Podcast: Play in new window

Gold and platinum continue to march higher, while silver and palladium buck the overall trend. Let’s take a look at where prices stand as of our recording on February 12:

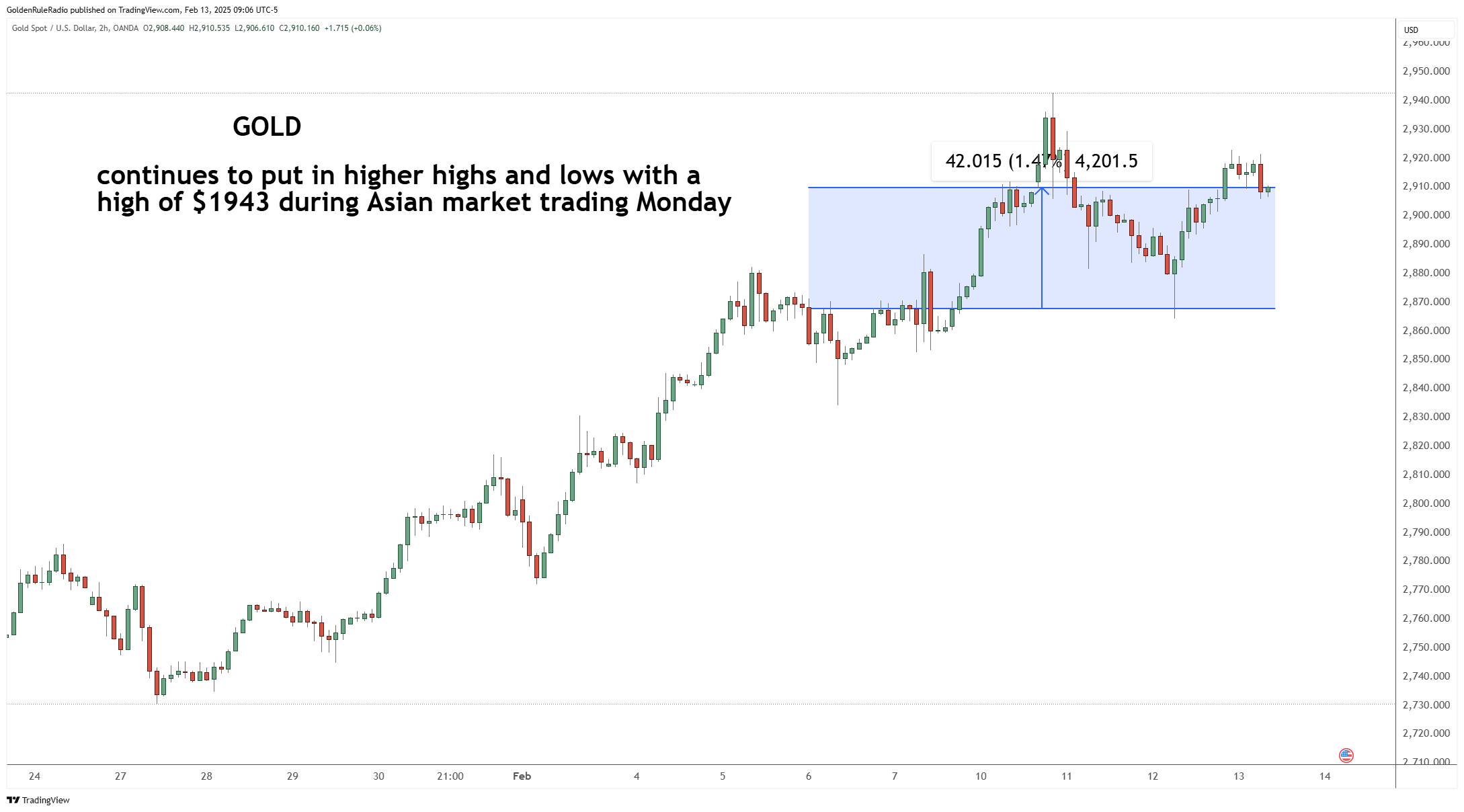

The price of gold is up 1.25% to around $2904 — not a huge change week over week. However, gold did reach a high of $2942 midweek, which marks a new all time high.

The price of silver is down 0.2% on the week, sitting at $32.22 — just about flat. However, silver had a swing from the intraday high to low of about 5%.

Platinum is up, 2.2% or $1,033, showing some strength this week.

Palladium continues its slide down 3% to $985. And if you look at the high right at the end of January, palladium is down 9% in the month of February.

Looking at the broader market…

The S&P 500 is down about 0.4% or 6,053. However, it seems to be in a sideways pause. At least as of right now for the last couple of weeks, the equities market is trading sideways.

The dollar is up about 0.16% to $108 from our recording last week — seeing some strength in the US dollar.

Dr. Copper’s Check Up

With the price of gold up and the price of silver basically flat, the gold-to-silver ratio hit 92.2 as of recording. That is the highest it has been since August 2022, and the fourth highest gold silver ratio ever.

How do we see silver moving with the ratio widening? That’s when we look at what copper is doing.

As we have discussed before, the metal carries the moniker “Dr. Copper” because it is an indicator that reflects the health of the economy. As we saw in a recent January episode, copper continues to show strength — which means the economy is growing.

Copper is back near all-time highs. As of this recording, it is around $4.70, which is right at the top of its trading range. And it’s likely that it could break through to $5. If it does, we expect that the price of silver will also rise, and narrow the gold-to-silver ratio again.

DOGE to Audit BLS

We’ve talked before about how statistical reports seem to paint a more rosy picture of the outlook of the economy. For example, everybody knows that inflation is way under-reported compared to what it actually costs to put food on the table and gas in the car.

Now, the Department of Government Efficiency (DOGE) is going to audit the Bureau of Labor Statistics.

While it’s impossible to know exactly what will happen, it’s possible we’ll see major changes in past reports on everything from non-farm payrolls to GDP and CPI. The inflation rate will likely be significantly higher than what has been reported in the past. Because the policymakers in Washington use all of the figures in the economic reports to allocate funding, whatever DOGE uncovers in their reports could lead to a massive overhaul in governmental spending.

Worldwide Demand for Gold

Meanwhile, the gold price continues to climb higher with strong demand worldwide. Global gold ETF holdings bounced up 3,253 tons to a total assets under management of US $294 billion. Now it’s a matter of who will control the physical aspect of of gold. Will it be the East or the West? Is it going to be the LBMA or the Comex and NYMEX?

One thing’s for certain, US investors have a distinct advantage right now with premiums on real, physical gold at very low prices — so this is the time to start adding ounces to your portfolio.

Plan Your Metals Strategy

How many ounces of gold and other precious metals should you add to your portfolio? The McAlvany advisor team is here to help guide you. With decades of experience in precious metals investing, they are happy to speak with you about your strategy for investing in gold and other precious metals. Reach us at 800-525-9556