Podcast: Play in new window

Precious metals continue to follow the playbook laid out by our analysis of a Republican presidential win. Let’s take a look at where prices stand as of November 20:

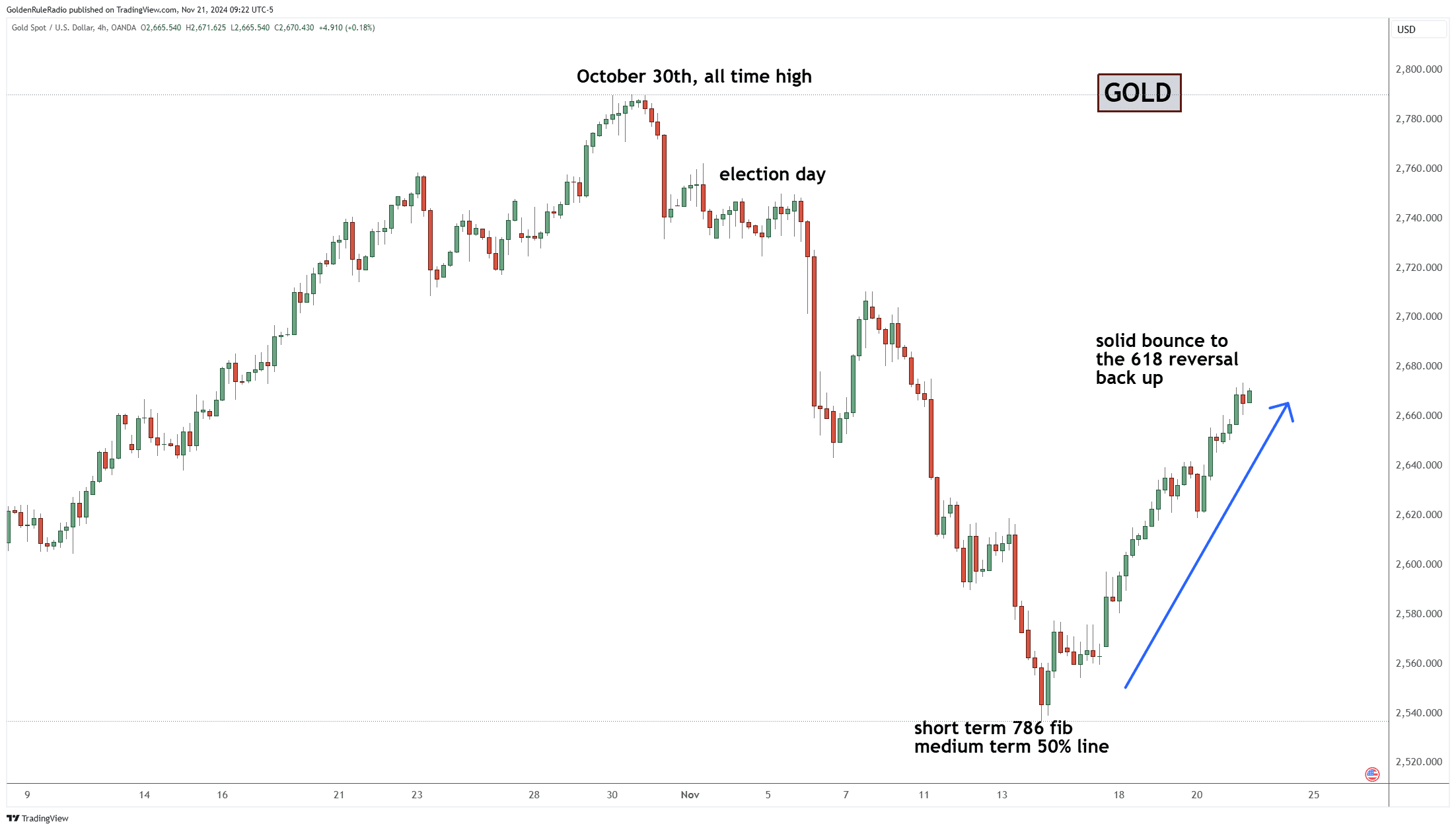

The price of gold is up about 4.3% or $108 to $2,650 from last week, a really nice bounce up in a week.

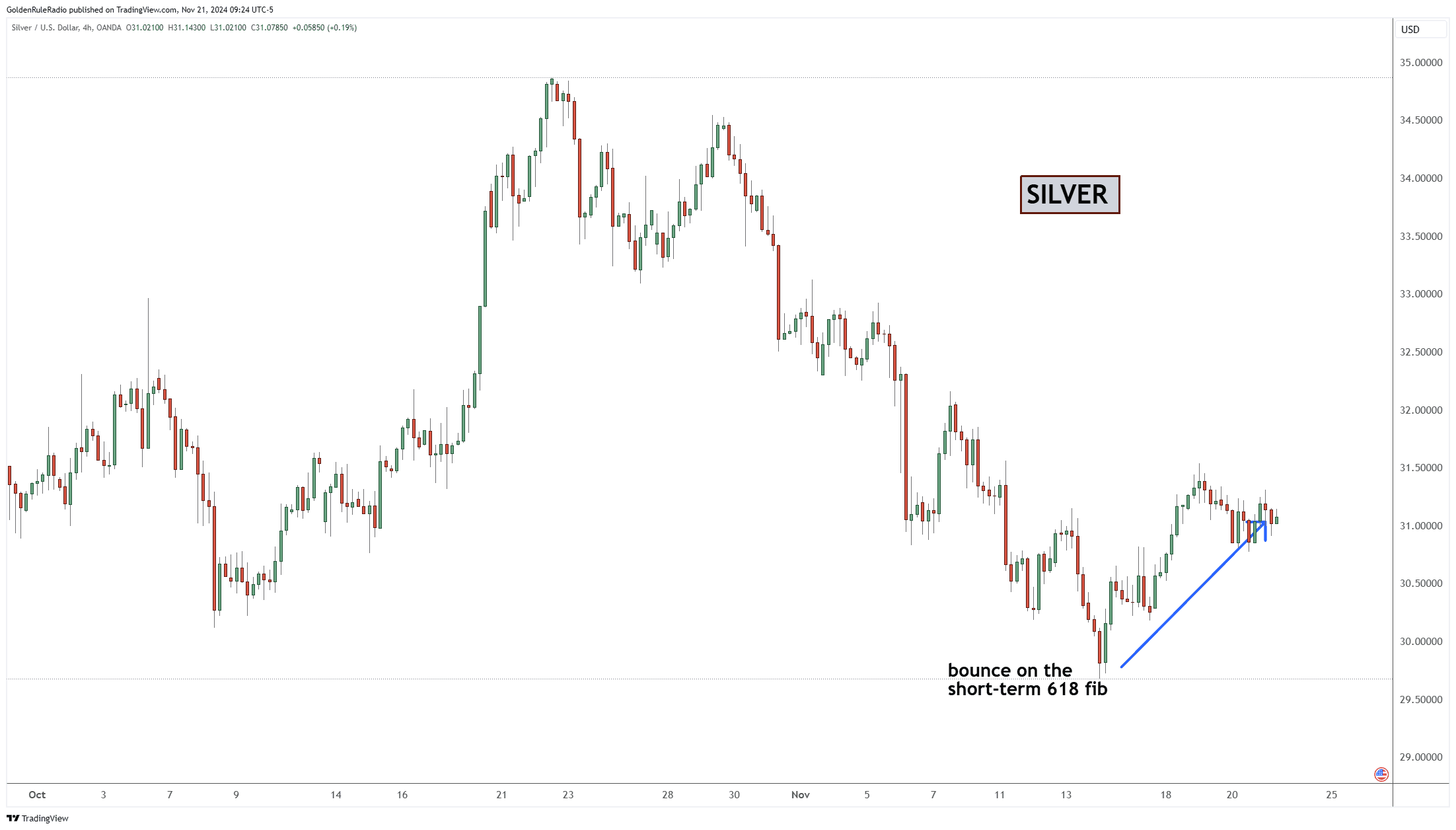

The price of silver is up 3.9% or around $1.15 at $30.86 from a week earlier.

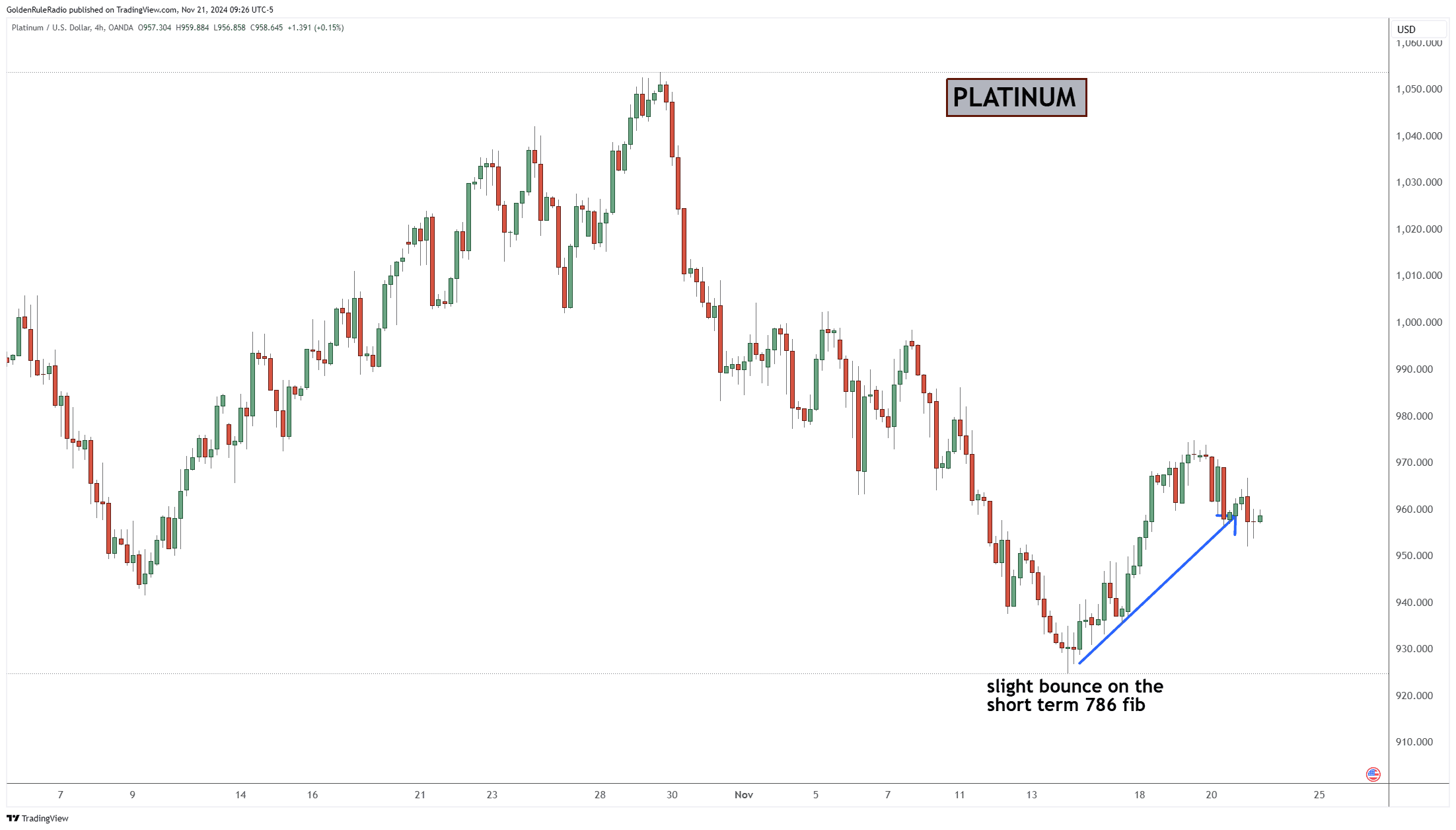

Platinum is up about 3.6% or $33 to $958 from a week earlier.

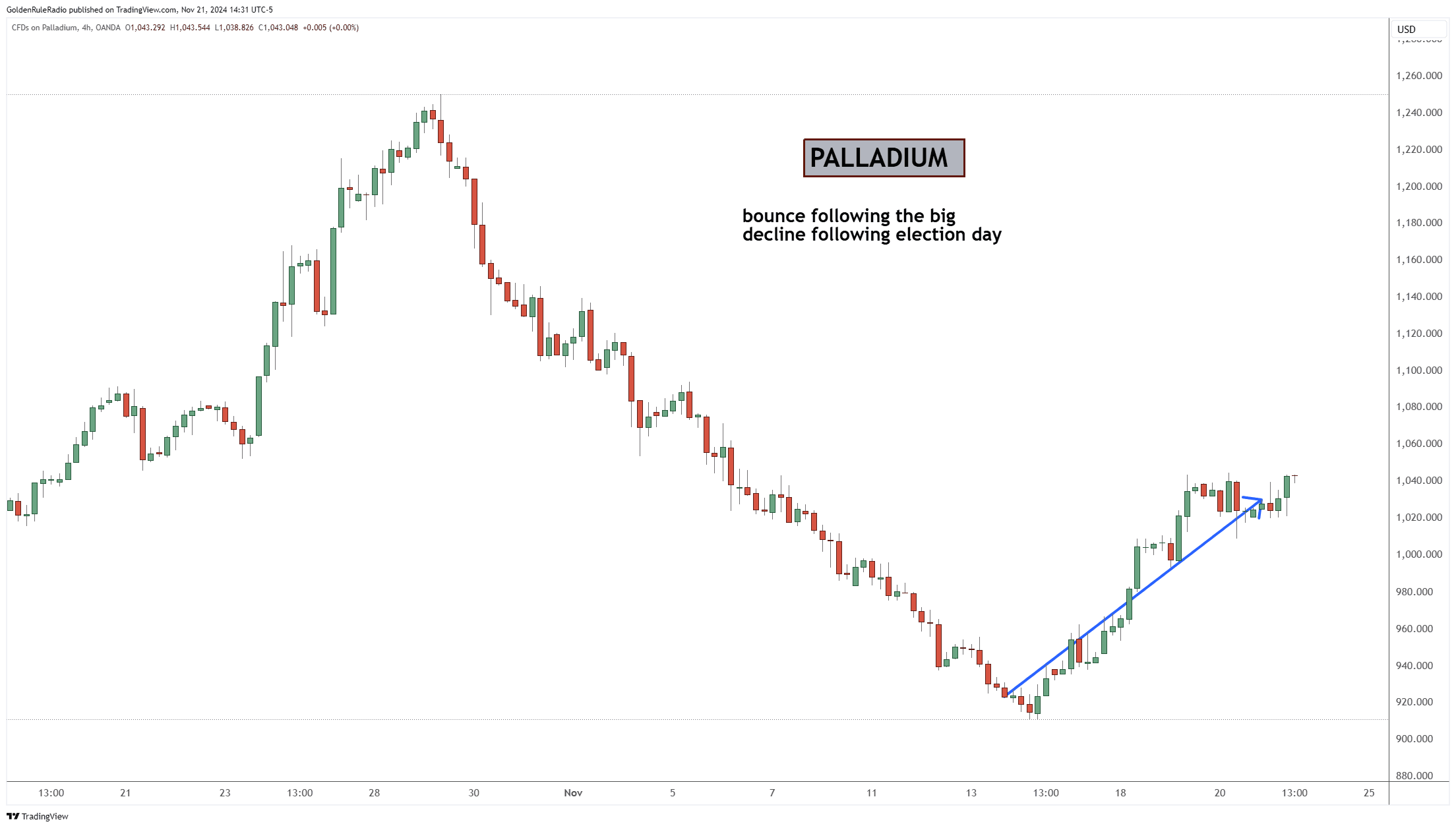

Palladium is up 12.5% or $113 to $1,024 from the prior week. That’s a nice recovery from last week’s dip of 5.3%.

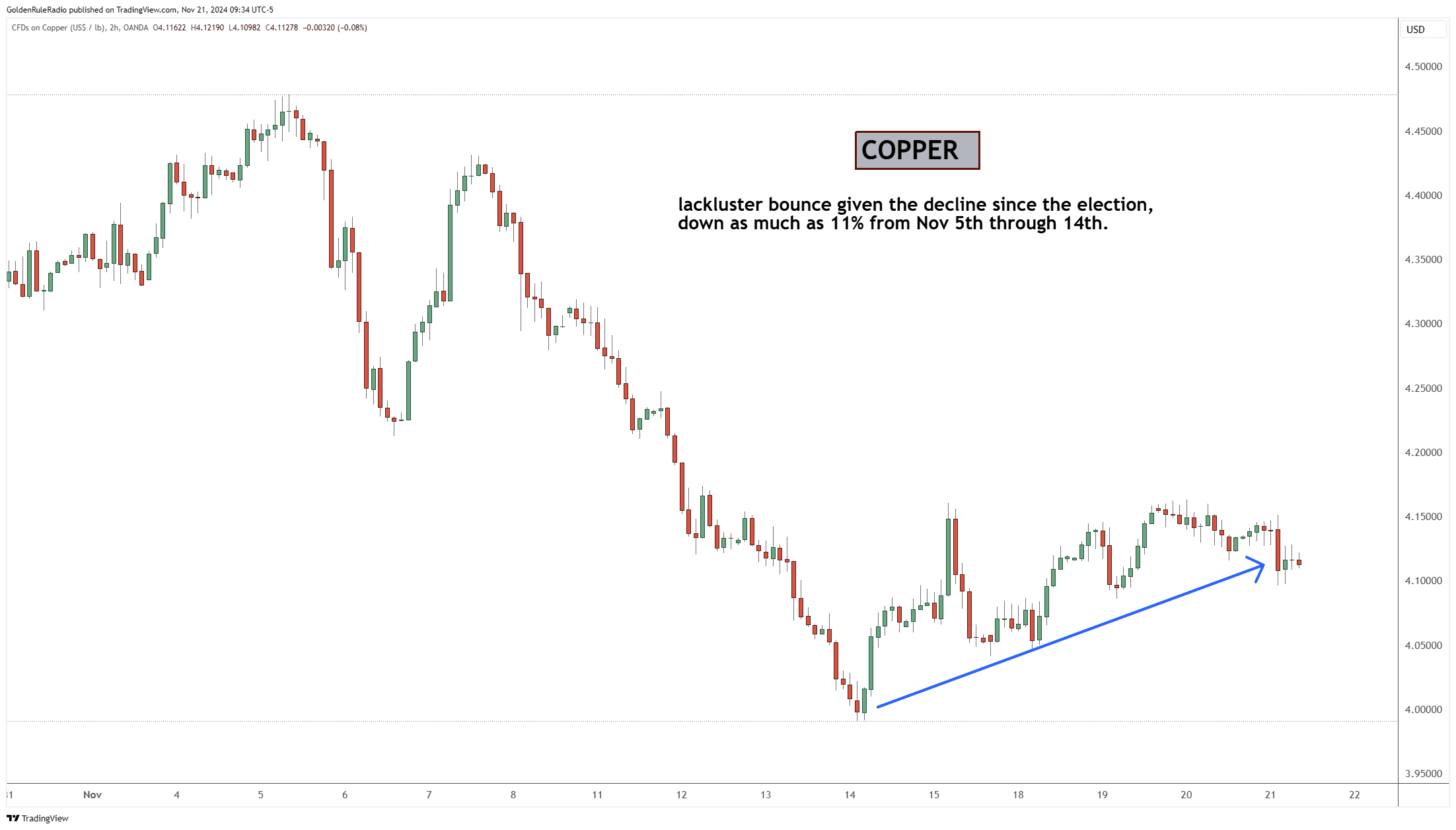

Copper’s up about 15 cents, or around 3.8% to around $3.80. There’s a good chance copper will reach $4 in the next few months.

Looking at the equities markets…

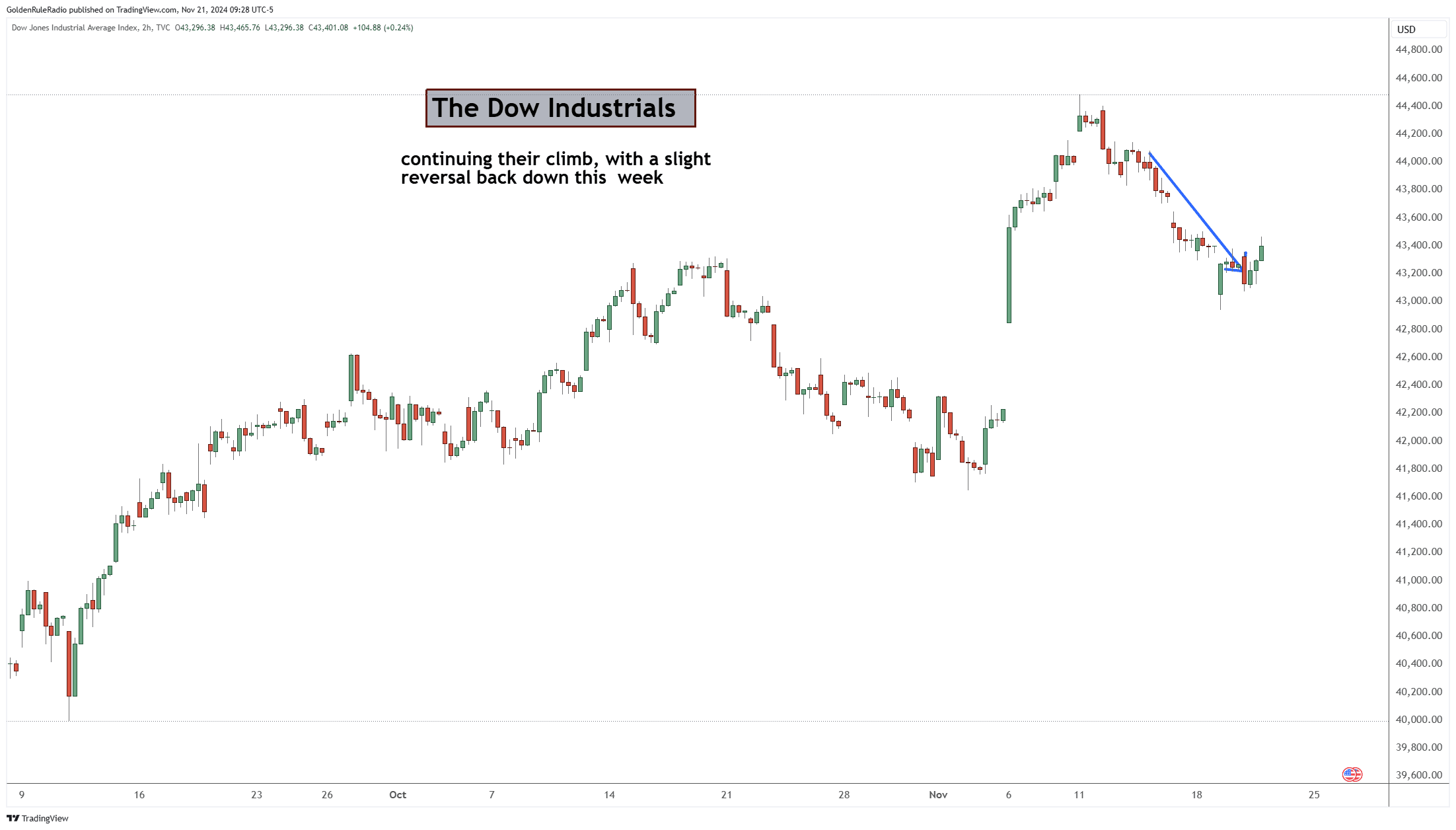

The DJIA is down 1.5% or 670 points to around 43,200.

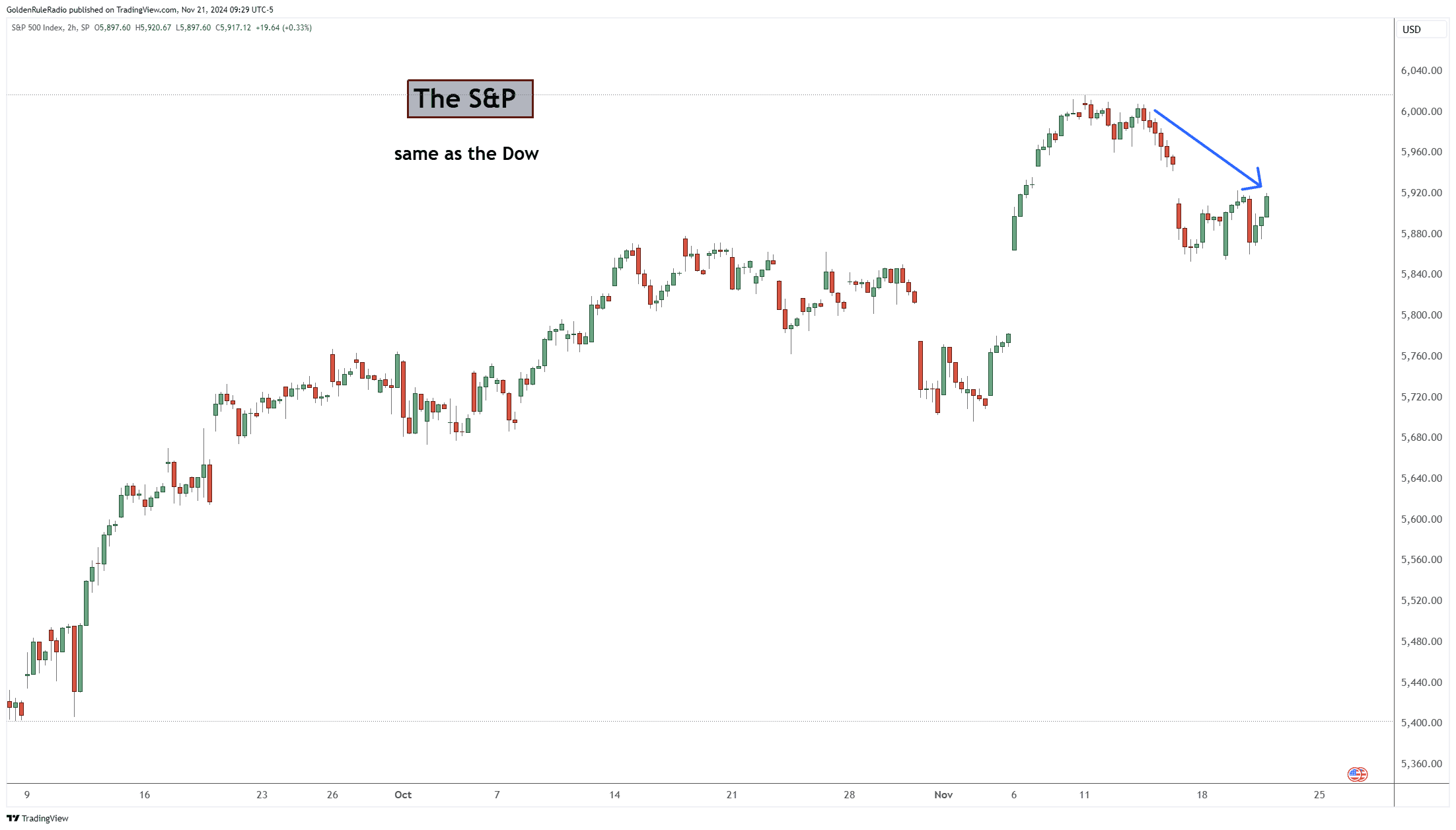

The S&P 500 is down 80 points or 1.3% to around 5,920.

The Dow Transports is off 600 points or 3.5% since last week.

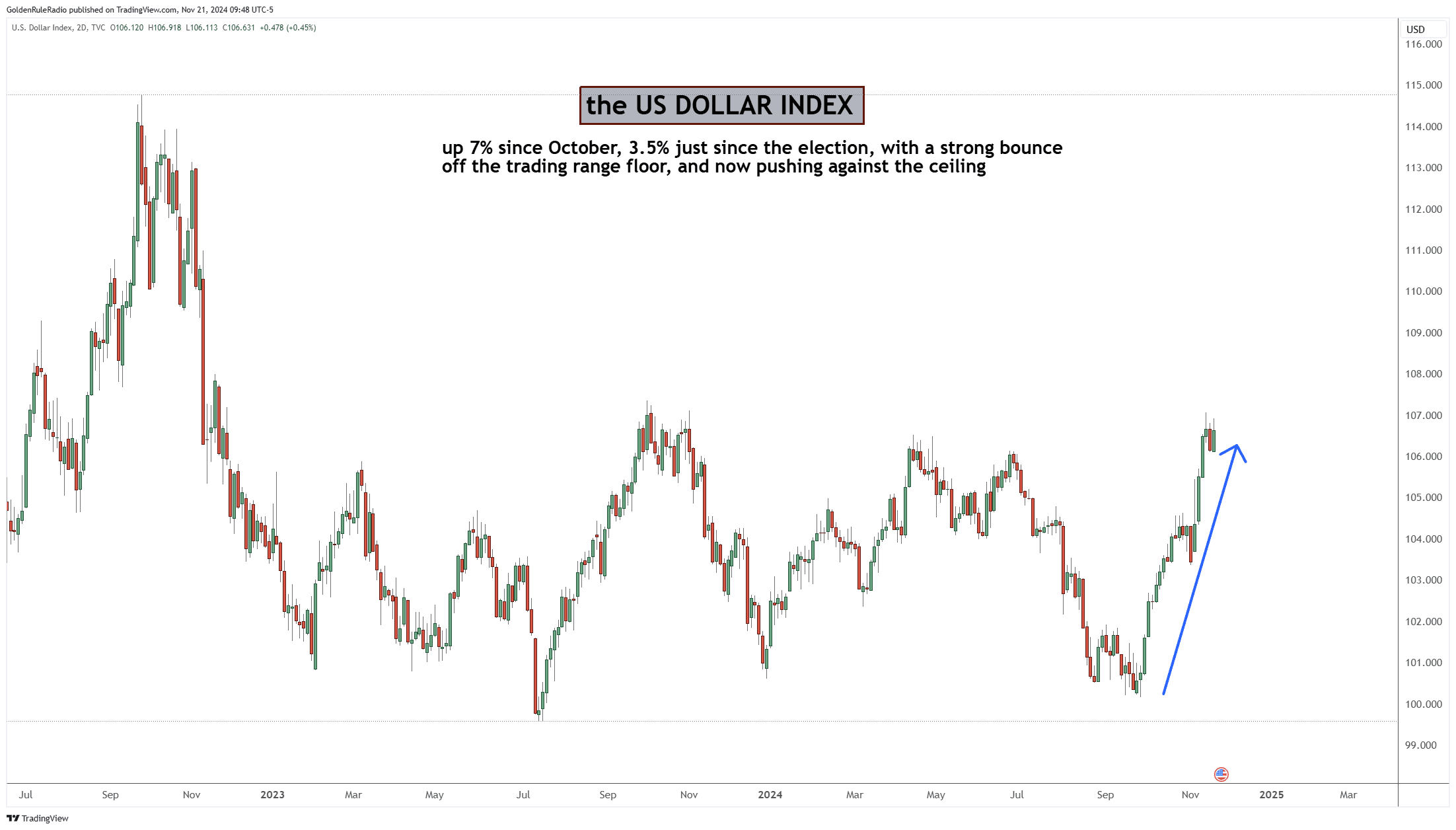

The US dollar index is up 7% since October, or 3.5% since the election with a strong bounce off the trading range floor. It’s now pushing up against the ceiling.

The Meteoric Dollar Rise

The rise in the dollar right now is insane. What’s driving it higher? When you look at where it’s going, it’s knocking on that ceiling right now.

This rise isn’t just an influx of money from Asia because of Chinese concerns. And it’s not just the average American thinking Donald Trump will be better for the US dollar. It may also be the flight of capital coming out of Europe due to fear.

While the BRICS alliance is trying to put up a strong front for a new BRICS currency, it is not a done deal. It takes a long time to compete with a global reserve currency. Just look back at how the Euro evolved. It was proposed in the 70s and 80s, but it didn’t become the powerhouse currency that it is today until the mid 2000s.

With respect to BRICS, there was some infighting between India and Russia and China about how India would pay for their oil. China demanded it be settled in Yuan. Instead, India left the deal to settle it in dollars with the US. So there’s no real agreement yet with the BRICS currency.

Gold Doesn’t Follow The Dollar

There may be investors out there that believe that gold will correct and go lower — and that will be their entry point. But that’s not what we’re seeing from our years of analysis.

Gold isn’t supposed to follow the dollar. But with the dollar at $107 right now and gold at $2,650 per ounce, it’s because of the sheer magnitude of money printing over the last decade. It represents the number of dollars in circulation.

The velocity of money is picking up the US dollar. If there’s also economic stimulus with a Trump economic plan, we’ll likely see the dollar rally and gold would follow suit if this is driven by geopolitics.

Don’t Miss Out on Gold

While China and other international markets have been heavily investing in gold, Americans have been missing out.

If you don’t own gold yet, now is the time. Get your position now. If there’s pullbacks, buy a dip. But the bottom line is you don’t know what gold’s going to do. Trump is not the save-all cure- all in these markets.

The McAlvany advisor team is here to help guide you. With decades of experience in precious metals investing, they are happy to speak with you about your strategy for investing in gold and other precious metals. Reach us at 800-525-9556