Podcast: Play in new window

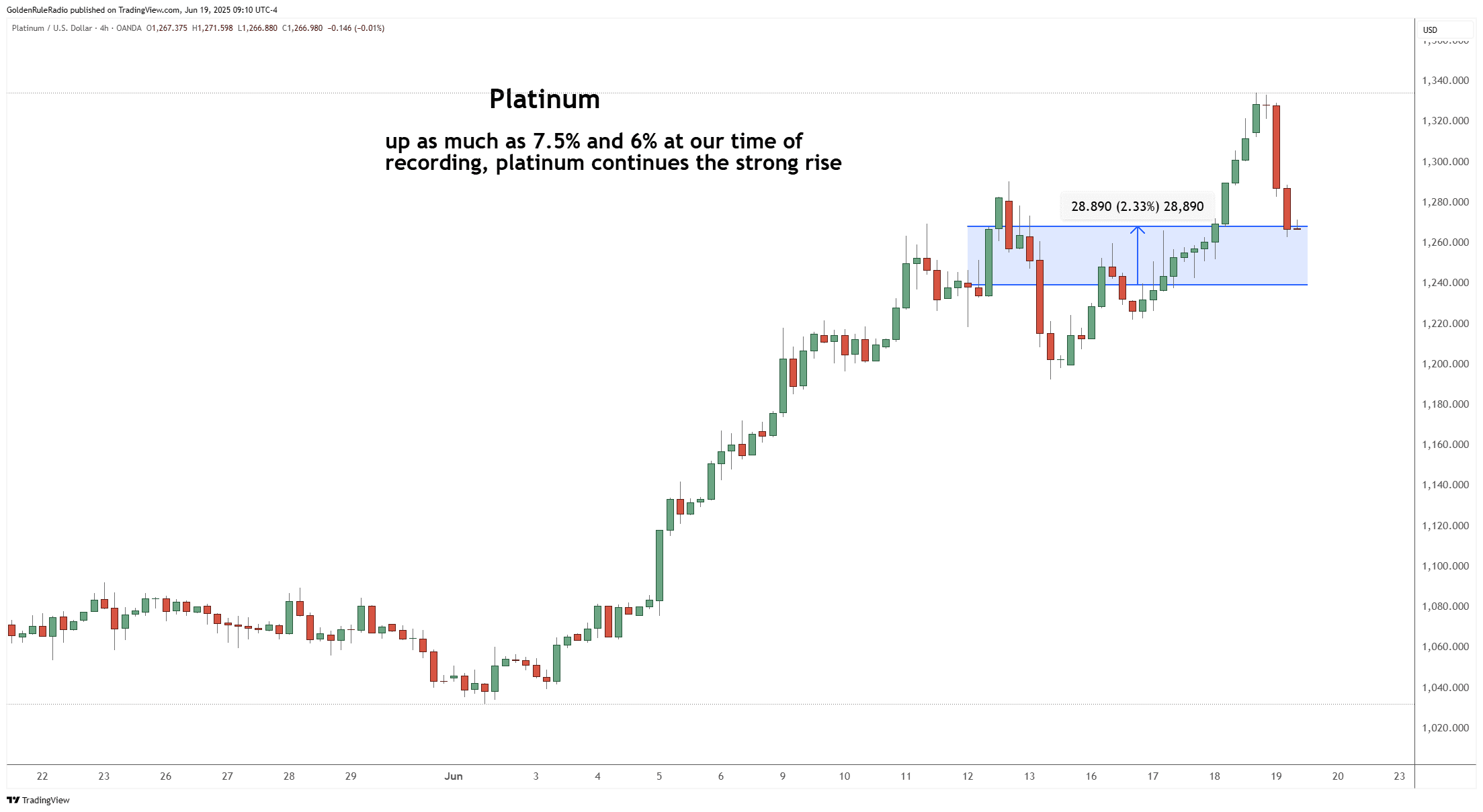

Platinum was the big winner of the week, rising up 6% and flirting with a previous high reached in February. And it still has more room to go higher.

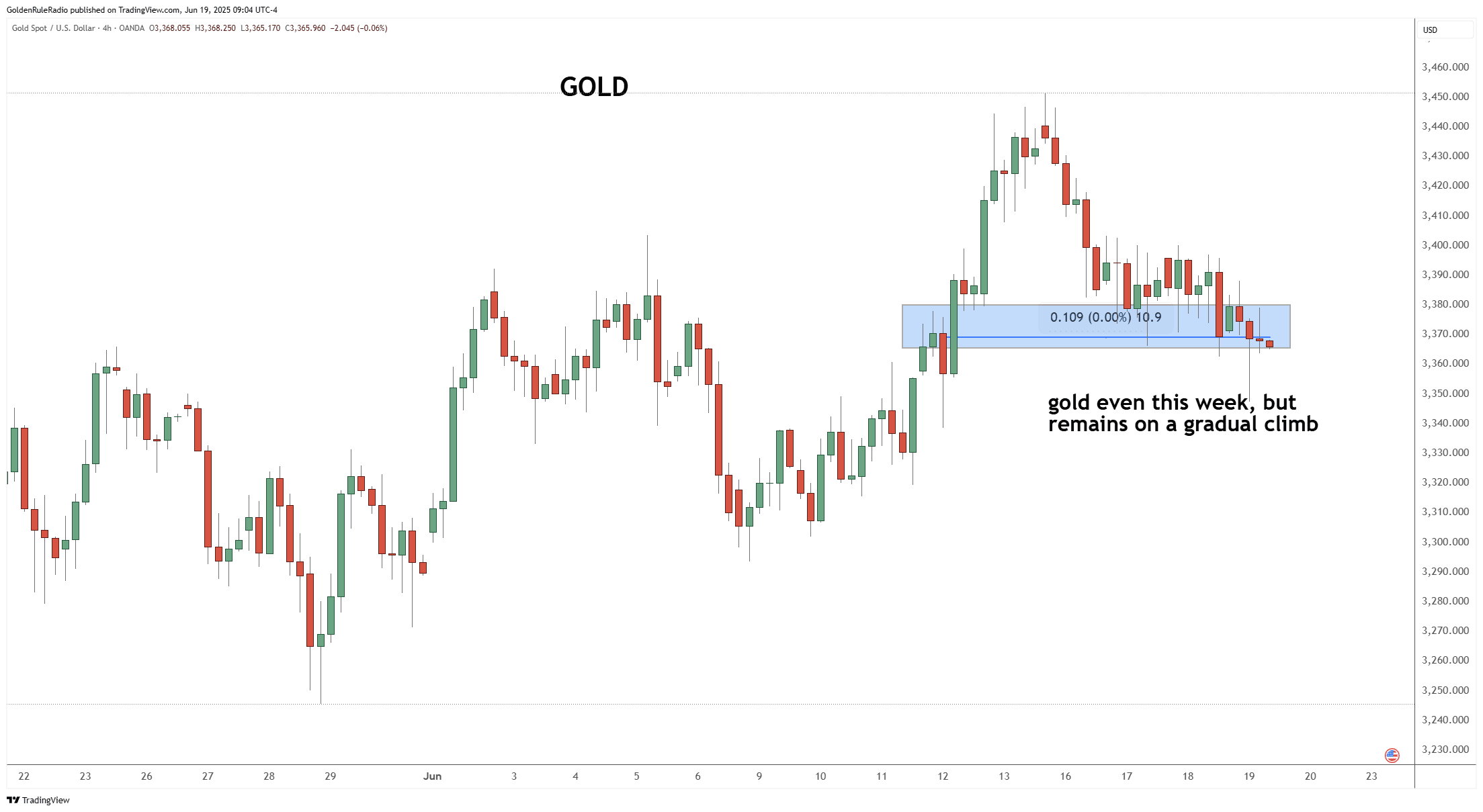

Gold was flat on the week. But it still continues to shine, as geopolitical and economic uncertainty has more investors seeking safety. Even bond market authorities call gold the new “flight to quality” asset. And silver broke through the important $35 ceiling with much more room for new highs.

Let’s take a look at where precious metals stand as of Wednesday, June 18:

Gold is flat at $3,360 as of last week’s recording. It was up as much as 2% intraweek, so it did have some movement.

Silver is up 1%, sitting at $36.70. It was up as much as 3% in between recordings during the week.

Platinum is up 6% at $1,320, nearing its previous February high and breaking out from its lockstep trading with palladium.

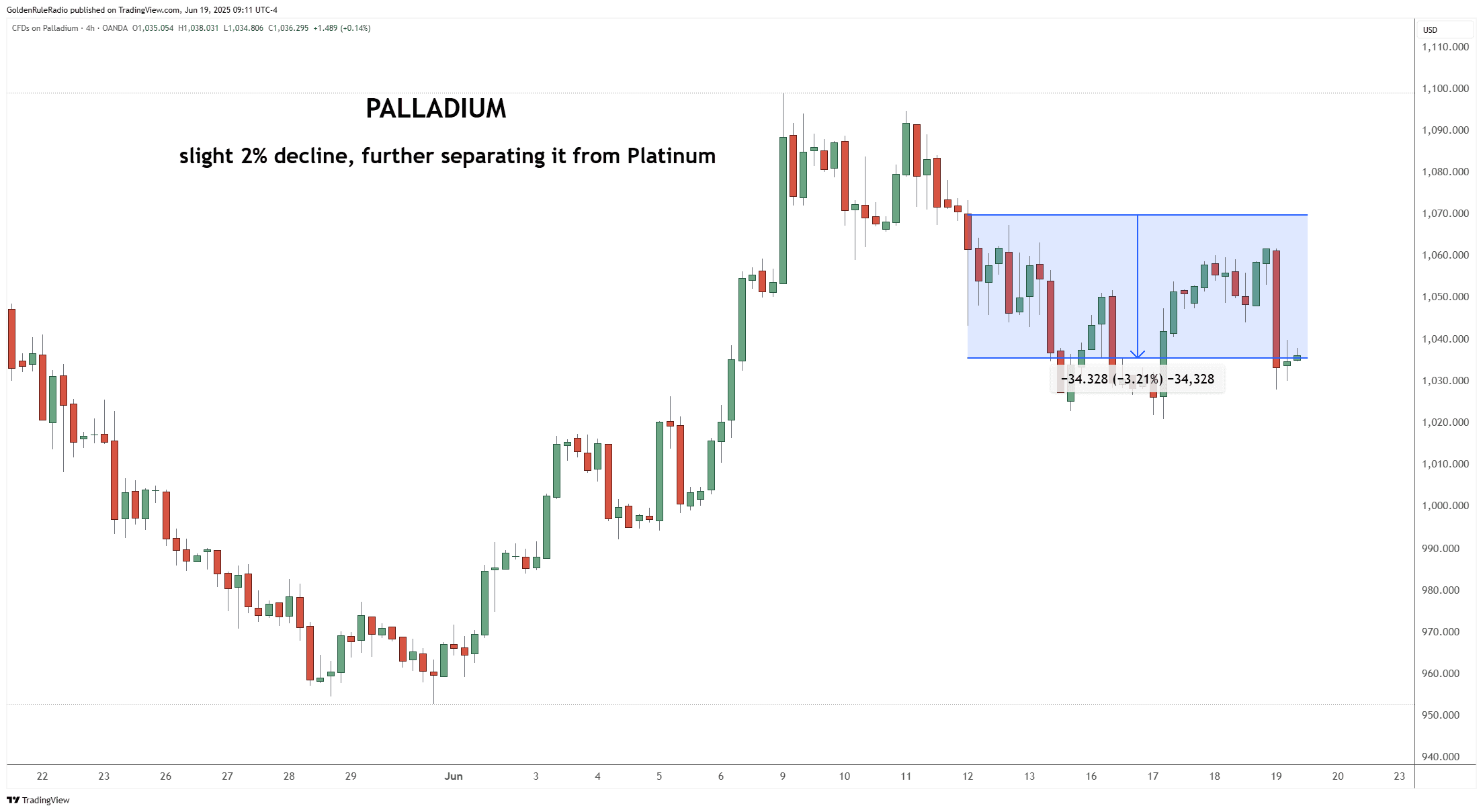

Palladium is down 2% to $1,045, diverging away from platinum.

Looking over at the paper markets…

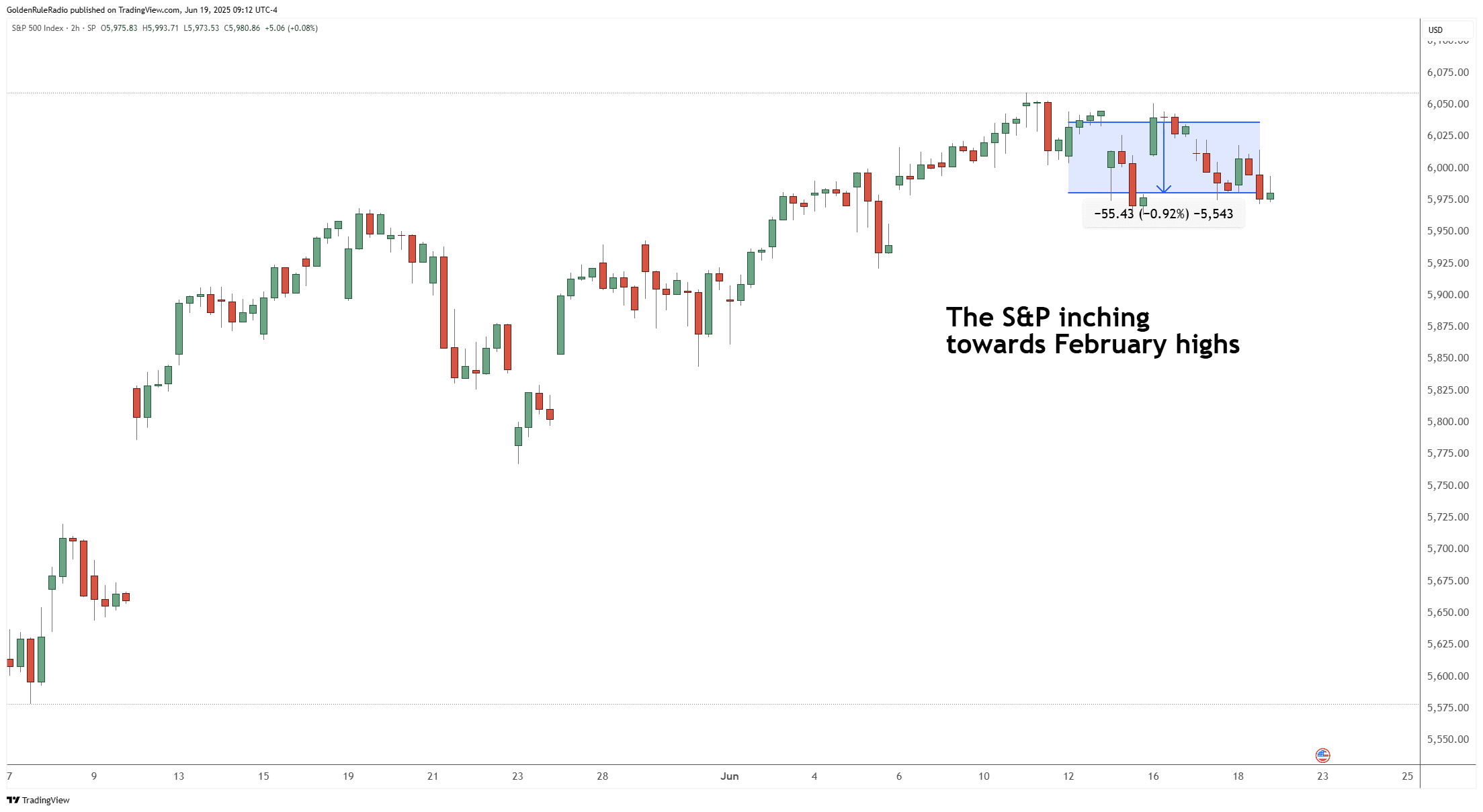

The S&P 500 is down 1% on the week, sitting at 5,980. It had inched up towards its all time high, but it is currently just sitting a little bit below it as of this recording.

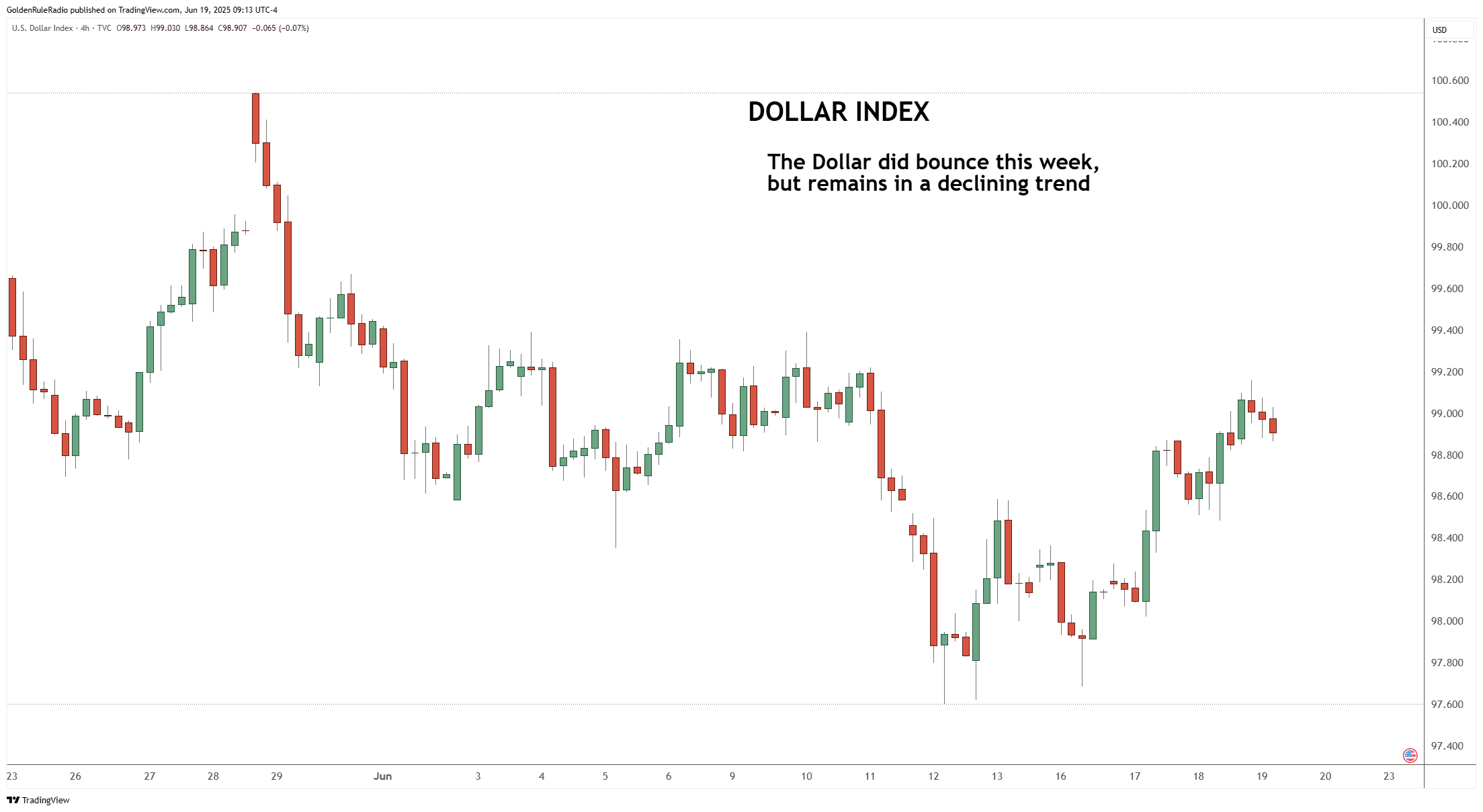

And finally the dollar index is up 0.5 points, sitting at 98.8.

Gold: The New “Flight to Quality” Anchor

Gold remains the foundation for precious metals investors, and this week was no exception. The price held steady around $3,360, even after some mid-week volatility. What’s notable is the growing chorus of major market voices—like Jeffrey Gundlach and Paul Tudor Jones—calling gold the new “flight to quality” asset. Traditionally, bonds have filled this role, but with global debt rising and the bond market under pressure, gold is increasingly seen as a safer store of value.

Central banks are ramping up their gold purchases, supporting the price and signaling a shift away from reliance on the U.S. dollar. This trend is reinforced by gold’s long-term performance: it has outpaced bonds and provided reliable downside protection during market stress. For investors, gold continues to serve as a core holding, especially in times of economic uncertainty and geopolitical tension.

Silver: Breaking Through

Silver was up as much as 3% this week before settling at a 1% gain, closing near $36.70. The big technical story is silver’s break above the $35 resistance level—a price point that has capped rallies for years. Technical analysts are watching this closely, with the next targets at $38 and $40. If silver sustains its momentum, a move toward $50 isn’t out of the question.

Another important metric is the gold-to-silver ratio, which recently hit 104:1. This high ratio suggests silver is undervalued relative to gold, and historically, such extremes have preceded periods where silver outperforms. As gold prices rise, retail investors often turn to silver as a more affordable alternative, which can drive further gains.

Platinum: Playing Catch-Up

Platinum was the standout performer this week, jumping 6% to $1,320. After years of underperformance, platinum is finally showing signs of life and is testing the lower end of its previous trading range. If it can break above $1,350, technical charts suggest a move toward $1,900 is possible.

Platinum’s market is much smaller than gold’s, making it more volatile. Most demand comes from industrial uses, especially in the automotive sector, and supply is concentrated in Russia and South Africa. Because of this, platinum is best held as a smaller, more speculative part of a diversified metals portfolio—around 10% is a common guideline among seasoned investors.

Geopolitics, Economic Uncertainty: The Wind in Gold’s Sails

Global events continue to play a major role in the metals markets. Tensions involving Israel, Iran, Russia, and China are adding to uncertainty, which typically supports gold prices. Economic data remains mixed, with inflation and interest rate expectations in flux. The Federal Reserve held rates steady this week but signaled possible cuts later in the year. Historically, such environments have been positive for gold and, by extension, for silver and platinum as well.

Ratio Trading and Diversification

How much should you own in gold, silver or platinum? Using the gold-to-silver or platinum-to-gold ratios can help guide your allocation decisions. When these ratios are stretched, it can be an opportunity to overweight the undervalued metal and later swap back as the ratio normalizes. This approach lets investors grow their total ounces of gold or silver without adding new capital.

Diversification remains essential. Holding a mix of gold, silver, and platinum helps reduce risk and smooth out returns, as each metal responds differently to market forces.

Here to Help Guide You

The McAlvany Precious Metals advisors have decades of experience investing in gold and other precious metals, and they can help you find the best strategy to meet your unique needs. They are happy to speak with you about your strategy for investing in gold and other precious metals. Reach us at 800-525-9556.