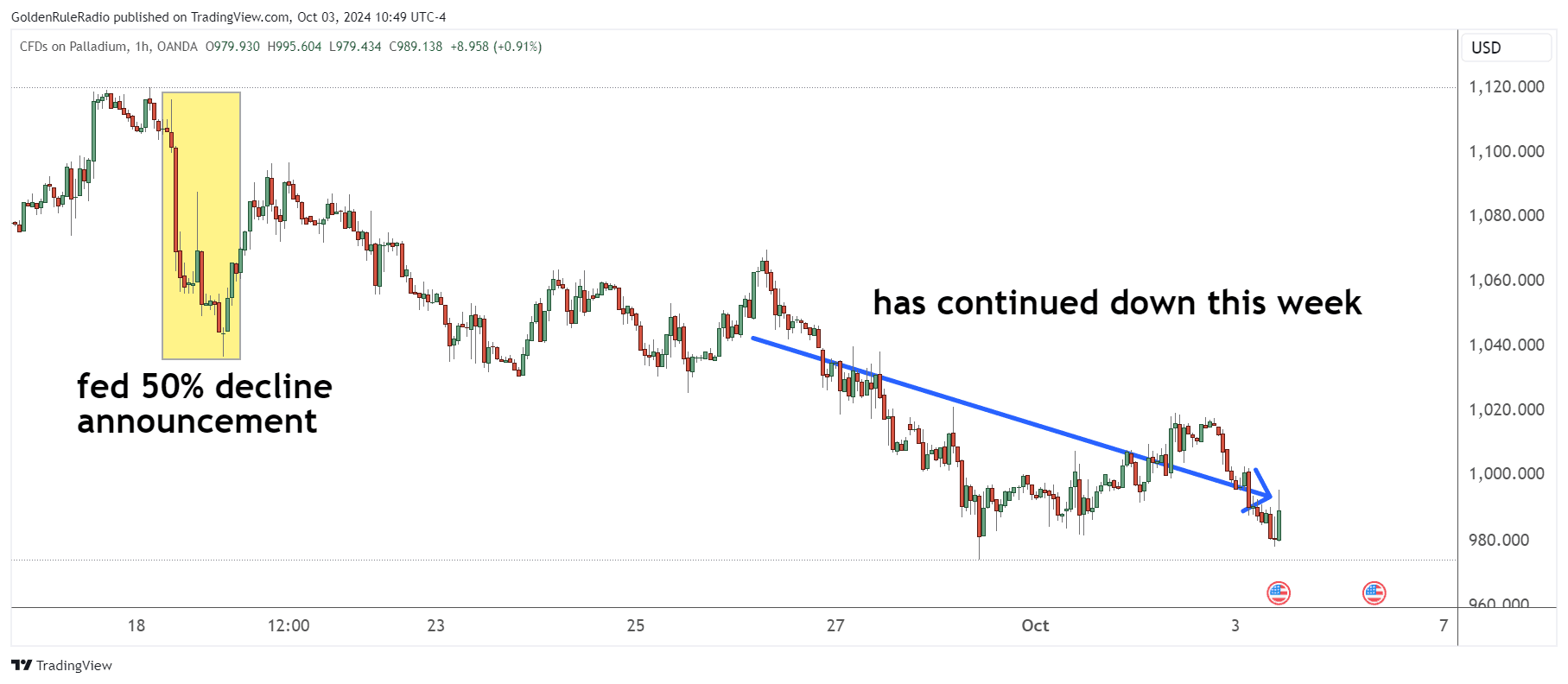

The price of Palladium declined 4%. Although there was a little jump up initially last week, now, it’s back down.

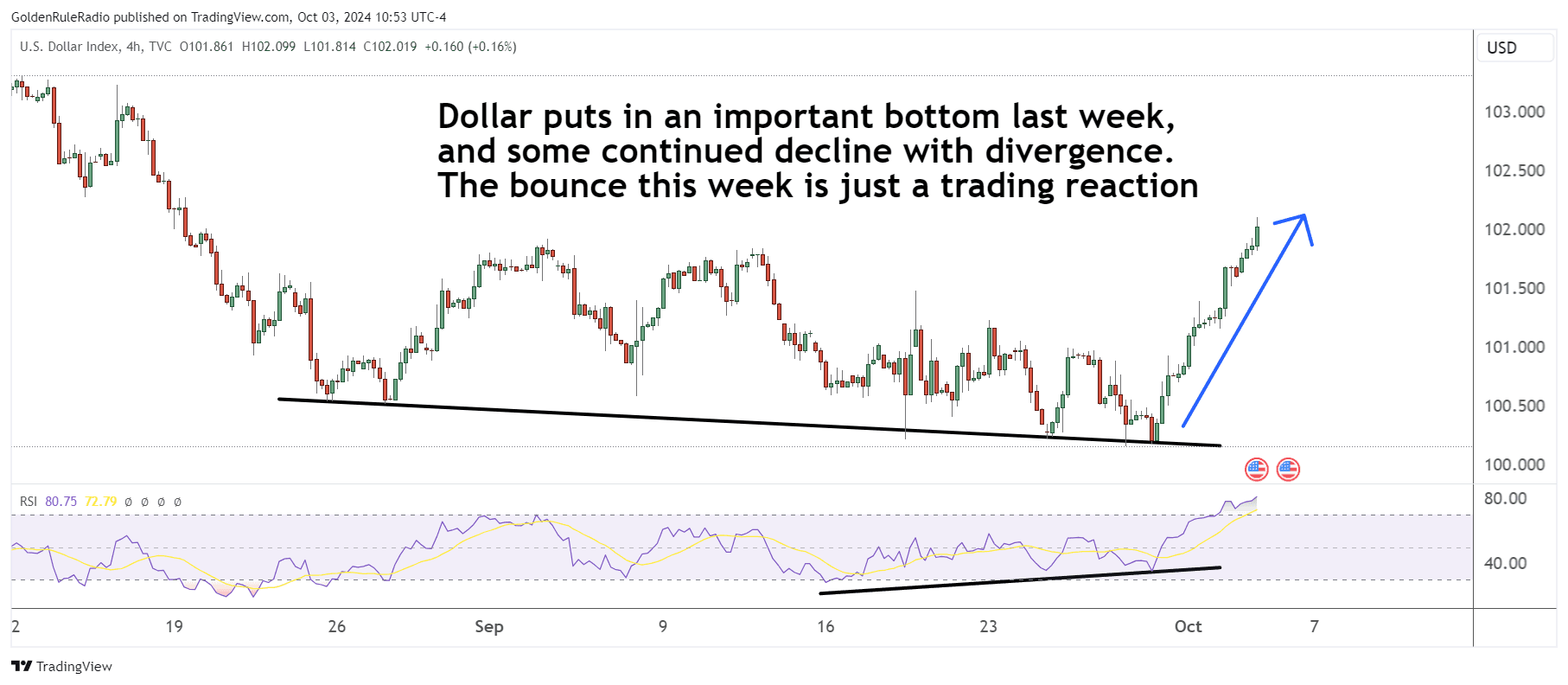

The dollar has put in an important bottom last week, and some continued decline with divergence. The bounce this week is a trading reaction.

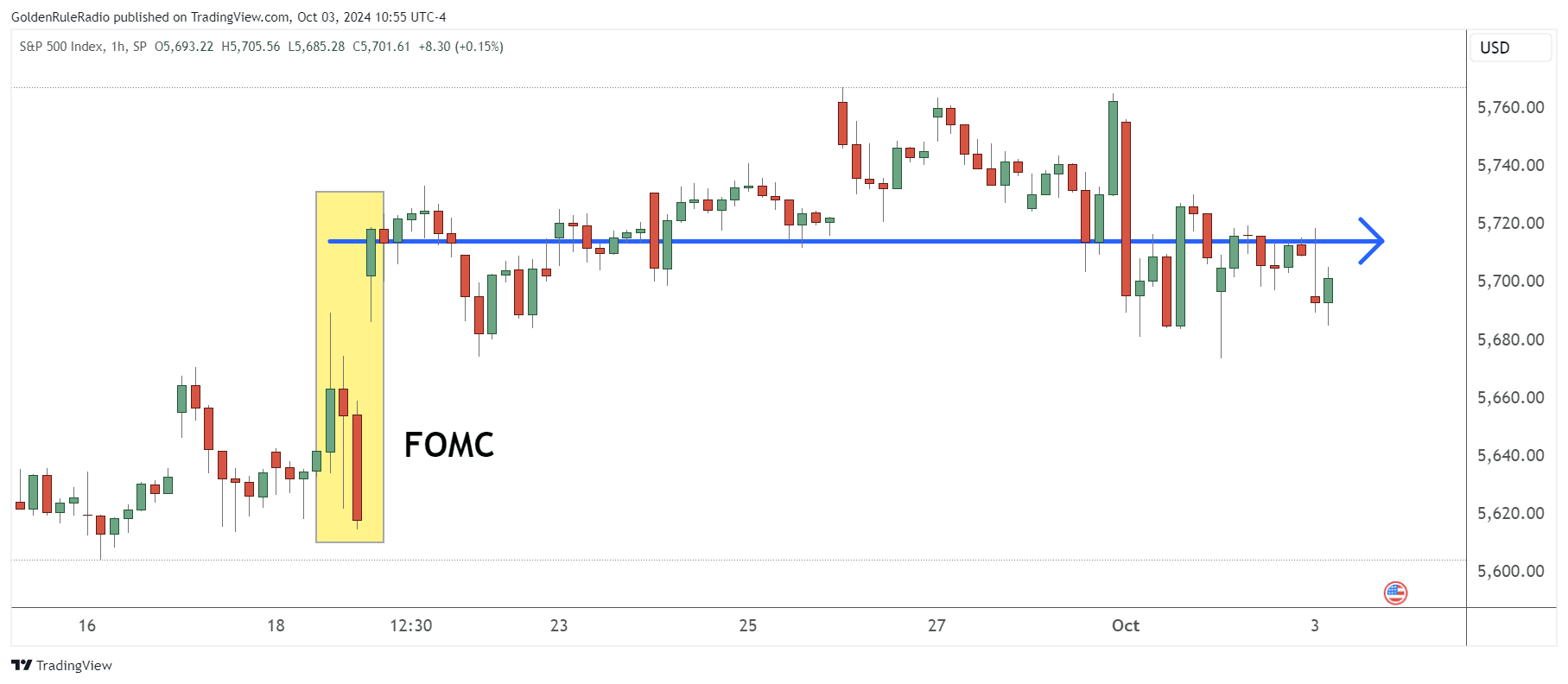

The S&P 500 is flat from last week, after reacting to the FOMC meeting.

Precious Metals’ Year-to-Date View

September marks the eighth straight month that the price of gold ended higher. The gold price closed up 5.3% in September. That’s after rising up 13.6% for the third quarter, and up 27.5% for the year-to-date price.

Silver ended September up 7.6%, which made it positive for the third quarter — up 6.5%. And its year-to-date price has climbed 30.3%, which is better than gold’s performance.

Platinum has not fared as well. The price of platinum was down 5.2% for the month of September, with a 2% decline for the third quarter. Platinum’s price has declined 4.2% from the year to date price.

On the other hand, palladium rose 2.5% in September and it was up 1.5% for the third quarter. But its price is down 9.9% from the year to date.

Finally, the gold to silver ratio has increased 5.8% for the quarter, but it is flat on the year otherwise.

Wait and See Mode

There are several geopolitical issues that could be contributing to the lack of movement in the precious metals market. There is the ongoing conflict in the Middle East, with Iran sending missiles into Israel. There’s the ongoing conflict in Eastern Europe.

Domestically, there is the uncertainty of the longshoreman strike that could have a dramatic impact on the US economy. And of course, there’s the upcoming US election which has people on edge.

So it’s no surprise that the markets are waiting to see which direction to go next.

What’s Next for Metals?

The US is just about 30 days or so away from the presidential election, so it is possible that the markets are still in the “buy the rumor, sell the news” phase. Once the election is settled, the US markets will likely look like a safer haven for investors. And the same will go for precious metals.

The hotter things get internationally, the better things like precious metals and liquidity assets are going to appear.

When to Buy Gold?

You can make regular acquisitions through your McAlvany Precious Metals advisor, or through your Vaulted account. If you’re not doing so already, now is the perfect time to connect with your precious metals advisor to determine your best entry points for purchasing gold and other precious metals.

You can reach out to the trusted McAlvany advisor team at 800-525-9556. They are happy to speak with you about your investment goals and strategy for investing in gold and other precious metals.