Podcast: Play in new window

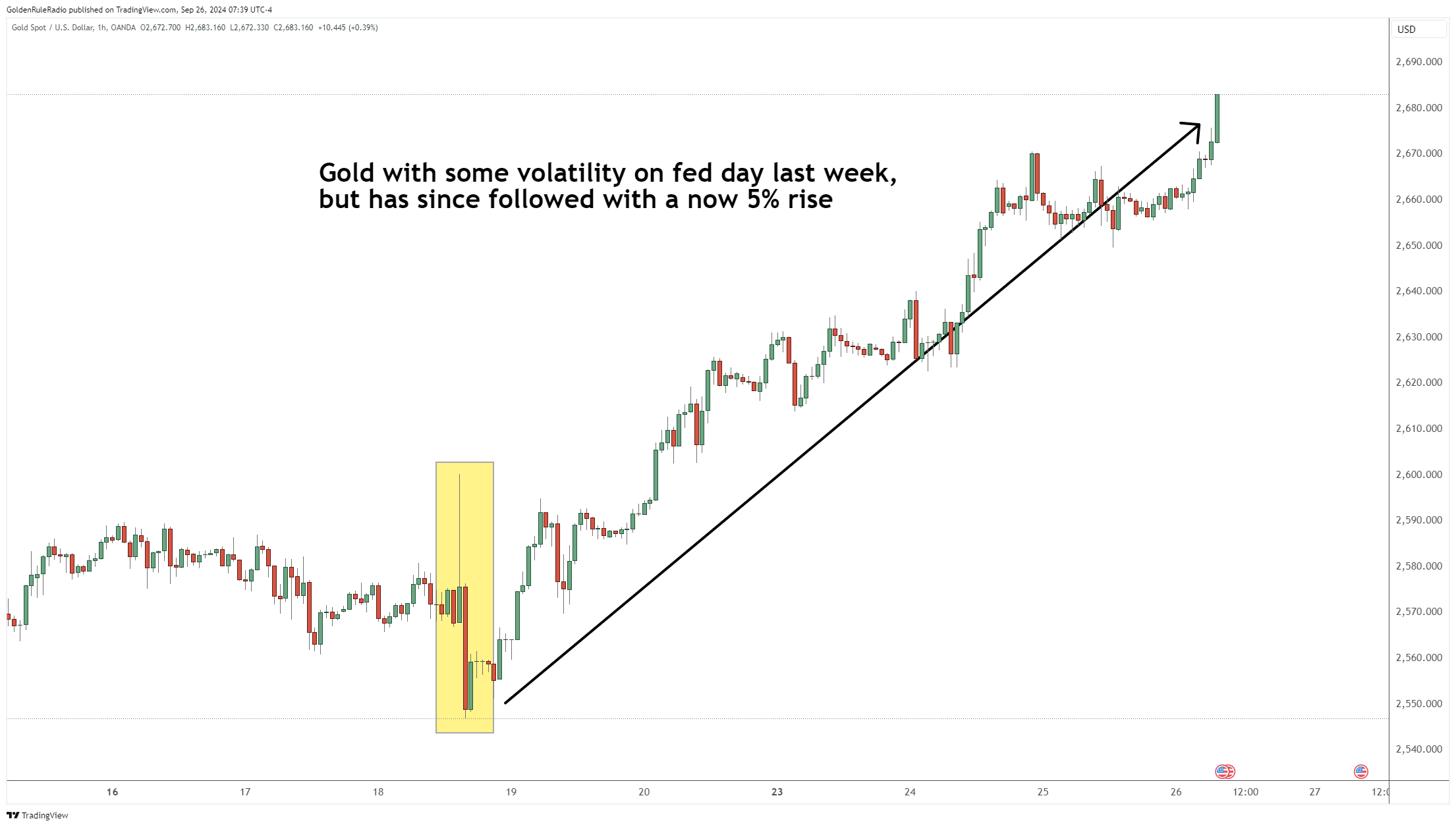

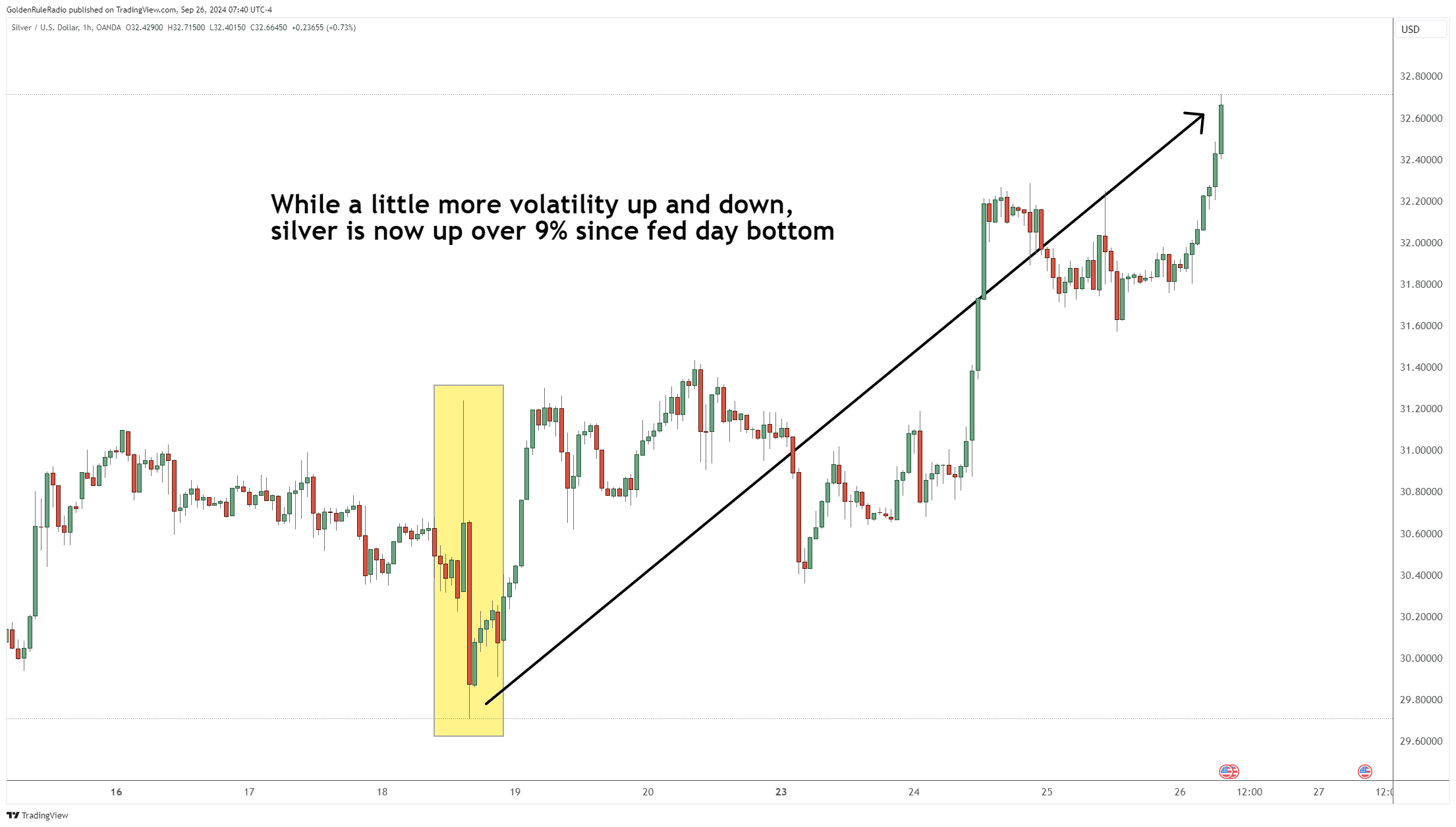

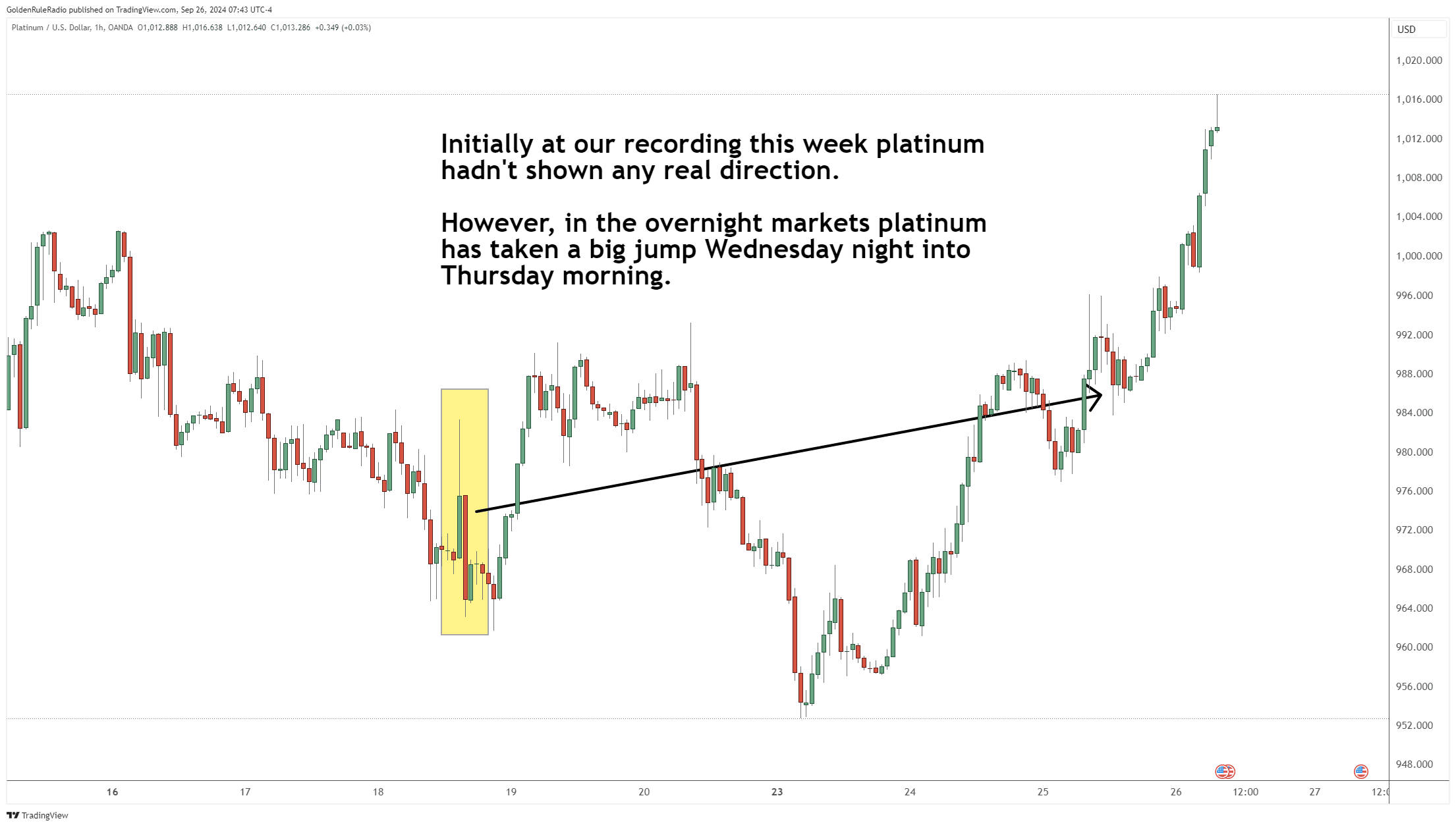

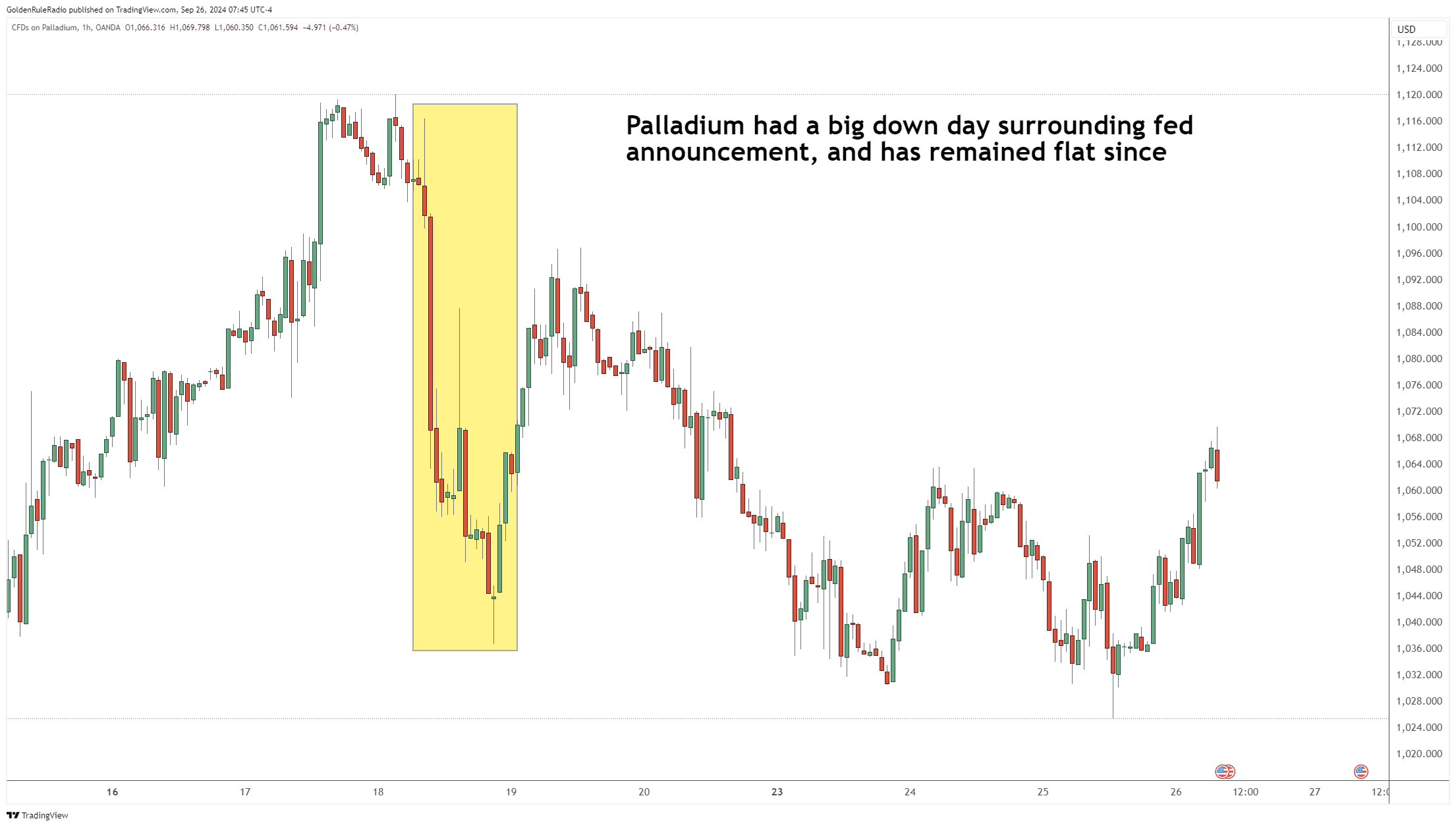

There’s been quite a range of movement in the price of precious metals over the last week, following on the heels of the Fed announcement. Let’s look at where precious metals stand as of September 25:

The price of gold is up 4.8% or up $122 to $2,672 from the previous week.

The price of silver has increased by 8.5% or $2.50 to around $32.60 from the week before.

Platinum is up about $19, or about 1.9% to $984 from last week.

Palladium is almost flat for the entire week. It had a range of a couple percent from top to bottom, but ultimately palladium is pretty much dead week over week.

The Macroeconomic Perspective

Looking at precious metals and commodities from the macro view, time will tell if the Federal Reserve policy will lead to a recession or continued inflation.

The market is now talking about another 25 basis points in November, as well as another 25 more in December. That would pull us off a full 1% by the close of 2024. What happens next for markets will depend on whether the economy goes into a recession or not.

The timeframe to watch is the six months following a rate cut.

If the equities markets have a rally of an average 15% or more, it would indicate that economic policy shifts reignited inflation. Conversely, if the economy goes into a recession following rate cuts, you’ll see an average decline of around 15% or more.

Rate Cuts Benefit Who?

A quote coming out of Fannie Mae said, “The newly released summary of economic projections implies another 50 basis points and cuts by the end of 2024.”

That’s what the organization that provides liquidity and stability in the housing market is hoping for anyway. You would think, in this case, that Fannie Mae is looking out for the consumer when calling for more interest rate cuts.

The idea behind interest rate cuts is that borrowing becomes less expensive. So in theory, making large purchases like homes should be more affordable for individuals.

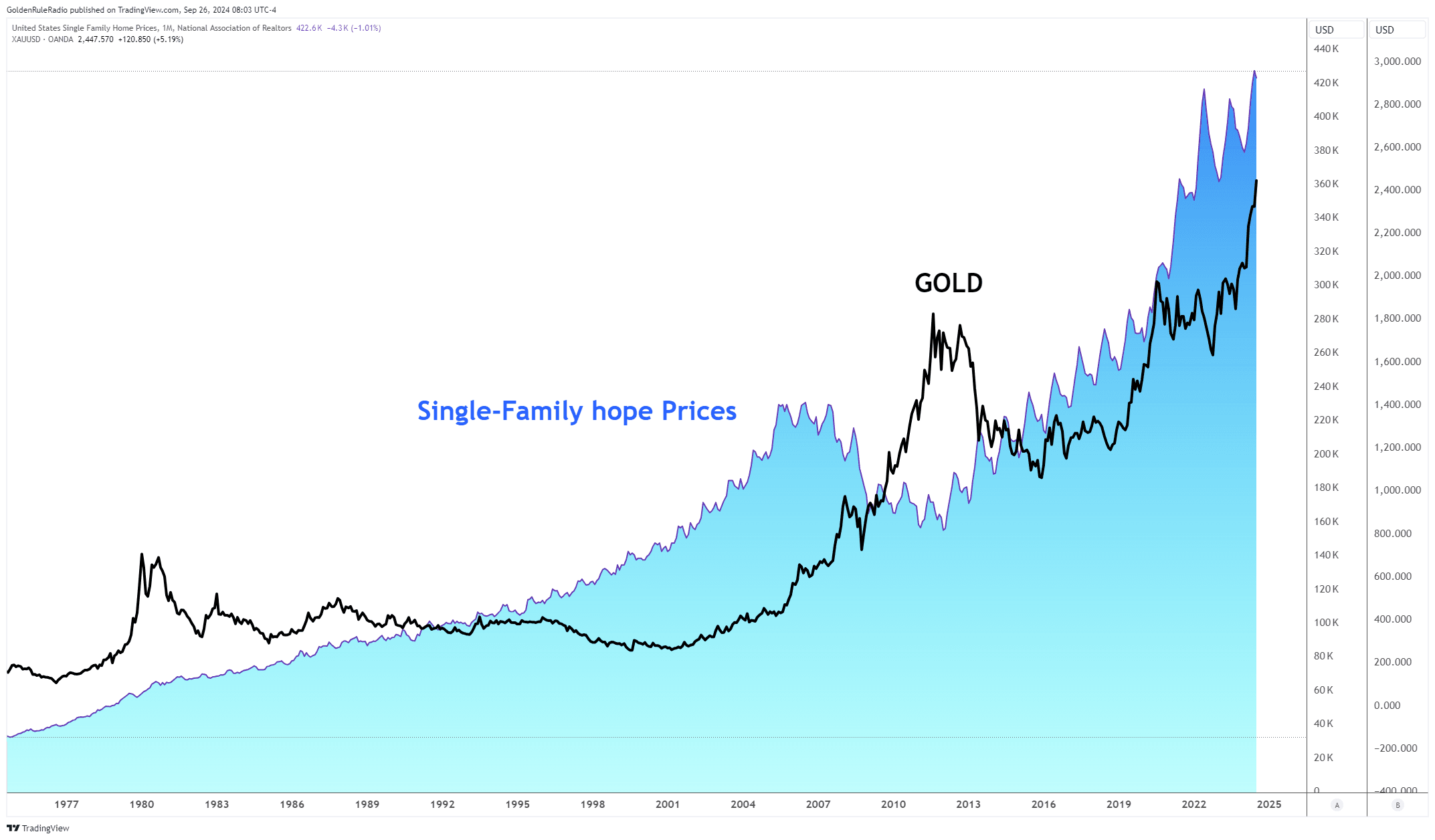

However, the price of single-family homes has not declined at all. If anything, the prices continue to increase. Just take a look at this chart of the price of homes compared with the price of gold:

Single-family homes are no longer a place for individuals to live. They are part of an investment portfolio owned by conglomerates.

Homes are no longer a wealth-transfer vehicle. They become a liability on your personal balance sheet. Gold is one of the remaining tangible assets that preserves its value so you can leave a legacy to your heirs.

Protect Your Own Economy

Interest rate cuts may look good for short-term economic growth. But they threaten the purchasing power of your hard earned dollars.

The best way to protect your personal economy is to turn a portion of your cash into assets that aren’t affected by inflation — like gold, silver and other precious metals. So even if the Fed uses monetary policy to increase the money supply and chip away at your purchasing power, your gold will protect you from wild government spending.

Now is the time to reach out to a trusted McAlvany advisor for precious metals investing advice. They are happy to speak with you about your investment goals and strategy for investing in gold and other precious metals. Reach us at 800-525-9556